Corporate stock and debt deals in the province hit $14.4 billion in 2017.

The value of B.C.’s largest corporate stock and debt deals hit $14.4 billion in 2017, 13.2% higher than 2016’s total and the first increase in four years.

The increase comes after a 31.2% drop in total value of deals over three years (2014 to 2016).

Although the total value of corporate deals in B.C. increased, it is still below the $18.5 billion recorded in 2014.

Meanwhile, the median value of deals on Business in Vancouver’s list of the top 100 corporate finance deals of 2017 has been steadily increasing. It jumped 80.1% in the most recent year alone: to $79.1 million in 2017 from $43.9 million in 2016.

The median value of the top stock and debt deals has more than doubled since 2013, increasing 151.2% from $31.5 million, as the value of deals ranked lower on the list rises faster than for those in the top 10.

Elsewhere on the list, the median value for the largest non-mining mergers and acquisitions (M&As) has fallen 51.6% ($102 million) to $95.9 million in 2017 from $197.9 million in 2014.

However, while the median value fell, the average M&A value more than doubled, up 106.6% to $546.5 million in 2017 from $264.6 million in 2014, as BIV’s M&A list is dominated by more billion-dollar deals than it has been in the past.

In 2017, the largest M&A deal was valued at $4.7 billion, more than four times (405.1%) the size of the largest M&A deal in 2014 ($933 million).

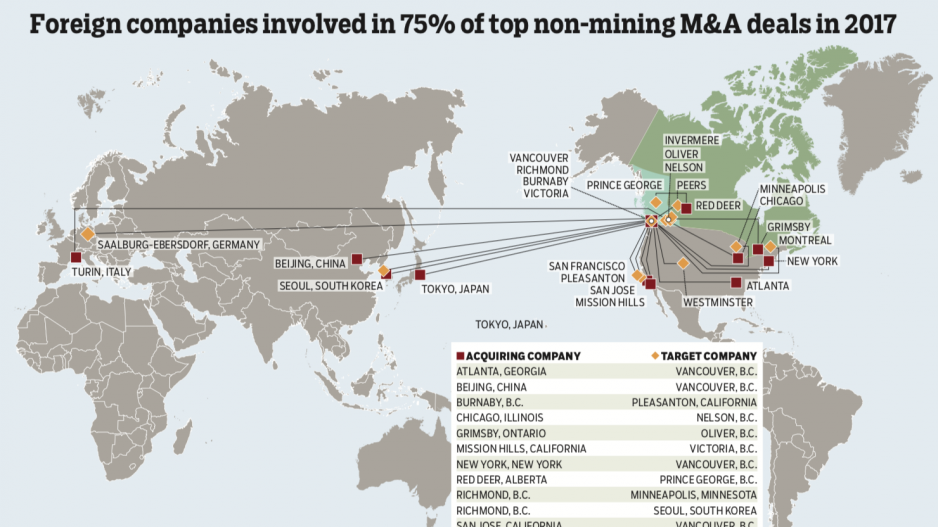

B.C.’s largest M&As involved significantly more foreign companies in 2017 than in previous years. In 2016, 40.6% involved foreign companies. That number jumped to 75% in 2017.