Securities investigators in B.C. say they have identified dozens more subjects in their ongoing investigation into an alleged illegal share distribution plan involving penny stock companies listed on the highly speculative Canadian Securities Exchange (CSE).

On Tuesday, a British Columbia Securities Commission (BCSC) panel of three commissioners reserved its decision on lifting or maintaining temporary trading orders against most of the respondents to a notice of hearing issued last November.

Before it did so, BCSC lawyer Graham MacLennan, who is spearheading the allegations on behalf of executive director Peter Brady, informed commissioners Nigel Cave, Judith Downes and Audrey Ho: “This investigation is very large; it’s ongoing; it’s very complex. And it will take more time to complete.”

In November, Brady issued a notice of hearing to 11 CSE-listed companies as well as 25 individuals and their 26 associated firms – collectively dubbed by Brady as the Bridgemark Group.

Once the investigation is complete, a full hearing will take place for the panel to judge the unproven allegations. Until then the panel had imposed three specific and limited trading orders (bans) on most of the respondents.

MacLennan said Tuesday there are now 82 subjects of the investigation, up from what was understood to be 62.

Glacier Media attended the panel’s hearing Tuesday. Recordings were not allowed and affidavits were not released to the public.

But MacLennan told the panel that the investigation has so far resulted in 116 production orders, including 14 to share-issuing companies, 44 to banks, 10 to brokerage firms, 36 to individuals and 12 to other entities. About 300 bank accounts and 230 brokerage accounts connected to subjects have been searched, he said.

Collectively, the respondents have been involved in hundreds of other penny stock companies listed on the CSE and TSX Venture Exchange.

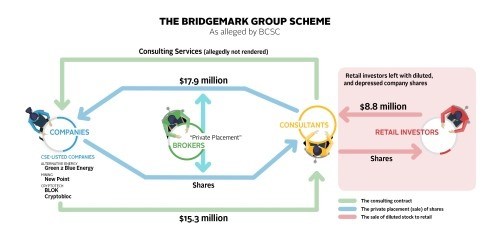

Brady alleged that between February 2018 and August 2018 that so-called consultants privately bought at least $50.9 million worth of stock at pennies per share but had most of the money returned in alleged phoney consulting fees – a process described by Brady as like a “cash swap.”

Meanwhile, noted Brady, the 11 companies (also respondents) publicly touted they had raised and secured all the money via the private placements (252 million shares), as evidence of investor interest.

The Bridgemark Group members then allegedly dumped the shares into the market, at a fraction of the original purchase price, where retail investors picked them up.

At the core of the case is the unproven allegation from BCSC that BridgeMark members are not actually consultants, defined by BCSC as those who spend “a significant amount of time and attention on the affairs and business of the issuer.”

That alleged conduct would be abusive to the capital markets.

MacLennan argued Tuesday that the orders should remain as “the public would reasonably expect” them to.

According to the BCSC, the orders include prohibiting the respondents from purchasing any securities of an issuer listed on the CSE that are distributed using the consultant exemption for distribution of securities without a prospectus.

Lawyers for the respondents argued against the orders being extended.

Lawyer Patricia Taylor said her client, Simran Gill, director of BridgeMark Management Ltd., did not conduct a so-called “cash swap” with one of the companies in question, Cryptobloc Technologies, which reported annual revenues of $76,000 in January 2018. Rather he only purchased $45,000 worth of shares, or just 1% of the questionable $4.5 million sale of shares to consultants in June 2018. Taylor said Gill did the work asked of him for $250,000.

The Bridgemark Group was dubbed such because of the many connections respondents had to BridgeMark Financial Corp., whose principal is Anthony Kevin Jackson, a chartered professional accountant from West Vancouver.

Some respondents had trading orders lifted in January because there were no ties to the four companies the panel determined Brady had, to that point, provided more substantial evidence of alleged abusive conduct.

Orders were also lifted against Jackson’s accounting firm Jackson and Company and BridgeMark Financial itself.

Jackson’s lawyer Patrick Sullivan has argued the term “Bridgemark Group” is prejudicial to his clients.

On Tuesday Sullivan argued the orders are unnecessary and disruptive to Jackson’s business dealings. He said there is no threat to the capital markets in keeping them in place.

Furthermore, he noted the CSE had recently placed a four-month hold on the resale of shares distributed under the consultant exemption (so they cannot be quickly resold). Thus the orders, which are prejudicial to reputation, are redundant, he argued.

MacLennan said the new CSE policy is subject to change and any breach does not have the same consequences as the orders.

“In my submission the evidence has not changed to justify ending the temporary orders,” said MacLennan.

Taylor said under the policy one couldn’t possibly sell the shares even if they wanted to.