Deals in cannabis, real estate and energy have kept Canadian merger and acquisition activity healthy despite turbulent Canada-U.S. trade talks.

According to PwC Canada, more than 1,500 deals worth $93 billion took place in the first half of 2018, including 48 cannabis deals valued at $5.2 billion.

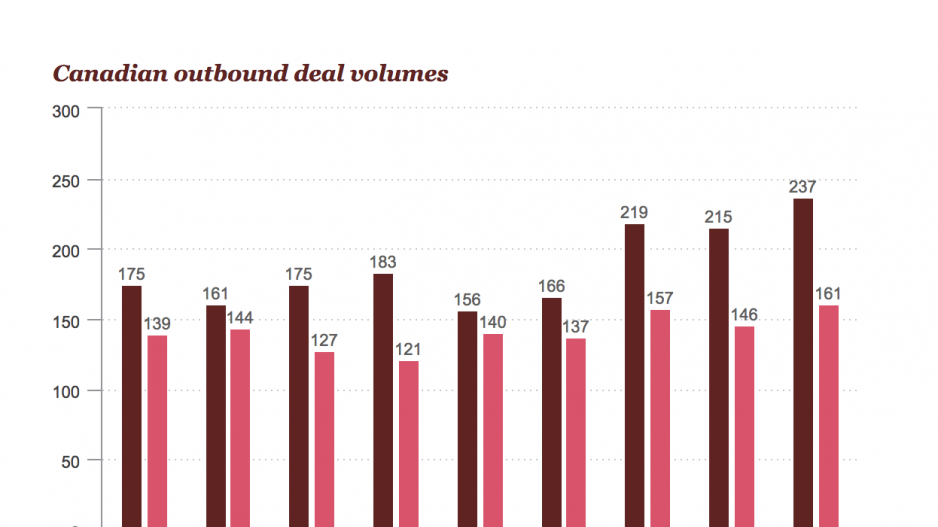

While activity dipped year over year, the firm says the results are strong and set a positive tone for the rest of 2018. It also found that outbound deals from Canada to the U.S. rose 8% compared with the first six months of 2017. More than 10% of all deals were international outbound deals in countries outside of the U.S, including Australia and the United Kingdom.

"Canada has had a solid relationship with the US, however, the global geopolitical environment is creating greater uncertainty for dealmakers,” noted Dave Planques, PwC Canada’s national deals leader, in a release.

"The growth in international outbound deals demonstrates that Canadian businesses are performing well and will continue to pursue growth opportunities at home and abroad.”

PwC Canada cautions that trade tariffs, slowly rising interest rates and an evolving cannabis industry landscape could all influence activity in the latter half of 2018.