Canadian regulatory organizations are facing a wide gap between levying fines to punish fraudulent behaviour and collecting those fines.

The BC Securities Commission (BCSC), for example, issued $172 million in financial penalties in the 2014-15 fiscal year and, more than a year later, has received only about $1 million, or approximately 0.6%, the BCSC’s director of enforcement, Peter Brady, told Business in Vancouver.

“It’s important to note that 93%, or $160 million, of [that] total sanctioned in fiscal 2015 relates to five cases,” he said before pointing to separate yet significant penalties levied against OSE Corp., Rashida Samji , David Michael Michaels, Freedom Investment Club and Independent Academies Canada.

Brady added that the BCSC has the power to freeze assets and put liens on property at the beginning of an investigation. That preserves assets if the case is proven.

The BCSC also conducts searches to find assets that might be added later to the list of seized property.

Unlike the Investment Industry Regulatory Organization of Canada (IIROC), the BCSC can register its hearing panels’ decisions directly with the Supreme Court of British Columbia.

Once registered, those decisions have the same force and effect as a BC Supreme Court order, Brady said.

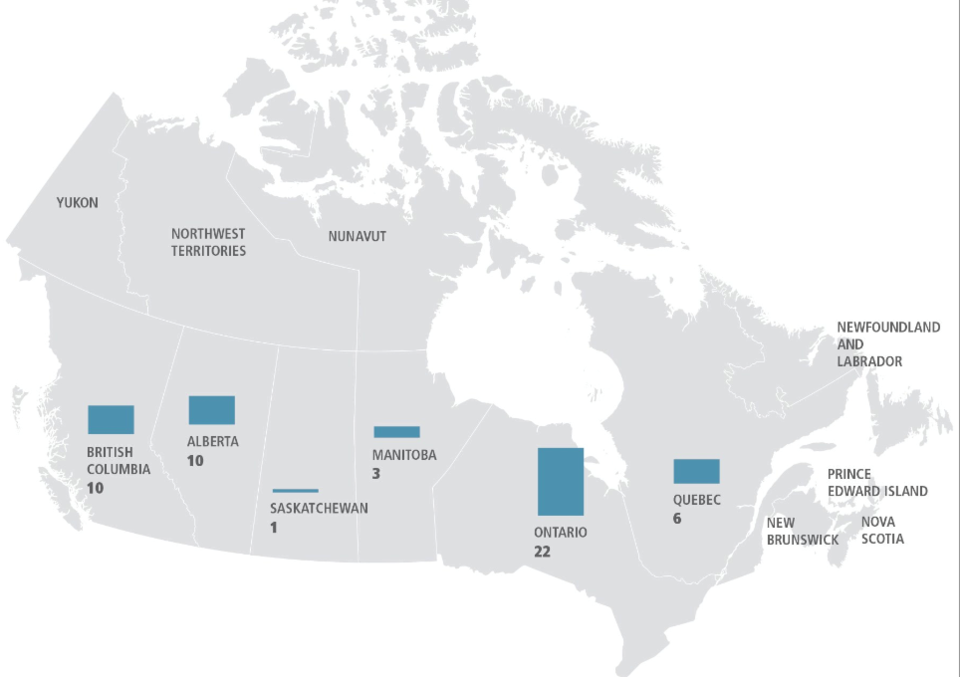

IIROC, in contrast, can enforce its financial penalties through courts only in Alberta and Quebec. It wants provinces such as B.C. to change securities laws so it is able to go to those provinces' courts.

“IIROC is encouraging other provincial and territorial governments to adopt similar legislative measures so that IIROC can provide a consistent level of protection to all investors across Canada,” IIROC CEO Andrew Kriegler told BIV. “This would foster investor confidence in our markets and the regulatory system that is their underpinning, and it would do so at no material cost to governments or taxpayers.”

B.C.'s Finance Ministry did not directly respond to whether it will tweak securities legislation to enable IIROC to go to court.

Instead, it sent a statement to BIV saying that the province “is a leading proponent of the Co-operative Capital Markets Regulatory System (CCMRS) and is considering IIROC’s comments and proposals along with the other provincial-territorial participating jurisdictions.”

Meanwhile, the struggle to enforce fines continues. IIROC levied a higher amount of financial penalties in 2015 than it did in 2014 but its fine-collection rate fell.

Last year, IIROC levied more than $4.5 million against companies and individuals nationally, compared with $3.67 million in 2014. While IIROC collected 84% of the fines assessed against companies, it collected only 13% from individuals across the country.

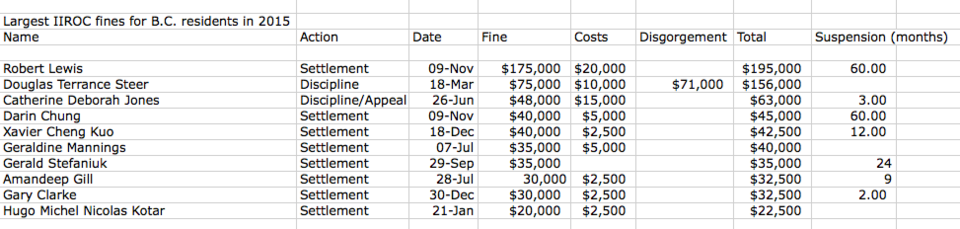

In B.C., its collection rate was worse.

IIROC issued $664,000 in financial penalties against British Columbians in 2015 yet collected only about $40,000 (approximately 6%).

Real Estate Council of British Columbia (RECBC) has a better fine-collection record.

According to RECBC spokeswoman Marilee Peters, it collected $121,000 of the $130,500 in fines it levied on realtors in 2015.

However, most RECBC fines are small.

The Law Society of British Columbia was also good at collecting fines. Of the $92,500 levied against current members last year, 100% was collected, said spokeswoman Vinnie Yuen. •