The past five years have been a roller-coaster ride for B.C.’s biggest corporate finance deals, with large fluctuations in the values of the largest stock and debt deals as well as the biggest non-mining mergers and acquisitions.

But despite the interim volatility, values have either remained the same or grown since 2017, according to data collected on Business in Vancouver’s Biggest Stock and Debt Deals of 2021 list and Biggest Non-Mining Mergers and Acquisitions of 2021 list (https://biv.com/lists).

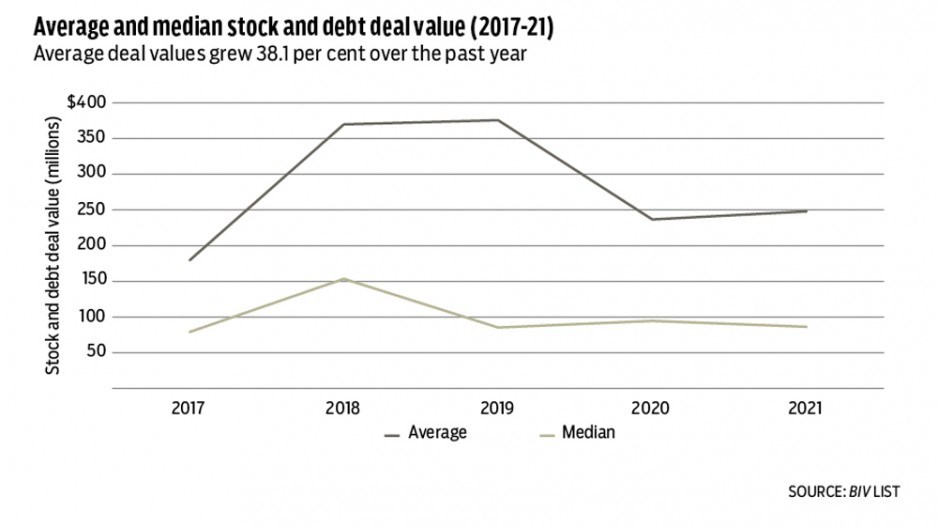

British Columbia’s largest stock and debt deals have bounced back slightly after values crashed in 2020 from their 2019 peak. In 2020, the average stock and debt deal value among the largest 80 in the province fell 37 per cent to $236.7 million, from $375.7 million in 2019.

In 2021, the average value increased by 4.8 per cent to $248 million, still well below its 2019 high. Despite the deep decline in 2020, the average value is up over the five-year period, climbing 38.1 per cent higher in 2021 from $179.6 million in 2017.

The median stock and debt deals value peaked in 2018 and crashed the year after. While median deal value is 9.1 per cent higher than it was in 2017, it dipped 8.1 per cent over the past year, trending away from its 2018 high. This suggests that larger deals higher on the list have grown while smaller deals lower on the list have decreased in value.

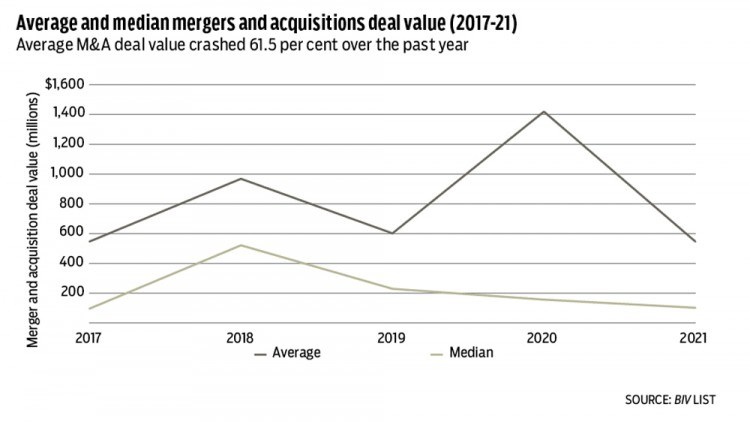

Average non-mining merger and acquisition values have had a more bumpy ride, and, despite hitting new highs in 2018 and 2020, average M&A deal value has slumped back to its 2017 level.

Over the past year, average deal value crashed 61.5 per cent: to $546.4 million in 2021 from $1.42 billion the year before. However, the 2020 high came after a 2019 trough where average deal value plummeted 37.8 per cent from its high of $968.2 million in 2018.

The median M&A value, on the other hand, has been consistently declining since its peak in 2018. This suggests that smaller M&As lower on the list have been decreasing in value over four years while larger M&As have experienced more volatility. •