British Columbia’s largest life sciences companies increased their employee base an average of 11.5% in 2018.

The industry has grown relatively steadily over the past five years, except for 2017 when the average employee base of the province’s largest life sciences companies fell 6.6% to 37.9 employees from 40.5 in 2016.

However, the largest players in the industry more than offset the 2017 loss by adding three times as many employees in 2018 as they had lost in 2017.

The average employee base at the B.C.’s largest life sciences companies grew 31.4% from 2014 to 2018. The median grew twice as much as the average, increasing by 73% over the same period. This suggests that smaller companies lower on the list grew faster than larger companies higher on the list.

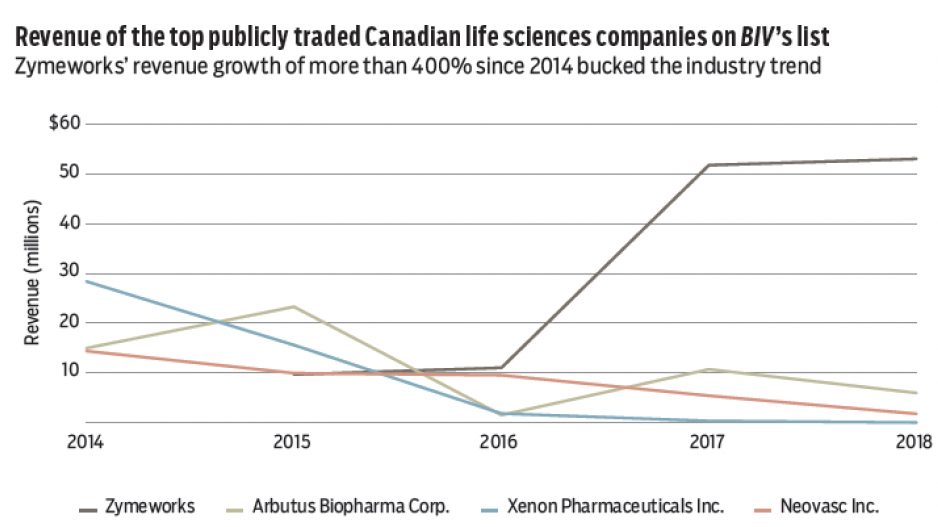

Despite the growth in staff numbers, the industry does not have the same positive outlook when it comes to revenue. Of the six public companies on Business in Vancouver’s Biggest Life Sciences Companies in B.C. list (page 12), three reported declining revenue while two showed revenue growth over the past five years, and one has not reported revenue earnings in recent years.

California-based Amgen Inc. (Nasdaq:AMGN) boasted the highest top-line revenue by far at $23.7 billion, or more than 400 times that of Zymeworks Inc. (TSX,NYSE:ZYME), the highest-revenue-earning B.C.-headquartered life sciences company.

Of the B.C.-headquartered public companies, Zymeworks was the only one to grow over the five-year period. It went public in 2017 and has made only four years of financial data available. Zymeworks’ revenue jumped approximately 450% to $53 million in 2018 from $9.6 million in 2014. Most of Zymeworks’ growth occurred in 2017, the year it went public. Its revenue increased 371% to $51.8 million from $11 million in 2016.

No. 12 Neovasc Inc. (TSX:NVC) and No. 6 Xenon Pharmaceuticals Inc. (Nasdaq:XENE) have each suffered annual revenue declines since 2014.

No. 3 Arbutus Biopharma Corp. (Nasdaq:ABUS) reported annual revenue declines since 2015.

While their revenue has dropped, both Xenon and Arbutus have increased staff numbers, which have risen 20% at Arbutus and 12% at Xenon since 2014. •