For more than two years British Columbians have been enjoying job growth best described as “unusually robust,” according to economist Jock Finlayson. While 2013 and 2014 were fairly anemic years, the West Coast – or, perhaps more accurately, the Lower Mainland – has since been buoyed by a white-hot real estate sector and the dollar’s decline.

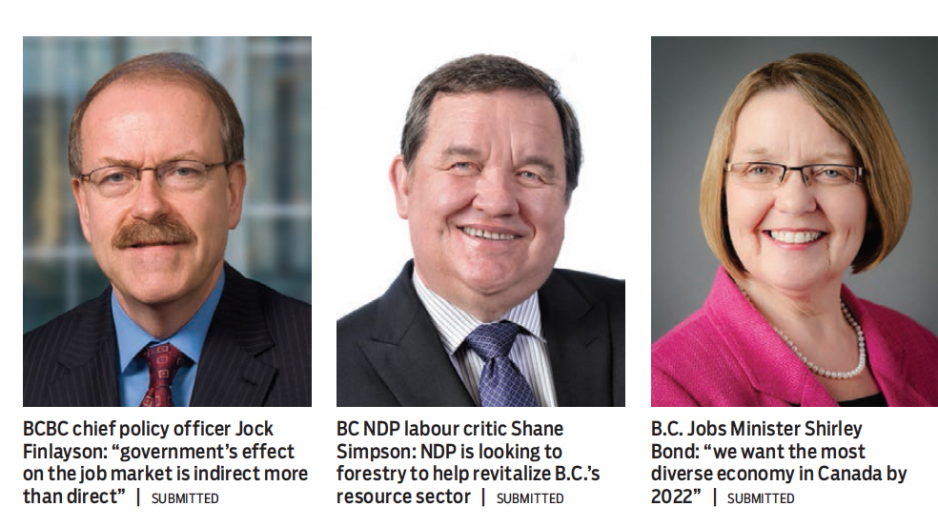

“Overall job creation is going to slow down,” said Finlayson, executive vice-president and chief policy officer at the Business Council of British Columbia (BCBC).

“We’ve been seeing job growth of 3%-plus, which is extremely brisk for a mature economy like B.C. The Lower Mainland has been closer to 5%. Those numbers are unsustainable in our view.”

Since the last provincial election in 2013, one of B.C.’s fastest-rising sectors has been manufacturing, which has grown at an annual rate of 4%.

Forestry, mining, and oil and gas have experienced an annual gain of 2.9%. And the culture and recreation sector has risen at an annual rate of 5.7%. Most of that growth comes courtesy of the 28% average annual increase in employment in the film and TV industry, according to the BCBC.

While the service sector has had just 1.6% growth, it accounts for 80% of all jobs in the province. Despite its more modest growth rate, it has generated 86,000 new jobs since 2013 – more than any other sector.

Overall, the Lower Mainland has added 120,000 jobs since the last provincial election. But B.C.’s net gain has been 114,000 jobs, meaning that the rest of the province has lost jobs over the past four years.

“I don’t think anyone would be surprised, [given] a global economic downturn in commodity prices, that the regions of the province that are heavily reliant on our natural resource industries are going to feel that impact,” B.C. Jobs, Tourism and Skills Training Minister Shirley Bond told Business in Vancouver.

She said the province has been putting together export pilot projects in rural regions in an attempt to “buffer” regional economies outside the Lower Mainland from global economic downturns.

“While we expect some moderation, we’re going to continue to build our export market looking at partners like India and Japan and others,” Bond said.

“We’re also looking at greater diversification. One of the goals of our refreshed jobs plan is we want the most diverse economy in Canada by 2022.”

BC NDP labour critic Shane Simpson said that while global markets have experienced a bump in the price of metallurgical coal, other commodities like copper have not yet fully recovered.

His party is looking to forestry to help revitalize B.C.’s resource sector if the BC NDP forms government this spring.

“It may never look like the days of MacMillan Bloedel and Crown Zellerbach, but there is an industry to be had here,” Simpson said.

“It’s about innovation, engineered wood products, cross-laminated products, and trying to encourage and support investment to do the secondary manufacturing and the processing around that.”

Although B.C. has added more than 100,000 jobs since the last election, Simpson said too many are tied to the Lower Mainland’s real estate sector.

“It’s not good economics to put all your eggs in one basket,” he said, adding that the “vast majority” of B.C.’s job growth over the past four years has comprised low-paying service-sector jobs.

But Finlayson said that’s not an accurate reflection of what’s going on in the B.C. economy.

“When you hear the debate roll out … where the opposition will talk about [how] we don’t have enough good- quality jobs being created and the government will point to its B.C. jobs plan as the reason why we’ve had a solid job market – what all that ignores is the fact that in a preponderantly market economy, government’s effect on the job market is indirect more than direct,” he said, adding the province’s influence is confined to its fiscal, tax, trade, infrastructure, education and training policies.

Instead, Finlayson attributes much of B.C.’s job growth the past four years to the decline in the dollar’s value.

“Our analysis suggests that because of the particular industrial structure we have in B.C., that we probably are affected more than any other province in the country, other than perhaps P.E.I., by shifts in the exchange rate,” he said.

Furthermore, the tourism sector and the province’s two main ports, the Port of Vancouver and the Port of Prince Rupert, have all benefited from a lower dollar.

“Relatively few of the jobs that have been created in B.C. the last four years are directly attributable to actions or decisions by government,” Finlayson said.

@reporton