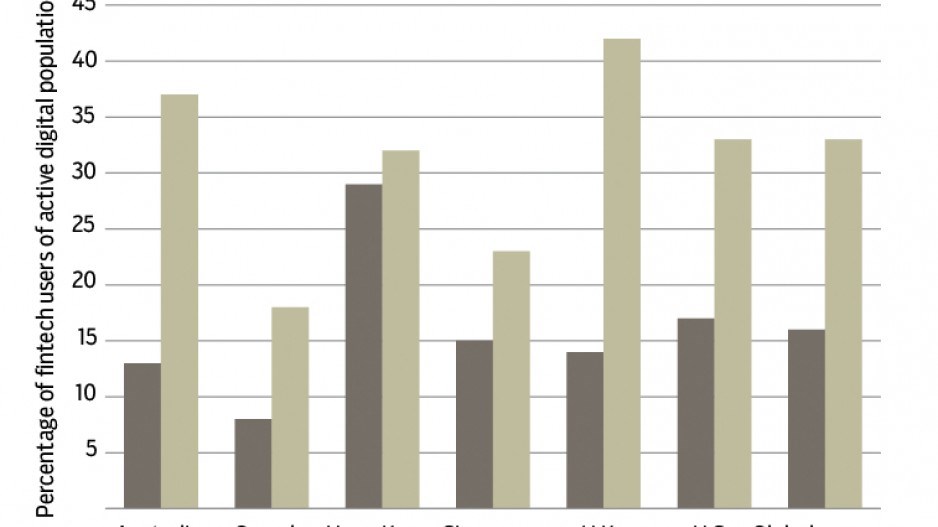

Canada’s adoption rate for financial technology (fintech) is just a little above half of the global average – 18% compared with 33% globally – and the lowest of the countries included in EY’s Fintech Adoption Index 2017 report.

However, the tide could be turning.

While Canada, as it was in 2015, is still the slowest adopter of fintech compared with Australia, the U.K. and other regions included in the report, its increase in fintech adoption is higher than the global average. It rose to 18% in 2017 from just 8% adoption in 2015, a 125% increase.

Global fintech adoption rose to 33% in 2017 from 15.5% in 2015, a 113% increase.

“One of the barriers in Canada is that most consumers still prefer to use a traditional service provider rather than a fintech [company],” said Ron Stokes, EY Canada’s fintech leader. “But the level of adoption rate in Canada is growing.”

He said Canadians are reluctant to abandon banks for new fintech alternatives because:

•Canadian financial institutions are embracing new technology that gives their consumers more access to fintech products; and

•Canadian banks’ ability to weather the 2008 financial crisis has increased the trust they have among domestic and international consumers.

Lack of knowledge and awareness is also affecting Canada’s fintech adoption. According to the EY report, 22% of survey respondents were unaware of what fintech was, the highest rate of any country studied. Canada also held this title in 2015 and had one of the lowest drops in fintech ignorance of the countries studied.

Canada has three fintech hubs: Vancouver, Montreal and the Kitchener-Waterloo-Toronto corridor. The areas’ universities are helping Canada develop its fintech industry.

“If we compare [Canada’s] fintech hubs to others in London, New York and Silicon Valley,” said Stokes, “I think we have a very attractive and powerful fintech ecosystem in Canada.”