The B.C. government will not raise the carbon tax above $30 per tonne for the foreseeable future, and its new climate action plan fails to adopt some key recommendations made by the government’s own Climate Leadership Team (CLT).

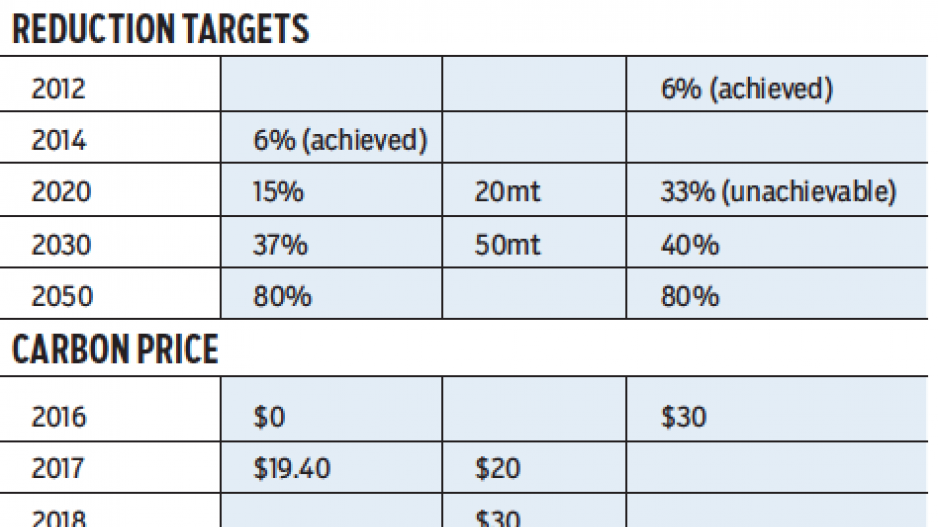

One of those key recommendations was setting new interim greenhouse gas reduction targets of 40% below 2007 levels by 2030.

That target is missing in the new updated plan. Instead, it has only a long-range target of an 80% reduction by 2050.

The plan announced Friday, August 19, is an update to the 2008 Climate Action Plan. It is being panned by groups like the Pembina Institute and Clean Energy Canada, both of which were part of the CLT, as climate action delayed.

"Under the Climate Leadership Plan released today, carbon pollution will not start to significantly decline for almost 15 years – assuming all the reductions in the plan come to fruition,” said Josha MacNab, B.C. director for the Pembina Institute.

“This falls far short of the level of ambition needed to reach B.C.’s 2050 target and leaves the hard work for a later day.”

“With this plan, British Columbia’s carbon pollution will be the same in 2030 as it is today,” said Clean Energy Canada executive director Merran Smith. “Instead of bold action, B.C.’s climate leadership has fizzled.”

Of the 32 recommendations made by the CLT, the key one was raising B.C.’s $30 per tonne carbon tax by $10 per year, after 2018. It has been frozen at $30 per tonne since 2013.

But Premier Christy Clark defended inaction on the carbon tax hike, saying other jurisdictions have not yet caught up to B.C.

“We will consider raising the carbon tax as other provinces catch up,” Clark said.

There is a concern with “leakage” when one jurisdiction has carbon pricing that is higher than competing jurisdictions. Industries may simply move to jurisdictions with lower carbon prices – or no price at all – which means a loss to the economy, but no net reduction to actual emissions, which will simply be produced in some other jurisdiction.

“There's a recognition that B.C. has had the highest carbon tax in North America, and still will have in the next five years, even based on the plans other jurisdictions have made,” said Greg D’Avignon, president of the Business Council of BC. “And they’re mindful of the fact that B.C. has to remain competitive going forward, particularly for trade exposed industries and those that are energy intensive.”

B.C. hit its first GHG reduction target – 6% below 2007 levels – in 2012, but will not meet its next target – a 33% reduction by 2020. The CLT recommended resetting it to 40% by 2030 – a recommendation that appears to have been ignored in the new plan.

B.C.’s carbon tax currently only applies to combustion sources, or about 70% of the economy. It could be made more effective – without raising it – by simply making it broader.

The CLT recommended extending it to non-combustion sources, such as the upstream emissions from the natural gas sector. That too has been ignored in the new plan.

However, the plan does commit to reducing methane emissions from the natural gas sector by 45% by 2025.

Another key recommendation was requiring BC Hydro to extend transmission lines in Northeastern B.C. to electrify the natural gas fields, where natural gas is burned to power wells, pipelines and processing plants.

The new plan commits only to discussing that possibility with the federal government. In other words, it is hoping for federal funding to pay for electrifying B.C.’s gas fields.

Another key recommendation of the CLT was a zero emission vehicle (ZEV) policy that would set targets for ZEV sales in B.C. – a move aimed at promoting more use of electric vehicles. California and Quebec have both adopted ZEV standards. B.C. has provided subsidies to encourage ZEV adoption, but has no specific targets.

“We need a zero emission vehicle standard,” Smith said. “It’s great to give support – rebates – to people buying electric vehicles and to put in charging stations. Those are all critical things. But we really need the policy – the zero emission vehicle standard.”

The new plan has no ZEV standard, but does commit to expanding an existing program to encourage ZEV adoption.

Other key points in the government’s new climate action plan include:

• increase reforestation of 300,000 hectares of forest over five years;

• increasing the existing low carbon fuel standard to require a 15% reduction in carbon intensity in fuels by 2030;

• setting a new target requiring that 100% of all new power generation in B.C. come from renewable, zero-emission sources; and

• new policies requiring all new buildings to have a net-zero carbon footprint by 2032.

Smith said it was important not to just commit to certain policies, but provide funding commitments as well. The new plan has no such funding commitments.

“We need to have clear policies that are getting announced and the dollars to implement them,” Smith said. “Without those, they’re just vague promises.”

Chris Ragan, chairman of the Ecofiscal Commission, which recently compared carbon pricing in B.C., Alberta and Quebec, said it is important that all provinces in Canada get on board with climate action policies and carbon pricing.

He said the key to carbon pricing is not so much the price, but the stringency – i.e. its ability to discourage GHGs. He said B.C. has a good climate change policy, but was puzzled over its decision to freeze its carbon tax.

He acknowledged that “leakage” is a real issue, but said it can be addressed.

“I can certainly understand a world where Christy Clark says, ‘We have a $30 carbon price … and nobody else does yet and so we’re going to wait and let the others catch up.’ I can understand that politically.

“Economically, what I would tell her is that you’ve got a great policy in place, where the revenues are used to cut income taxes – that gives you a great advantage – why not continue along that front and, at the same time, you can also deal with the competitiveness issues that your business community is worried about. You can do it.”