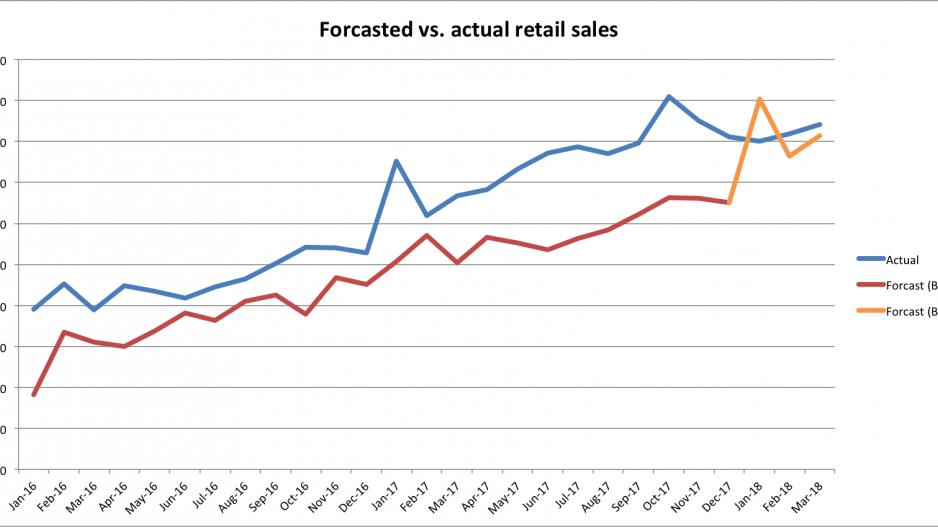

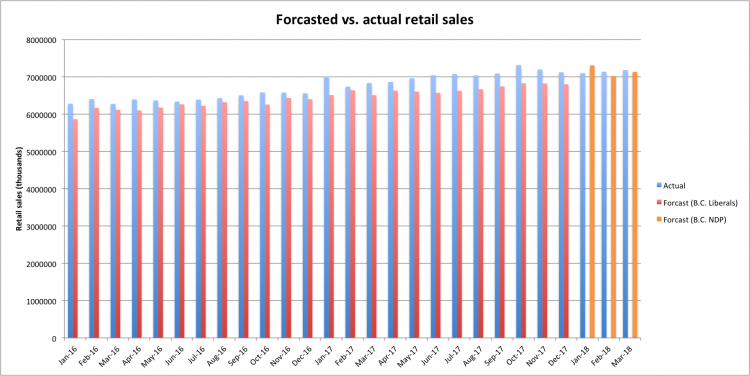

After a rough January start, B.C. ‘s retail sales have edged closer the government’s projected sales growth for the sector.

In March, retail sales grew 5.1% to $7.18 billion, up from $6.8 billion from the same month last year. This was $53.9 million more than projected in the 2018 provincial budget released earlier this year and eight points higher than the province’s projected annual growth of 4.3%.

March’s retail numbers built on February’s success where retail sales grew 5.9% from the same month last year. March and February results were in contrast to January where retail sales came in well below the projected values. In January 2018, retail sales came in $204 million short of projections, growing only 1.4% to $7.1 billion, compared with projected growth of 4.3% or $7.3 billion.

Even with January’s disappointing retail sales numbers, the first quarter of 2018 is coming in close to projections at $21.4 billion, only 0.2% or $40.8 million bellow target.

British Columbia was one of seven provinces that experienced monthly increases in retail sales over the previous year. However, B.C. was at the back of the pack at 0.6% growth in March from February, compared to Manitoba’s 3.2% and Quebec’s 1.3%.

Nationally, retail sales grew 0.6% in March from the previous month. Motor vehicle sales were primarily responsible for the boost in sales during March, growing 3% during the month. According to TD economist Rishi Sondhi, if motor vehicles were excluded, national sales dipped 0.2%. Clothing, home furnishing and general merchandise all posted an increase in sales, however, sales at electronics stores and gas stations reported significant declines in sales from the previous month.

“The pickup in consumption at the end of Q1 leaves growth tracking 1.7% for the quarter, but provides better momentum heading into Q2,” said Katherine Judge, economist at CICB Capital Markets, in a note to investors. “With Q1 GDP comfortably topping the Bank of Canada’s forecast of only 1.3%, a July hike is still likely as long as the coming month or so of data put Q2 tracking measures north of 2% again.”