British Columbia’s top money sources and financial institutions have managed to grow through the pandemic, according to data collected for Business in Vancouver’s lists of the top money sources in B.C. (https://biv.com/lists).

Assets held by the province’s biggest credit unions in 2021 reached their highest average in at least the past five years.

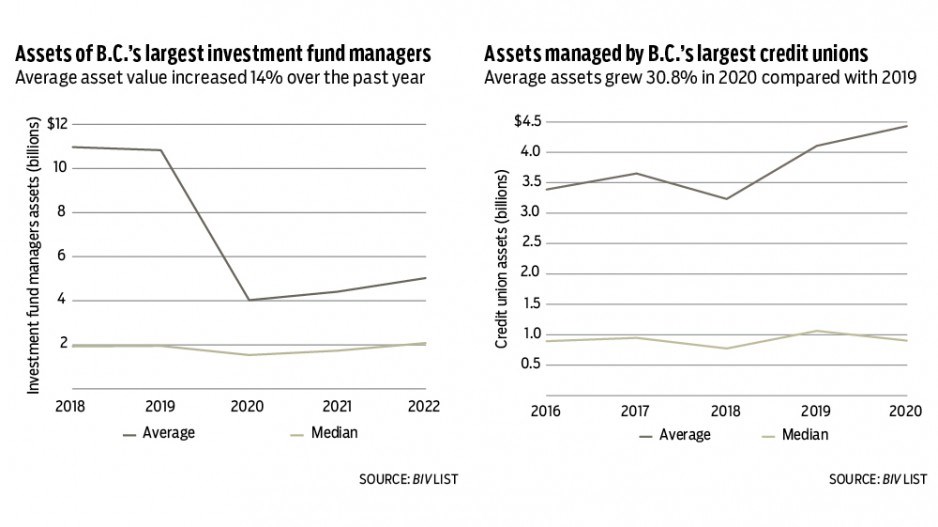

Average assets grew 37% to $4.43 billion in 2021 from their low of $3.23 billion in 2018.

The median asset value held by credit unions followed a similar trend, hitting a low in 2018.

But unlike the average, median asset value peaked in 2019, growing 37% to its five-year high of $1.06 billion from its five-year low of $773.7 million.

Over the past year, however, median asset value decreased by 15.1%.

This suggests that credit unions with larger asset holdings higher on the list grew faster than smaller credit unions lower on the list.

B.C.’s largest investment fund managers didn’t fare as well during the first year of the pandemic.

Their average asset holdings plunged 62.8% in 2020 to $4 billion from $10.8 billion in 2019.

The median asset value at B.C.’s top investment fund managers fell significantly less: 21.2% to $1.54 billion in 2020 from $1.95 billion in 2019, which suggests that the steep decline in asset holdings was isolated to a few large outliers at the top of the list.

However, during the second year of the pandemic, average asset value at B.C.’s top investment fund managers rebounded by 24.9%.

The largest banks operating in British Columbia also suffered a significant decline in their asset holdings in 2020.

Average holdings fell 29% to $579.8 billion in 2020 from $816.2 billion in 2019.

However, the largest banks in B.C. recovered swiftly, growing 37.8% to $798.8 billion in 2021. •