The US$1 billion sale of Vancouver tech firm Avigilon to Motorola Solutions Inc. (NYSE:MSI) was one of only a “small handful” of “mega-deals” announced during the first quarter of 2018, according to a new report on Canadian mergers and acquisitions (M&A) activity.

While the Canadian M&A market began the year at its highest pace in six years with 834 transactions, a May 9 report from Crosbie & Company Inc. reveals the total deal value amounted to $47 billion.

The total deal value during the same period a year earlier amounted to $80 billion.

Crosbie attributed the decline to both trade uncertainty and a drop in so-called mega-deals — transactions valued in excess of $1 billion.

The report said mega-deal activity was at its lowest in two years.

“Given that a significant portion of Canadian M&A activity is north-south with the U.S., it is possible that the uncertainty created by the ongoing NAFTA [North American Free Trade Agreement] renegotiations has caused acquirers to hit the ‘pause’ button on larger transactions,” the report stated.

Among the eight mega-deals announced in the first quarter, two of the targeted firms were based in B.C.

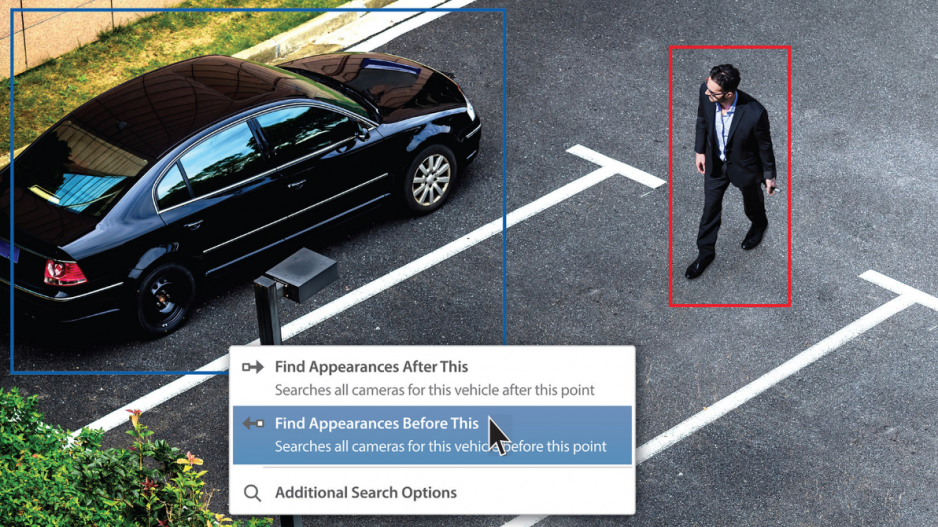

In addition to Avigilon, which specializes in software and hardware for video surveillance, Vancouver-based Pure Industrial Real Estate Trust announced its acquisition by The Blackstone Group LP in a deal worth $3.7 billion.