Petronas, the Malaysian energy giant behind the multi-billion dollar Pacific NorthWest LNG project in Prince Rupert, may be planning a large workforce reduction and scaling back of capital projects.

Earlier in the week, the Wall Street Journal reported Petronas is planning to slash capital and operating spending by US$11 billion, after obtaining an internal memo circulated by Petronas among staff.

Petronas responded to it and other media reports with a terse confirmation that it is planning expenditure reductions, but offered no details.

“Petronas confirms that it has circulated an internal communication on part of its on-going efforts to optimize costs to address the impact of the continuous fall in crude oil prices,” the company said.

The US$11 billion figure cited by the WSJ just happens to be how much the liquefied natural gas plant in Prince Rupert was originally estimated to cost.

When the pipeline and natural gas assets are included, the total capital cost of the project is $40 billion to $50 billion range.

Like all other global oil and gas companies, Petronas is feeling the pinch of low oil prices. American oil prices fell to US$27 per barrel on January 20 – a 12-year low – before bouncing back to $30 per barrel the next day.

Morgan Stanley and Merrill Lynch have both warned that oil could go as low as US$20 per barrel in 2016.

Whether the Pacific NorthWest LNG project is one the major capital projects that Petronas may decide to postpone is unclear.

A spokesman for PNW LNG said he couldn’t comment on whether Petronas’ project is being considered for deferral because Petronas isn’t the only company involved.

Petronas owns a 62% stake, Sinopec 15%, Japex 10%, Indian Oil Corp. 10% and Petroleum Brunei 3%.

The PNW LNG project is one of the several major multi-billion dollar projects that Petronas has on the drawing board.

Others include the US$16 billion RAPID refinery and petrochemical plant in Malaysia, and the Sabah-Sarawak integrated oil and gas project in Borneo.

Just last week, in an interview with Bloomberg Business, Petronas’ new CEO, Wan Zulkiflee Wan Ariffin, said the company remains committed to multi-billion dollar projects with a capital spend of $80 billion over the next five years.

Ariffin told Bloomberg that the company would decide by the end of the first quarter of this year whether or not to proceed with its Canadian project – PNW LNG – saying that it “can’t be held in abeyance indefinitely.”

Petronas’ PNW LNG project considered one of the frontrunner LNG projects in B.C. – one of two large LNG projects that are most likely to get investment green lights this year.

Petronas has already spent billions in B.C. acquiring and building out natural gas assets in northeastern B.C. Last year, it announced a conditional final investment decision. One of the two conditions – a project development agreement with the province on taxes and royalties – has been ticked off.

But one remains outstanding – an environmental certificate from Environmental Assessment Agency (CEAA).

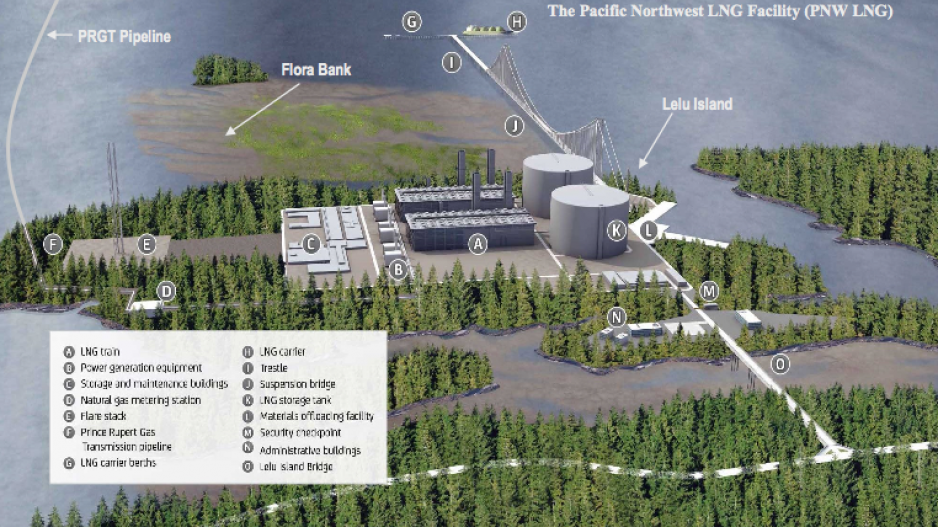

That approval has been delayed by environmental concerns over the potential impact on salmon rearing eelgrass beds from a trestle and suspension bridge that would pipe LNG to a loading terminal off Flora Bank.

Last week, the Department of Fisheries and Oceans concluded in a letter to the CEAA that the project would have “low potential of resulting in significant adverse effects” on fish and fish habitat.

Those assurances are unlikely to deter the Lax Kw’alaams First Nation, however, which rejected a $1.1 billion benefits agreement and launched an aboriginal rights and title claim on Lelu Island, where the LNG plant would be built.

One other large LNG project – Shell’s LNG Canada – is further ahead than the Petronas project in that it already has all of its environmental certificates, not to mention the cooperation of key First Nations, like the Haisla.