Kenneth Tollstam, then the City of North Vancouver manager, quietly moonlighted as a director, officer, and investor of at least a dozen low-quality start-up companies, enabling him to purchase a $16-million oceanfront mansion, a Glacier Media investigation reveals.

Many of those companies, listed on the highly speculative Canadian Securities Exchange and TSX Venture Exchange, are connected to Tollstam’s son-in-law, Anthony Kevin Jackson, the principal of BridgeMark Financial Corp., at the centre of a massive, alleged scheme to defraud retail investors — one that rivals those at the now defunct Vancouver Stock Exchange.

Although Tollstam, a chartered professional accountant, retired in July 2018 after 37 years of public service, corporate records dating back to June 2014 show he began working closely with his son-in-law — a busy player in the penny stock world — in a series of promotions and transactions, some of which are now under the lens of a B.C. Securities Commission investigation.

On Nov. 26, 2018, a property assessment report shows Tollstam and his daughter Lisa Jackson closed the $15,888,888 million cash sale — more than $3.5 million above the assessed value — for her family’s new home on Bellevue Avenue, complete with an infinity pool overlooking Burrard Inlet from one of the wealthiest area codes in Canada. Coincidently, this was the same day the BCSC implicated Anthony Jackson as the scheme’s central figure.

Tollstam and the Jacksons are now among more than two dozen people implicated in the alleged share distribution conspiracy. The case has implications for investments in CSE- and TSXV-listed companies and will focus on how gatekeepers of the public interest such as regulators, brokerage firms and professionals are conducting themselves.

The Jacksons, who did not respond to multiple requests for comment, are middle-age professionals — Anthony is a self-employed chartered professional accountant and corporate services provider and Lisa is a realtor with Macdonald Realty in West Vancouver.

The alleged scheme

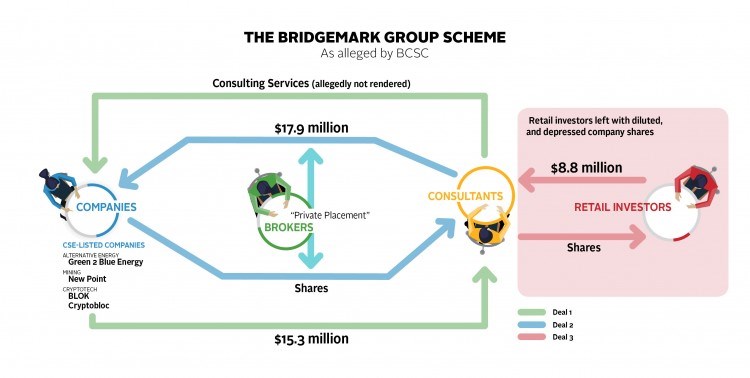

Anthony Jackson and his companies — BridgeMark Financial Corp. and Jackson and Company Chartered Accountants — are among 25 so-called consultants and their 26 associated firms who are alleged by BCSC to have entered into consulting agreements and share purchases with 11 CSE-listed cannabis, cryptocurrency, mining and alternative energy companies. They are collectively dubbed by the commission as the “Bridgemark Group” for the many close associations to Anthony Jackson and BridgeMark Financial Corp.

Additionally, Lisa Jackson is a respondent to an Alberta Securities Commission hearing regarding related allegations involving TSXV-listed Prize Mining Corp.

BCSC has specifically alleged that, between February and August, the Bridgemark Group members privately bought at least $50.9 million worth of stock in the 11 companies at pennies per share but had most of the money returned for consulting services that were allegedly not rendered. The transactions are described as “cash swaps.”

With these share sales (private placements), the companies publicly touted investor interest.

A BCSC panel noted “what was disclosed to the public” by some companies with respect to their private placements was different from “the actual net benefit.”

Meanwhile the Bridgemark Group members quickly sold their shares, at a discount of their original purchase price, to retail investors who were left with diluted and depressed company stock. Online investor forums began to fill with complaints in the summer of 2018 about those associated with BridgeMark and Anthony Jackson.

BCSC executive director Peter Brady contends the alleged actions are “abusive to the capital markets” and contrary to the public interest.

This enforcement action involves an unusually high number of operatives who have collectively been involved in hundreds of other companies. Should the BCSC allegations be proven, it raises serious questions about the credibility of those other companies and how the exchanges are monitored.

As an investigation continues, a hearing scheduled for April, with more detailed and unproven allegations, will determine liability.

Tollstam one of dozens under investigation

In 2017, Tollstam was the highest-paid bureaucrat among local government managers on the North Shore, earning over $275,000 in compensation, according to the municipality’s Statement of Financial Information report. He retired from that position in July 2018.

