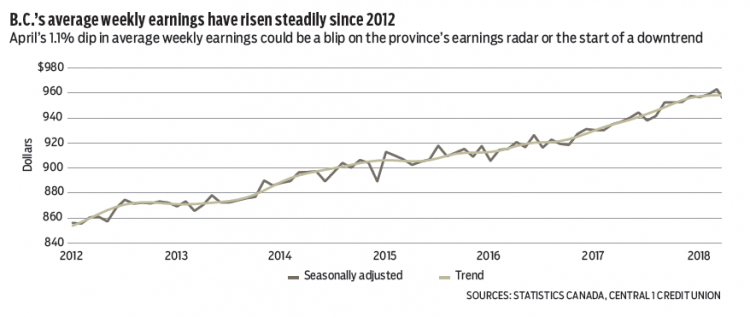

Following a strong March bump, average weekly earnings (AWE) posted a weak April showing in B.C. According to the Survey of Employment, Payrolls and Hours, April wage earnings fell 1.1% from March to $952 and year-over-year growth dropped to 1.6% from 3% the prior month.

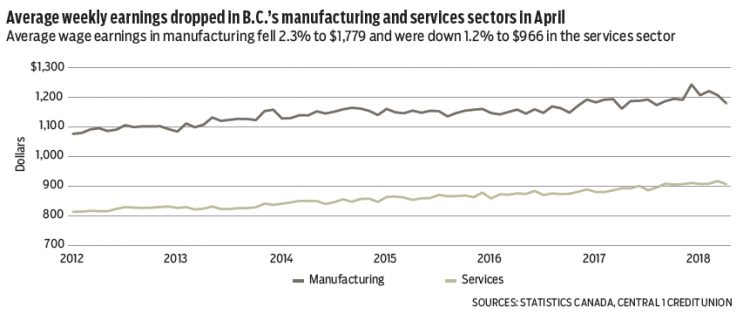

Relative to March, average weekly earnings declined in 12 of 20 industry sectors, spanning both the goods and services sectors. Goods-sector wage earnings fell 2.3% to $1,779, owing mostly to a 5% drop in manufacturing, which offset growth in utilities and resource-extraction sectors. Services-producing sectors fell 1.2% to $906 with declines in most industries. Earnings in real estate, finance and leasing declined 5.6% from March to $1,072, but were up more than 20% from April 2017. Declines were also observed in professional, scientific and technical services (down 2.5%), management services (down 5%) and accommodations and food services (down 5.3%).

While average weekly earnings are typically volatile due to a number of factors, April’s performance was disappointing. The fixed weighted index of average hourly earnings, which adjusts for job tenure effects, showed similar weakness, with a 1% monthly decline and deceleration in year-over-year growth.

It remains to be seen whether the latest decline is a temporary blip or a delayed response to more subdued economic data in the first quarter of the year. Prior to April, AWE had tracked a strong pace of close to 3% year-over-year, aligning with even more robust average hourly wage growth in Statistics Canada’s related Labour Force Survey.

Small-business confidence in B.C. remained subdued in June, according to the Canadian Federation of Independent Business’ (CFIB) monthly Business Barometer. At 58.8 points, the index was unchanged from May. While above the 50-point threshold, which means that of the firms surveyed, more anticipated better business conditions over the coming year relative to those expecting worse conditions, the index was at its lowest since late 2012. Typically, a value in the 65-to-70-point range is linked to a moderate-growth economy. In comparison, the national index came in at 62.2 points.

In a matter of months, B.C. has transitioned from a province ranked among the highest for small-business confidence to one that lags behind most other provinces.

This recent dip in confidence could reflect a number of factors. Signs of slower economic growth emerged in the first quarter, while expectations have naturally downshifted after a robust 2017 growth performance. That said, costs have also risen. The CFIB survey points to more acute skilled-labour shortages, which are contributing to higher wages.•

Bryan Yu is deputy chief economist at Central 1 Credit Union.