The retirement of Hong Kong magnate Li Ka-shing – and the succession of his son Victor Li, who holds Canadian citizenship and previously spent significant time in Vancouver – is unlikely to renew Li family business interest in B.C., a Chinese-Canadian community leader said.

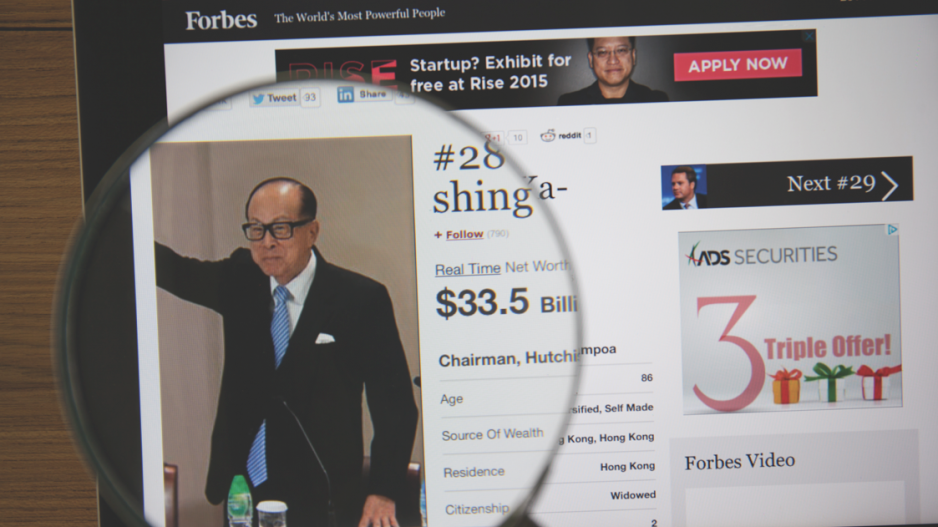

The elder Li, Hong Kong’s richest man and a regular amongst the top players on Forbes’ most-wealthy lists, announced this month he will retire after CK Hutchison Holdings Ltd.’s May 10 annual general meeting. For 2018, Forbes put Li’s net worth at US$34.9 billion, ranking him 23rd in the world, and his companies employ 323,000 people.

Former Vancouver city councillor and CEO of immigrant services group SUCCESS Tung Chan, who has met both Lis during their time in Canada, said while people might debate Li’s role in shaping Vancouver’s current real estate and urban development trends, the key impact of the billionaire’s 1988 purchase of the Expo 86 lands was an instant image refresh for the city in the eyes of Hong Kong’s investment elites.

“He really put Vancouver on the map,” Chan said, noting a number of high-profile Hong Kong investors who followed after Li’s $320 million purchase of the Expo lands. “Once he bought the land, others quickly followed suit.… The proper credit for Mr. Li is that he was able to bring the investment and the initial impetus to invest in Vancouver.”

Li’s current holdings in Canada (through companies like Cheung Kong Property Holdings Ltd.) include water heater/air conditioner firm Reliance Home Comfort, which was bought last year for $2.82 billion. Other holdings include stakes in Husky Energy Inc. (TSX:HSE), as well as companies like Park’N Fly, Canadian Power Holdings Ltd. and Wex Pharmaceuticals.

In his retirement announcement, Li, 89, told Reuters that he has been “working for a long time, too long,” and that he is “very happy and very honoured” to have had the opportunity to achieve the business success he has seen.

He is also expected to stay on as a senior adviser to Victor Li, whose CK Hutchison responsibilities have increased in recent years in anticipation of his father’s retirement.

Most analysts, therefore, are not expecting a change of direction for Li’s business empire under Victor Li, who has already assumed top posts in Husky Energy and Power Assets Holdings. He also has co-managing director and deputy chairman roles at CK Hutchison.

As such, Chan said he does not expect Victor Li – who previously spent winters in Whistler due to his ties to the Vancouver market – to return more investment focus to the Lower Mainland, given that the local market here has changed since the 1980s, when the elder Li bought the Expo lands.

“If you look at what they have been focusing their efforts [on] recently, it’s much about the strategic acquisition of port facilities around the world,” Chan said. “I don’t think Vancouver has any port facilities available for purchase, and the potential – as well as the reception – in Europe right now for foreign investment is very different from what you see here. Vancouver’s profile is now different; its politics are different, and its public opinion – especially for foreign investment – is different.”

Chan does note, however, that given Canada’s political and economic stability, the Lis might still consider Vancouver and the rest of Canada as a safe haven in case of turmoil in other markets. But otherwise, investment elsewhere might be more attractive – especially given the elder Li’s operational philosophy of targeting valuable assets that are undervalued and buying at the appropriate time.

Given the younger Li’s more westernized, documentation-centric method of managing businesses, Vancouver’s current status is unlikely to make it more attractive, Chan surmised.

“I know people who have worked for both Lis, and Mr. Li [the elder] is known more for doing business the old Chinese way, where a handshake is a handshake – and a lot of value is put on long-term relationships and the trust that comes along with that. Victor represents a new way of doing business; the contracts are all laid out, and the documentations up front – before any deal is made – is very important. So relationships will likely be less focused upon.” •