Despite his large salary, Tollstam is listed as an employee or director of 10 public companies listed on Stockwatch.com. Five of those companies are headquartered at 800 – 1199 West Hastings Street, the office of BridgeMark Financial Corp., where many other shell companies operate. Only two companies are trading above $1 and most are under 10 cents a share, operating as little more than shells.

As it relates to the Bridgemark scheme, Tollstam bought $655,000 worth of shares as a consultant for Beleave Inc., a cannabis company now trading at 12 cents a share.

He also invested close to $500,000 in Green 2 Blue Energy Corp., a Polish-Canadian company that produces wood fuel pellets. Tollstam was listed a consultant of Green 2 when he took part in the private placement.

Tollstam’s LinkedIn profile features his position as Chief Administrative Officer but makes no mention of his work as a director or CFO of these various companies. Conversely corporate management records of the companies he’s involved with make no mention of his role as the City of North Vancouver’s CAO.

Tollstam did not respond to multiple requests for comment from Glacier Media, by phone or at his primary residence near the Capilano watershed.

The Bridgemark Group

Anthony Jackson’s business associates in this alleged scheme are a potpourri of North Shore residents, including: Royal LePage realtor and failed West Vancouver council candidate Tara Haddad, former NHL player Cameron Paddock, his receptionist Danilen Villanueva and his brother-in-law Ryan Venier, who runs a prominent dental practice in Abbotsford and purchased shares with his company, Altitude Marketing Corp., headquartered at his dental office.

Additionally, two others are alleged by one of the CSE-listed companies to be key orchestrators of the transactions.

One is convicted securities fraudster Aly Babu Mawji, who is working from and living in a $2.8 million West Vancouver home, which was sold by Lisa Jackson last year in a cash transaction to a numbered company. Mawji’s Facebook friend Michael Ivison, who lists employment at a Port of Vancouver grain terminal, is the company’s sole director; he did not return a request for comment.

Mawji spent 17 months in German prison after being convicted in 2012 for a 25.7 million Euro pump and dump scheme of B.C.-based company De Beira Goldfields.

Corporate records show Anthony Jackson and Mawji were both directors of Golden Touch Resources Corp. in 2011, prior to Mawji’s arrest.

Mawji was released from prison ahead of schedule. He returned to the Lower Mainland and married Denise Marie Trainor, who is also named as a respondent as an officer for stock promoter Northwest Marketing and Management. Both have declined speaking to Glacier Media.

BCSC has not explained how Mawji was able to re-emerge into B.C.’s markets after his conviction. He became manager of Northwest, which was among the most active purchasers among Bridgemark Group members.

BCSC applied for a permanent trading ban against Mawji on Oct. 1. The commission, in applying to ban Mawji from business related to securities, said it made its October application “based on [his] conviction for securities misconduct in Germany.”

It provided no explanation why Mawji wasn’t faced with orders in B.C. immediately after his highly publicized conviction in Germany.

Another central figure is illegal cannabis distributor Justin Liu, who has had documented business dealings in West Kelowna with a known Hells Angels associate.

Liu, of Lukor Capital Corp., bought $2.25 million in shares, as a consultant, from Abattis Bioceuticals, according to CSE filings.

Company documents show Liu residing at a mansion on Groveland Road in West Vancouver, the same address of his mother May Joan Liu (Yee), a penny stock player at the Vancouver Stock Exchange, according to past reports. Liu operates cannabis dispensaries, as does his mother.

May Joan Liu is director of WeeMedical Dispensary Society, which has run afoul with numerous municipalities, including Delta, Richmond, Parksville and Prince George, also for illegally operating a business.

Justin Liu was a director of Green Tree Dispensary Society in District of North Vancouver when, in 2016, the municipality filed an injunction against it for violating bylaws.

It took Tollstam’s municipality until May 2018 to file an injunction WeeMedical.

Court documents from April 2018 identified Liu as a “directing mind” of Green Tree and Shane Schuhart as the society’s director. In 2015, according to the Vancouver Sun, RCMP identified Schuhart as a Hells Angels associate operating an illegal dispensary in Vancouver.

Green Tree and WeeMedical were subsequently shut down by the City of West Kelowna in 2018.

Investigation is ongoing

With an investigation in full swing in December, executive director Brady issued temporary and limited trading bans against the Bridgemark Group and the 11 companies, who are also respondents to the hearing.

