U.S. President Barack Obama had killed the Keystone XL pipeline, Canadian Prime Minister Justin Trudeau had allegedly killed the Northern Gateway pipeline, and even if anti-pipeline forces couldn’t kill the Trans Mountain pipeline expansion, surely low oil prices and the new climate change imperative in Alberta would.

But oil prices are edging back up – nearly touching US$50 per barrel last week – Alberta’s NDP Premier Rachel Notley is lobbying hard for new pipelines to the West Coast and Northern Gateway’s death notice might have been issued prematurely.

When Trudeau announced a moratorium on oil tankers on the West Coast, it was assumed that it would be Northern Gateway’s death knell. Work was to begin on the pipeline by the end of this year, according to approval granted by the National Energy Board (NEB).

There is now talk of changing the pipeline terminus from Kitimat to Prince Rupert – although that discussion is not officially coming from Enbridge Inc. (TSX:ENB) – and even some speculation that the West Coast oil tanker moratorium promised by the Liberal government might not be quite as impermeable to tankers as some might have assumed.

Meanwhile, Enbridge has been trying to improve its relationships with First Nations by sweetening the pot and now claims to have 31 First Nations and Métis groups on board.

Enbridge and its partners agreed to reduce their position in the pipeline to increase First Nation ownership to 33% from 10% and double economic benefits to First Nations and Métis partners to $2 billion from $1 billion.

Enbridge recently filed for an extension that would delay the construction start date to 2019 from the end of 2016.

But Kinder Morgan Inc. (NYSE:KMI) is now poised to beat Enbridge to the West Coast. It already has a pipeline in place that it plans to twin, at a cost of $7 billion. All it needs is federal government approval.

So would a green light for Trans Mountain mean a red light for Northern Gateway?

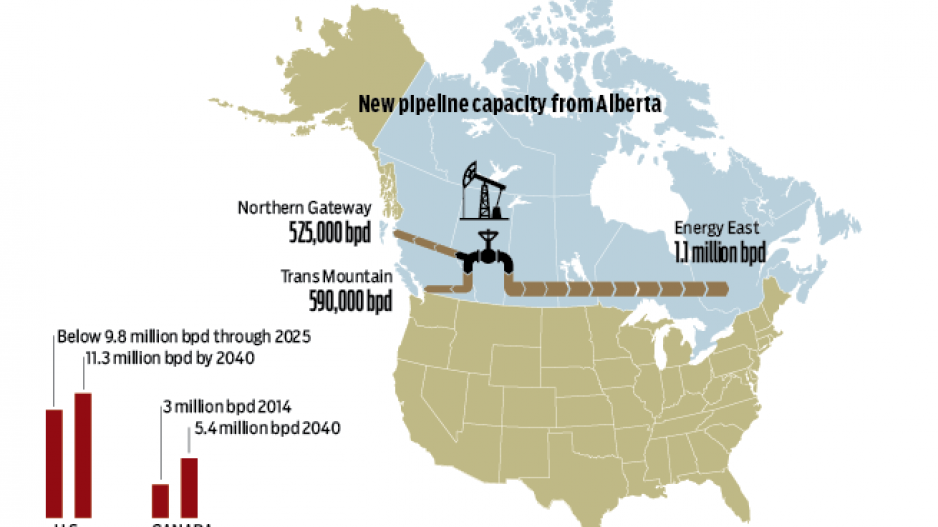

In addition to the two western oil pipeline proposals, there is the TransCanada Corp. (TSX:TRP) Energy East project, which, if built, would have roughly the same capacity as both western pipelines combined: 1.1 million barrels per day (bpd).

In total, if all three proposed pipelines get built, they would add 2.2 million bpd of new capacity – about one million in each direction.

Does Canada really need three new oil pipelines? Aren’t the oilsands in sunset mode?

Not according to projections for growth made by the NEB and S&P Global Platts, the U.S.-based energy business intelligence firm.

Despite current low oil prices, Platts projects Alberta’s oilsands will continue to attract investment and grow, expanding by more than one million bpd by 2021 – from 2.6 million bpd this year to 3.72 million bpd.

That’s equivalent to the capacity of a single pipeline: Energy East.

Longer-term, in a recent Canada-wide energy outlook, the NEB projects Alberta’s total production of oil will increase to 5.4 million bpd by 2040 from three million bpd.

If the Northern Gateway pipeline isn’t built, more Alberta oil will travel to U.S. refineries by rail, said Travis Whalen, energy analyst for S&P Global Platts.

“The crude continues to flow, but we do start to see rail utilization pick up in the outer years of our modelling,” he said. “So once we get past 2022 and past 2024, rail exports from Western Canada will need to rise. On top of that, the pipeline utilization starts to get much higher.”

Alberta’s oilsands currently account for 60% of Canada’s total oil production, but that’s projected to increase to 79% by 2040.

Some question how that growth can occur in a climate of low oil prices, a global paradigm shift to decarbonization and Alberta’s new cap on carbon.

Alberta’s oilsands currently produce an estimated 70 megatonnes (Mt) of carbon dioxide per year. The government is capping it at 100 Mt per year.

Alberta’s oilsands are, of course, notorious for their carbon intensity, which makes it a challenge to meet climate change objectives.

But Whalen said it’s a mistake to treat the oilsands as a monolith. Some operations do a better job than others in terms of carbon intensity and other environmental impacts.

“It’s definitely more carbon-intensive than many types of crude,” he said, “but it’s not the most carbon-intensive type of crude.”

Whalen added that there is some conventional production in California that is just as carbon-intensive.

“If you compare it to the carbon intensity of something like the heavy oil coming out of California, or if you look at similar oilsands coming out of Venezuela, you’ve got other high-carbon-intensity crudes out there.

“The interesting thing about the oilsands in Canada is exactly the ability to improve. They’ve come down dramatically, and there’s still room to improve it.”

It has been suggested, for example, that Alberta and B.C. could work together to provide clean B.C. power to Alberta to reduce oil producers’ reliance on thermal (gas-fired) power production. Some energy companies operating in Alberta have also been investing in renewable energy projects and clean technology.

Suncor Energy Inc. (TSX:SU), for example, has invested in high-tech approaches like using radio frequencies to heat and loosen up bitumen electromagnetically instead of using steam in its in-situ operations, reducing the amount of water it uses.

And in partnership with the BC Cleantech CEO Alliance and Cenovus Energy Inc. (TSX:CVE), Suncor has helped create the $100 million Evok Innovations technology fund, which funds innovation and technology that address climate and other environmental issues in the oil and gas sector.

Despite predictions that a move to decarbonization means oil will go the way of coal, energy analysts say that day is a long way off.

The U.S. Energy Information Administration predicts that oil demand and prices will continue to rise over the next few decades.

It is predicting slow growth in new American oil production, increasing by 1.5 million bpd by 2040, and Brent oil prices rising to US$77 per barrel in 2020.