If Malaysian energy giant Petroliam Nasional Berhad (Petronas) doesn’t already have a green light from the federal government for its $36 billion Pacific NorthWest LNG project in Prince Rupert by now, it is expected to have one any day now.

The statutory deadline for federal Environment Minister Catherine McKenna to approve or deny an environmental certificate is October 2, and many observers and analysts expect the project will get approved, albeit with conditions.

Rejecting it would have far-reaching implications for foreign investment in Canada, said Jock Finlayson, chief policy officer for the BC Business Council.

Major energy projects, from oil pipelines to hydroelectric dams, have been given such a rough ride in Canada lately from First Nations, environmentalists and regulators that foreign investors and governments have begun to take note, he said.

“I’m sure the prime minister heard about this when he was in China for the G20 meetings,” Finlayson said.

“So as the federal government looks at this project – and others – they really need to keep in mind that Canada’s reputation is very much eroding as a reliable supplier of resources, but also as a place where there are regulatory processes that have some clarity and transparency to them. We’re really losing ground on that.”

Even those who think approving PNW LNG would compromise the federal Liberals’ commitments to First Nations and battling climate change agree it’s likely to be approved.

“It seems to be a time for choices for the Trudeau government, and the signals we’re getting so far are ‘yes’ to a lot of things,” said George Hoberg, a political science professor at University of British Columbia’s Liu Institute for Global Issues.

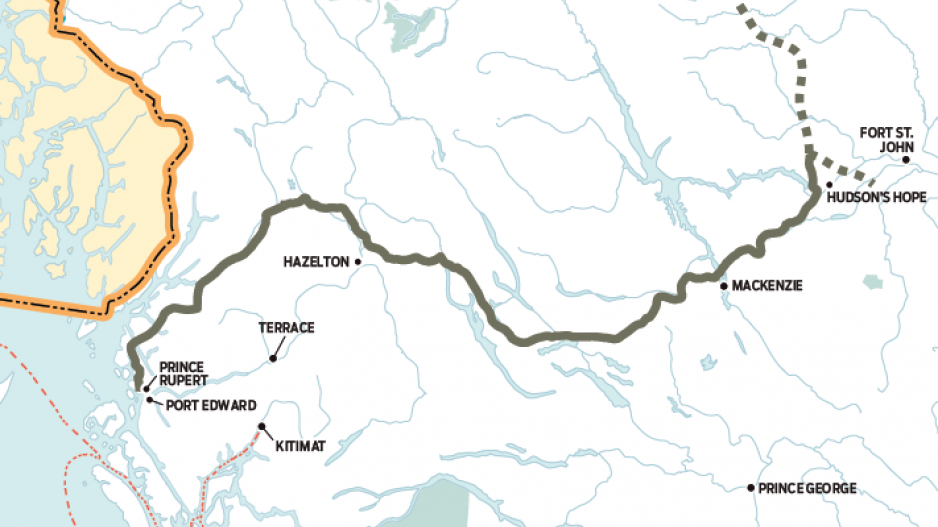

“They’ve authorized the permits to continue the construction of Site C dam, the word is now that they’re going to approve the Kinder Morgan Trans Mountain expansion pipeline, and really the Petronas project is in some ways the next big thing. And it is certainly a project coveted by the Christy Clark BC Liberals, but causes major problems for both the province of B.C. and the government of Canada for its climate change aspirations.”

Even if Petronas gets a federal environment certificate, a number of industry analysts and observers expect Petronas will wait until mid-2017 now to approve the additional spending needed to build the LNG plant itself ($11 billion) and two new pipelines to feed it ($7 billion).

Nor is it just Petronas’ board of directors who need to vote on moving forward. Petronas is the majority owner of PNW LNG, but other partners hold 38%:

•China Petrochemical Corp. (SINOPEC) (15%);

•Japan Petroleum Exploration Co. Ltd. (10%);

•Indian Oil Corporation Ltd. (10%); and

•Petroleum BRUNEI (3%).

Those partners aren’t just investors; they’re also buyers with gas offtake agreements.

Provincial and federal government delays have resulted in LNG projects like PNW LNG already missing one window of opportunity, so they must now time projects for the next window.

Asian utilities have typically bought LNG under long-term contracts. Some of those contracts have been locked down by other LNG producers, and there is now a glut of LNG on the market.

Worse, a sustained oil price plunge has eroded profits, forcing big oil and gas companies to defer spending on large capital-intensive projects.

Spot prices for LNG in Japan have dropped from US$15.21 per MMBtu (million British thermal units) in July 2014 to just US$6.32, as of last week. Asian LNG prices are expected to recover in four or five years as demand and supply balance out. Petronas’ proposed LNG plant in Prince Rupert, and the pipelines to bring the gas there from northeastern B.C., will take an estimated four years to build.

Industry experts therefore expect Petronas will wait until 2017 before making a final investment decision, which would mean the new plant would start producing LNG around 2021 – when the current LNG glut is expected to balance out with the longer term gradual increase in demand in Asia.

“The window of opportunity earlier on was missed because there was far too much discussion around counting your chickens before they hatched,” said Jihad Traya, manager of Natural Gas Consulting, Solomon Associates in Calgary. “Petronas is looking at the next phase. They’re not looking at prices today – they’re looking at prices tomorrow.”

One of those unhatched chickens is the tax and royalty scheme the B.C. government took so long to finalize and wanted in place to start filling up its promised $100 billion Prosperity Fund.

Traya thinks it was a mistake to even come up with such a scheme before an industry had developed. He said the Alberta government waited until an oilsands industry had developed before it came up with a tax and royalty scheme to fund its Heritage Fund.

“[B.C. was] taxing a non-existent industry,” Traya said. “The B.C. government was a rent-seeking agent, when it should have been a partner and was trying to facilitate an industry.”

PNW LNG is one of only two major LNG projects considered to have serious prospects of being built in B.C. The other is Shell’s LNG Canada project in Kitimat.

But Petronas’ site in Prince Rupert has been problematic because it has raised concerns about impact on salmon habitat. That has resulted in pushback from First Nations that otherwise have been generally supportive of an LNG industry.

Petronas has already invested billions in PNW LNG. It acquired Alberta’s Progress Energy in for $5.5 billion and spent billions more acquiring and building natural gas assets in northeastern B.C.

Last year, former Progress Energy and PNW LNG president Michael Culbert said the company had been spending roughly $2 billion a year. Petronas’ 2015 annual financial report cites its Canadian project as still “underway.” Its most recent financial statements show a 23% revenue drop in 2016’s first half compared with 2015’s first half and a 26% decrease in cash flows. •