But Brady only presented a commission panel with bank records for four companies: Green 2 Blue Energy Corp., Cryptobloc Technologies Corp., BLOK Technologies Inc. and New Point Exploration Corp. The panel ruled in January that evidence submitted to date against the other seven companies was not sufficient.

And so, the panel strengthened and extended the trading bans against the hearing respondents but also lifted them against those who had no dealings with the four noted companies. Those whose bans were lifted remain under investigation.

Several market experts and investors have told Glacier Media the companies—none of which have any meaningful revenue—were either complicit or ignorant for entering into the consulting contracts. Many believe the scheme is bigger than what has been presented to the panel to date.

“I was always surprised these small companies were getting big investments,” Canadian mine investor Luc Ten Have told Glacier Media.

“So I went through all these reports; I’d see Anthony Jackson and all these names.

These were big investments in very small, illiquid companies,” said Ten Have, who noticed the scheme as far back as late 2016.

“All these companies had the same financials; all these companies were spending way too much,” he said.

Lawsuit shines light on transactions

One company is challenging its culpability by alleging a “conspiracy” by Liu, Mawji and others against the company in a civil lawsuit filed in B.C. Supreme Court.

PreveCeutical Medical Inc. CEO Stephen Van Deventer alleges Mawji and Liu arranged $2.8 million worth of pre-paid consulting agreements (including their own) while concurrently buying $4 million worth of shares under consultant exemptions of the Securities Act, in June, 2018. PreveCeutical claims the consultants quickly sold their shares contrary to the interest of the company.

The company’s shares nearly tripled to about 15 cents in September, 2018, before it declined again to five cents after heavy trading activity.

As with many CSE-listed respondents analyzed by Glacier Media, Preveceutical had questionable chances of commercial success. Its audited financial statements for 2017 flag financial concerns. Documents show PreveCeutical had spent $423,402 on travel and meals and $517,612 on research and development. It had “no significant revenues.”

In September, 2017, PreveCeutical hired high-profile New York-based publicist Susan Blond, as it promoted an array of products. In January, 2018, its scorpion venom research “remained on schedule” according to one of several news releases. By September, 2018, records show its deficit grew from about $10 million to over $16 million while amassing $11,161 in gross revenue in 2018.

Liu denies any of the company’s allegations, noting his company Lukor didn’t even buy shares, thus questioning how he could he be a part of the conspiracy.

Van Deventer claims Stadnyk and Partners Inc. introduced registered broker Robert Barber of Mackie Research Corp. to him. Barber then introduced Van Deventer to Mawji on June 21. Mawji also claims, in his defence filing, Barber contacted him “to present him with an opportunity “ to invest in PreveCeutical.

It is unclear how and why a registered broker is allegedly setting up deals with a convicted fraudster and promoting a company with questionable prospects of commercial interest. Mackie Research and Barber did not reply to a request for comment.

Mawji claimed PreveCeutical gave his company a $425,000 prepaid contract to conduct online promotions. He also stated in his counterclaim he bought 30 million shares for $1.5 million. Mawji denies selling shares contrary to the best interests of shareholders and said it was up to PreveCeutical to do its due diligence.

Speaking to Glacier Media in December, Van Deventer conceded he could have simply Googled Mawji’s name. Instead, he said he depended on Mawji and Liu’s reference, who happened to be Anthony Jackson. Van Deventer claims to be a seasoned veteran in the industry, according to corporate disclosures.

While Preveceutical was one of seven companies that had its limited and temporary trading orders lifted in January, they remain under investigation by the BCSC.

Tollstam shows interest in Polish wood pellets

Green 2 is one company Tollstam purchased shares in, although the BCSC panel has noted evidence has not been presented to it that shows Tollstam sold his shares.

Green 2 came onto the market in a reverse takeover of Brigade Resource Corp. It sells Polish wood pellets.

After reporting gross annual sales of $454,880 to June 30, 2017, the company was listed on the CSE that December, causing a spike in the stock to about 30 cents a share.

CSE filings show Tollstam purchased $500,000 worth of 30-cent shares on April 13, 2018. Four other Bridgemark Group members rounded out a total purchase of $4.28 million, including $1.5 million from BridgeMark secretary Danilen Villanueva, who was sole director of Detona Capital Corp., headquartered at 800 – 1199 West Hastings Street, the office of BridgeMark Financial Corp.

Trading records show a massive selloff of shares in late April, as the share price plummeted to around 15 cents.

Audited financial statements to June, 2018, show the company had sunk $3.75 million into consulting and management fees and $1.44 million into general and administrative expenses.

