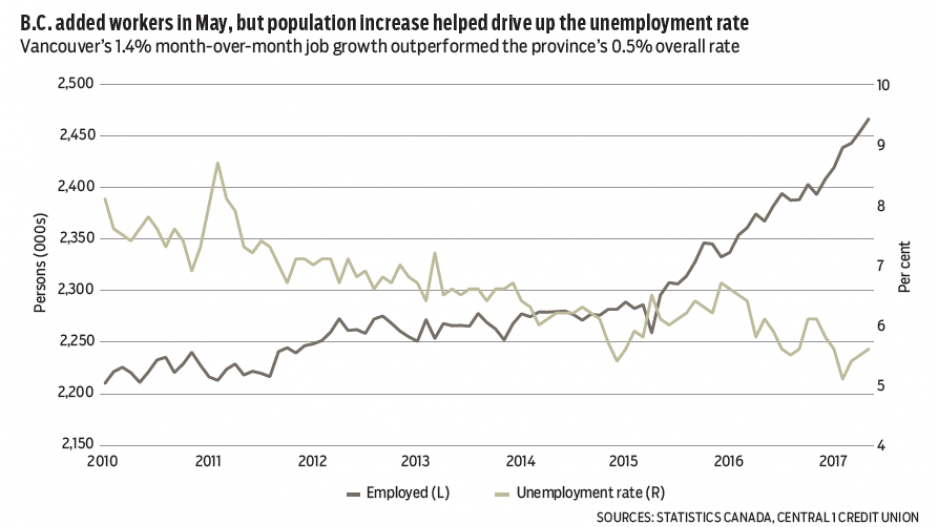

May marked another strong month for B.C.’s labour market as estimated employment jumped 0.5%, or 12,300 persons, from April to reach 2.47 million persons and well exceed a national increase of 0.3%.

Higher levels of business confidence, housing demand, tourism and exports have contributed to a robust expansionary employment cycle. Year-over-year employment growth reached a sparkling 4.2% with a full-time gain of about 3.5% and a rise in part-time work of 6.6%.

The Vancouver census metropolitan area outperformed the rest of the province in May with a 1.4% increase from April, reversing some of the weaker early-year trend. However, year-over-year growth, at 2.9%, remained lower than the provincial performance.

A slight rise in the provincial unemployment rate to 5.6% in May reflected population growth and a significant increase in the labour force participation rate, particularly among youth. Strength in hiring has led to greater labour force engagement and fewer discouraged workers.

Three-month average unemployment rates for census metropolitan areas show a near 4% rate in Kelowna and Victoria, 5.2% in Vancouver and 5.6% in Abbotsford-

Mission. Small urban and rural areas are higher.

Meanwhile, the Lower Mainland housing market tightened again in May with surging prices and higher sales as a strong economy, low rates and desire for home ownership remained an offset to policy measures meant to cool the market. Despite a 9% year-over-year decline, same-month sales of about 7,000 units were second highest on record next to 2016, and compared to a 26% drop in April.

Stronger sales absorbed higher new listings, holding inventories at historical lows. Insufficient inventory is a key driver of accelerated market conditions and price growth.

The benchmark-value surged 1.7% from April on a seasonally adjusted basis to $855,550. Coupled with April’s numbers, price growth trends were the strongest since July. While the more “affordable” apartment and townhome market continued to lead price gains, detached-home prices picked up steam for the second straight month after a six-month lag.

Current market trends point to further price growth over the next few months, but policy uncertainty could weigh as a BC NDP-led and BC Green Party-backed minority government will likely lead to tightening of housing policy, and could include some form of occupancy tax and expansion of the foreign-buyer tax. This could shift consumer sentiment, or delay purchasing decisions. •

Bryan Yu is deputy chief economist at Central 1 Credit Union.