Price wars are forcing Western Canadian grocers to grapple with food deflation as discretionary spending tightens and consumers employ various strategies to reduce spending and trips to grocery stores, according to research from consumer behaviour consultancy Nielsen.

Grocery prices in Western Canada were down 0.9% at the end of 2016, compared with a year earlier, Nielsen vice-president of consumer insights Carman Allison told Western Canada’s largest grocery show, Grocery & Specialty Food West, in Vancouver March 20.

That is three times the 0.3% decline in food prices that Nielsen found nationally.

Business in Vancouver reported on the trend toward food deflation trend in September, but at that point, actual deflation was only taking place in the U.S. and Canada had a nominal 1.1% food-inflation rate.

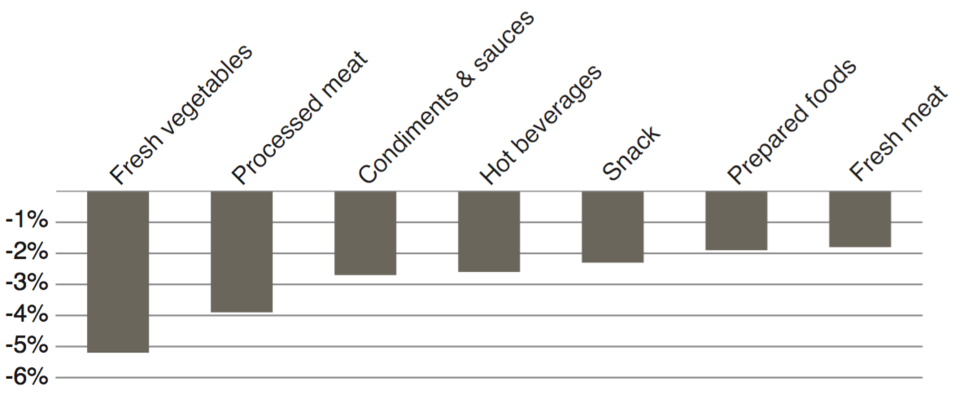

The steepest drops in Western Canadian grocery prices at the end of 2016 were for fresh vegetables (-5.2%), processed meat (-3.9%) and condiments (-2.7%), according to Nielsen.

Its data shows actual purchases, Allison said, and not the proverbial “basket of goods” that Statistics Canada uses to determine the consumer price index.

“Consumers are still very much motivated by promotions and by price, and they’re seeking value,” Allison said.

That drive to find value is driven by forces such as Alberta’s economic slowdown and rising Vancouver real estate costs.

The trend of consumers being more price focused squeezes retail margins and makes it more important for retailers to have what Allison called the “right assortment” of products, where promotions on one product do not cannibalize sales for another.

Instead of carrying brands that customers see as being interchangeable, Allison suggested that retailers carry distinctive brands or unique offerings that provide stable revenue streams even when similar items are on sale.

Stong’s Market has been employing the strategy with great success, president Cori Bonina told BIV.

“We ride that wave because our customers follow what we carry, and they ask us to carry certain products. That’s how we’ve been successful.”

(Graph created by Randy Pearsall)

Bonina, a fourth-generation owner of her company, has noticed more price competition than in past years.

Her chain moved into a larger 20,000-square-foot store on Dunbar Street in December and opened a second store, also about 20,000 square feet, on North Vancouver’s Dollarton Highway last May.

“I sent some people out last week to do some price checks just to see what everyone is charging,” she said. “Our North Vancouver location has a [Real Canadian] Superstore near us and a Safeway, so we have to be competitive.”

Coinciding with price wars is a drop in consumer trips to grocery stores, Allison said.

His research shows that Western Canadians made 668.4 million trips to grocery stores in 2016. That is 7% fewer than in 2012.

He chalks up that decline to people buying more products on each trip, buying larger portions as a way to get better deals and by online shopping.

Nielsen research showed that grocery e-commerce remains at less than 1% of sales nationwide even though there are exceptions, such as Stong’s, which Bonina said generates about 6% of sales from e-commerce.

Millennials, the generation most likely to buy groceries online, make only 116 trips per year to Western Canadian grocery stores. That compares with 147 on average for members of generation X, 186 for baby boomers and 193 trips for older demographics.

While that might appear to make millennial shoppers less valuable customers for grocers, Allison said they are likely the most important because they’re part of a large and long-lived generation.

He projects that millennials will surpass baby boomers in size by 2020. Sales growth for millennials is also key to a grocer’s survival because as a group they’re expected to spend 107% more by 2024 while baby boomers’ spending is projected to decline 9% by that year.

“E-commerce is absolutely going to grow,” Allison said. “Our forecast is that it will be about 5% of the Canadian [grocery] marketplace by 2020.” •