Comparing 2018 news releases touting “production capacity” to actual gross sales, the company was operating well below its capacity. For instance, in April, 2018, the company stated its monthly capacity was 1,800 tonnes of pellets, which, at an estimated $200 per tonne of pellets, would amount to $360,000 a month. Financial statements showed gross monthly sales from July to September were about $69,000.

It now trades for eight cents a share.

Quantum Cobalt; a family investment

Tollstam’s entrance into being employed by and directing publicly traded companies begins with mineral exploration company Bravura Ventures Corp. in 2014.

Anthony Jackson arrived as Bravura’s CFO in October, 2012 while Tollstam became a director in June, 2014, after the company listed on the TSXV. In 2014 the company wrote off its initial property.

In May, 2015, the company paid off about $275,000 in debt by selling five-cent shares to a number of Bridgemark Group members including Tollstam, Haddad, Venier, Jackson and Simran Gill. Lisa Jackson also bought shares, as did Ryan Venier’s family members.

The company, now named Quantum Cobalt, is not a respondent to the BCSC hearing. It does, however, show a similar transaction pattern to a company such as Blue 2.

Many Bridgemark Group respondents made an investment in the company as consultants, which preceded a spike in stock price only to be followed by a large sell off of shares. In the same year, millions of dollars were spent on consulting fees and advertising despite having no revenue.

For example, in June, 2017, with Tollstam now the CFO, shares were issued for between 15 and 25 cents to the Bridgemark Group.

At the end of the year the stock peaked at around $1.80 but following heavy trading activity from December, 2017, to February, 2018, it dropped precipitously and is now, once again, sitting at about five cents a share.

In the year ending Jan. 31, 2018, audited records show the company spent $3.3 million on consultants (up from $684,600 the year prior) and $1.46 million on advertising and promotion (up from $343,052). It is not disclosed who received the consulting contracts.

Tollstam subject to disclosures

As a municipal employee, Tollstam would have had to file annual disclosures of “the name of each business located or carrying on business in British Columbia” that is “financially remunerating” him for services performed as an employee.

Disclosures are not accessible to the public but are sent to council members and the provincial government.

City of North Vancouver Mayor Linda Buchanan, who was on council for seven years when Tollstam was CAO, did not return calls or emails on the subject.

Rod Clark, a former City of North Vancouver councillor, said he was shocked to read Tollstam’s name in reports on the securities commission investigation.

“I’ve known Ken for 35 years,” he said. “I always thought of him as a consummate professional.”

Clark said he was not aware of Tollstam’s involvement in any kind of consulting work for venture companies during the time he worked for the City of North Vancouver.

“We were paying him a very good salary to do a full-time job as administrator of the city. ... I knew nothing of this happening at the time.”

Chartered accountant and real estate agent regulators on alert

As accountants, BCSC enforcement actions against Tollstam and Jackson are now being monitored by the Chartered Professional Accountants of BC.

CPABC vice-president Edward Tanaka said his self-regulatory body is aware of the BCSC hearing that involves several accountants, including Anthony Jackson and Tollstam.

At this point CPABC is monitoring the hearing outcome, he said.

“We can’t shoot first and ask questions later,” said Tanaka.

Tanaka said securities violations by accountants are highly relevant to conduct expected of accountants. If BCSC were to make a finding against one of its members, Tanaka said a committee would likely hold a hearing. Depending on the seriousness, an accountant can lose his or her designation, he said.

Still, whereas CPABC would publish internal proceedings against its members, it does not flag outside regulatory violations or proceedings on its own website unless it takes action itself.

Tanaka wouldn’t comment on any specifics pertaining to BCSC respondents.

Meanwhile, two realtors have caught the eye of the Real Estate Council of B.C. that says it too is now aware of the BCSC and Alberta Securities Commission investigation, after Glacier Media contacted it.

Glacier Media first asked Tara Haddad and Lisa Jackson’s respective managing brokers if they were aware of the proceedings. Both said they were not.

When Glacier Media subsequently asked Haddad if she had informed her employer, she said she had. Jackson did not respond to requests for comment.

The Council states: “Real estate licensees are required to notify RECBC promptly whenever they are subject to disciplinary or regulatory proceedings by another regulator or in another jurisdiction in any the following fields: real estate, insurance, securities, mortgage brokers, accountants, notaries, lawyers. Failure to notify RECBC can result in disciplinary proceedings.”

The Council said, via email, “due to legal requirements regarding privacy and confidentiality, RECBC is unable to provide details about any information it may have received about a licensee or a brokerage.”

- With files from Jane Seyd, North Shore News