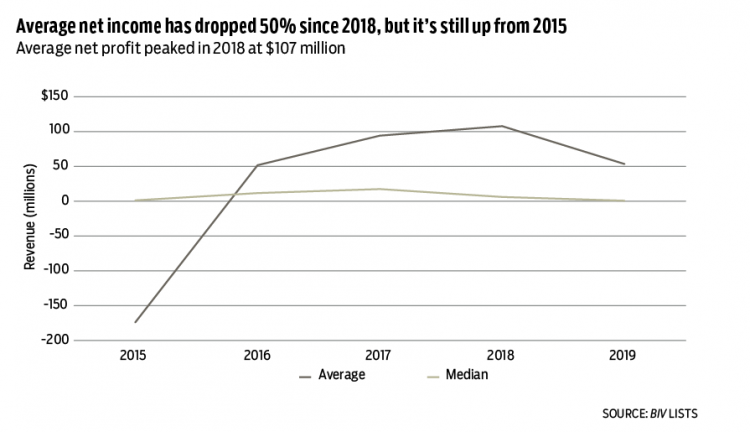

Net income at the province’s top 100 public companies fell 50.4% to $53.4 million in 2019 compared with 2018, according to data collected on Business in Vancouver’s Top 100 Public Companies in B.C. list (pages 11–12).

But their average net income was still up by $227.3 million from a $174 million loss in 2015.

Meanwhile, median net income for B.C.’s top 100 public companies fell to its lowest level in at least five years. It nosedived 96.1% to $674,781 in 2019 from its 2017 peak of $17.4 million and was down 43.6% from 2015.

Despite the 2019 drop in average net income and median net income, the average revenue generated by B.C.’s top 100 public companies rose to $1.08 billion, which was 7.6% higher than in 2018 and the highest on record.

However, median revenue has dropped below 2016 levels, falling 18.3% to $188.3 million from $230.6 million. This suggests that revenue generated by smaller companies lower on the list is falling while the revenue generated by their larger counterparts higher on the list is rising.

The average value of assets owned by the top 100 public companies peaked in 2016 at $3.9 billion, but fell 20.6% over the next two years. That average asset value increased 19.3% to $4.9 billion in 2019 from 2018 but has yet to reach the 2016 high. Median asset value followed a similar trend, but did not fall or recover as dramatically.

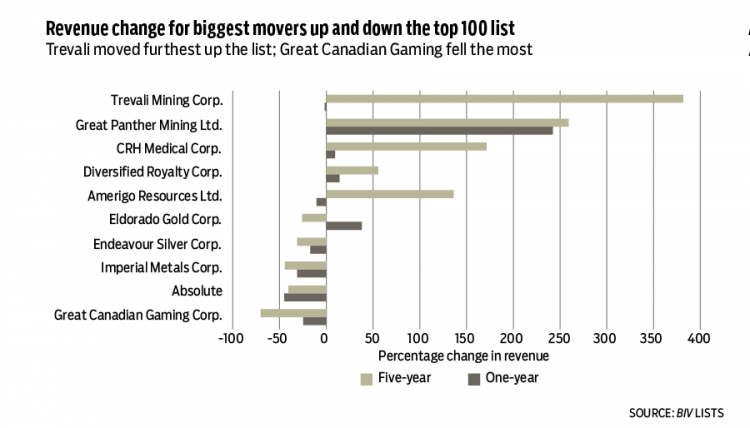

There were 67 companies on BIV’s list in both 2020 and 2016. Forty-two moved up the list; 18 dropped in rank.

No. 33 Trevali Mining Corp. (TSX-TV) moved the furthest up the list. It jumped 26 places from 59th in 2016 after posting a 381.7% revenue increase to $512.3 million in 2019 from $106.4 million in 2015. Most of Trevali’s revenue increase occurred in 2017, when the company’s revenue increased 215% to $429.2 million from $136.3 million in 2016.

No. 59 the Great Canadian Gaming Corp. (TSX-GC) suffered the largest drop in ranking. It fell 24 spots from 35 in 2016. The drop was due to a 70.1% revenue decline to $135.6 million in 2019 from $453.8 million in 2015.

No. 93 Auxly Cannabis Group Inc. (CVE:XLY) recorded the largest one-year revenue increase: 1,018.1% to $8.5 million in 2019, up from $747,000 in 2018.