Large new industrial customers in B.C. needing electricity are forced to spend too much money and wait too long to be connected to the grid, says an association representing major power consumers.

So when Energy Minister Bill Bennett announced his decision to expand the mandate of a provincial task force investigating B.C.’s industrial electricity policies to include an analysis of how customers requiring huge amounts power are interconnected, the Association of Major Power Consumers of BC (AMPC) lauded the move.

Richard Stout, AMPC’s executive director, told Business in Vancouver that when one of his organization’s members wants to connect to the grid, it must pay for technical studies required and administered by BC Hydro, which can cost up to $100,000 each, and then wait 18 months for the results.

“Making industrial customers have to wait that long, there is no reason for that,” Stout said.

AMPC has therefore been lobbying for changes to industrial interconnection policies for years.

In June, Bennett sent a letter to the Industrial Electricity Policy Review Task Force – the three-person panel created by Rich Coleman last January tasked with the electricity study – asking them to:

•“review utility interconnection policies and timelines from relevant jurisdictions and determine how they compare with BC Hydro’s current approach and performance”; and

•“to consult with low-cost, hydroelectric-based jurisdictions [such as Quebec and Manitoba] to better understand their approaches to interconnecting large loads as well as to identify what, if any, role government can play in the process.”

In an email to BIV, Bennett confirmed that the new terms were included because of “industry concerns about the time and cost of connection for new developments. This will help B.C. be ready for future industrial development.”

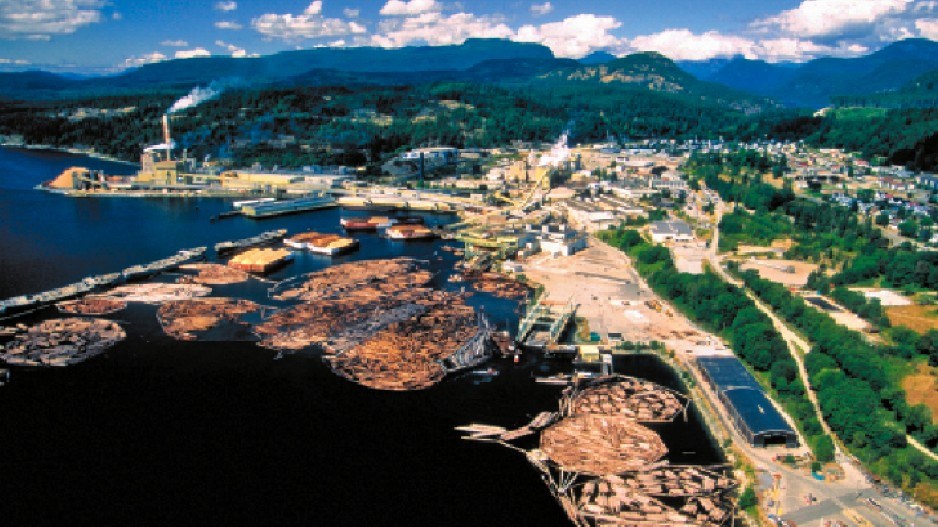

That future development includes a potential industrial boom from the LNG sector, which will require large amounts of power to run compression units at LNG facilities, as well as new mines, such as Imperial Metals’ (TSX:III) Red Chris copper-gold mine and AltaGas’ (TSX:ALA) Forest Kerr run-of-river project.

But others in the B.C. energy industry say the review must also address the larger public policy question of who should pay for the new infrastructure needed to connect new industrial loads.

Currently, BC Hydro’s large industrial customers are on the hook to pay for the new, dedicated infrastructure needed to service them. For example, the Northwest Transmission Line (NTL) – a $736 million, 344-kilometre transmission line being built to power industrial development in northwest B.C. – is expected to be paid for by customers plugging in to the line, like Red Chris and Forest Kerr.

Donald McInnes, executive vice-chairman of Alterra Power Corp. (TSX:AXY), a Vancouver-based renewable energy company, said relying on industry to fund such expensive developments makes B.C. less competitive with other jurisdictions.

“We want big consumers of electricity in this province. BC Hydro and government should pay for the cost of hooking up to the grid because we want that new user [that] provides jobs and economic activity,” he said.

“We should be making that investment in infrastructure to facilitate economic development.”

The Industrial Electricity Policy Review Task Force will be investigating these issues until October 31.

Dawson Creek/Chetwynd Area Transmission Project

Unlike building new infrastructure such as the Northwest Transmission Line, upgrades to existing BC Hydro lines are to be funded by the entire rate base – both residential and industrial consumers. The policy created controversy when power upgrades needed to service growing demand in the Dawson Creek/Chetwynd area were being planned.

Organizations such as the Association of Major Power Consumers of BC argued to the BC Utilities Commission (BCUC) that the required upgrades – dubbed the Dawson Creek/Chetwynd Area Transmission Project (DCAT) – were driven by the natural gas industry in B.C.’s northeast and that asking existing large consumers to help pay the bill was unfair.

The natural gas industry, represented by companies such as Encana Corp. (TSX:ECA), as well as industrial air supplier Air Liquide (Paris:AI) and the City of Dawson Creek, said the DCAT improvements were essential to the overall growth of the region and the province, not just that of the natural gas industry. According to Dawson Creek’s submission to the BCUC, “the DCAT line is warranted on the basis of opportunities [that] it will support both the Dawson Creek area and the province as a whole.”

In its October 20, 2012, DCAT decision, the BCUC ruled that the upgrades were necessary to service new load growth and provide reliable service to area residents and should be paid for by the rate base.