March housing data confirms what we speculated last month: the Lower Mainland down cycle has bottomed out. Proving that a market with a strong economy, low interest rates, positive demographics and an insatiable appetite for real estate can’t be kept down indefinitely, home sales and prices popped higher in March.

Based on our adjustments, Multiple Listing Service sales in the combined Abbotsford-Mission/Metro Vancouver area climbed about 10% from February on a seasonally adjusted basis, but we wait for confirmation later this month with the release of official Canadian Real Estate Association statistics. Year-over-year, headline sales growth still looked terrible with a 30% decline, but a deeper look shows a noticeable improvement from the 40% decline in February. Moreover, as spring 2016 was by far a record pace, sales for March were above seasonal averages going back a decade.

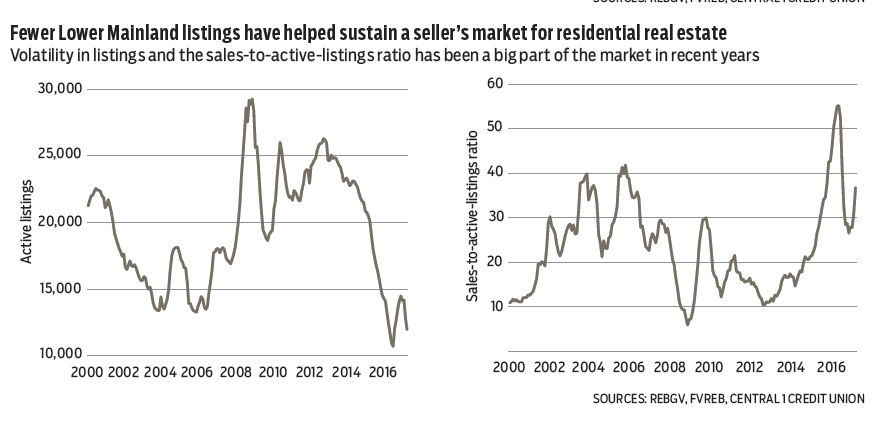

While sales are moderate, the market faces continuing pressure from a severe inventory shortage. New listings rebounded 10% from February, but the flow is down 15% from the fall, and down 24% year-over-year. Seasonally adjusted active listings, already near record lows, fell lower.

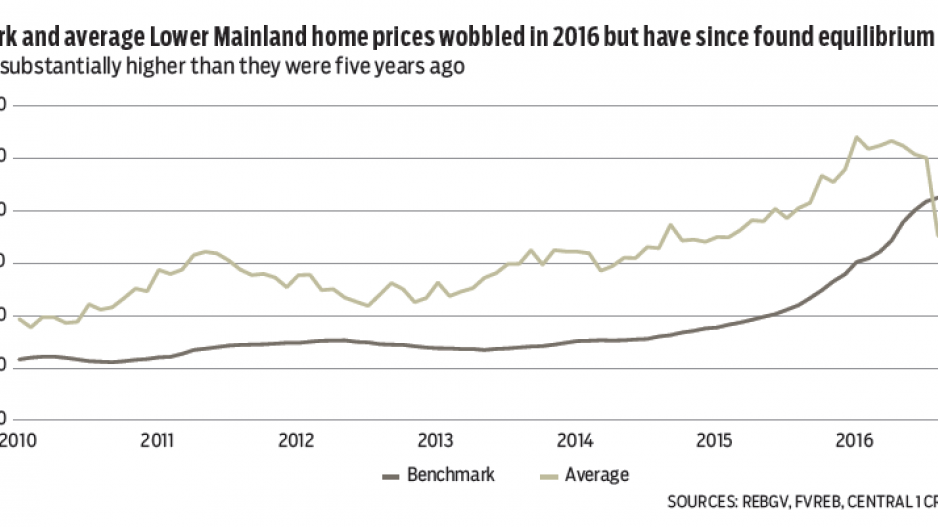

Average prices continue to trend well below a year ago near $860,000 due to a shift towards multi-family homes and a geographic dispersion of sales, but benchmark prices are rising, with a surge in apartments and townhomes.

We do not see a short-term solution to the supply problems in the market. Without a significant bump in listings, a 5% to 10% increase in the annual benchmark price index would not surprise.

While the housing market began a turnaround, B.C. international goods exports took a steep tumble in February, putting the brakes on what had been a strong export trend from late 2016 into 2017. Seasonally adjusted export sales fell 15% from January, marking the sharpest month-to-month contraction since early 2009. At $2.98 billion, unadjusted year-over-year sales fell from a 27% pace in January to 4.8%, with a wide array of products contributing to the deceleration.

While an eye-popping drop-off, the decline partly reflects a rollback after aggressive gains in recent quarters, and sales were still up a moderate amount from a year ago. A recent run-up in energy exports, however, reversed course, contributing to the pullback. The easing of food, forestry and manufactured industrial goods exports could signal a softer trend.

Real export growth is closer to 5% following February’s pullback. We expect this softer performance to be a blip in the road. •

Bryan Yu is deputy chief economist at Central 1 Credit Union.