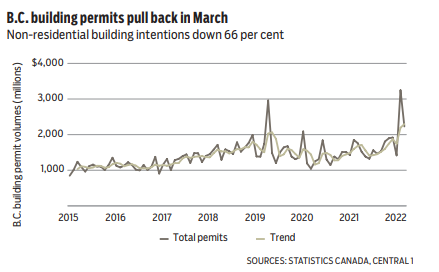

After a record February pace, B.C. building permit volumes naturally pulled back 31.4 per cent in March. The retrenchment reflected normalization in non-residential building intentions, which fell 66.3 per cent, offset in part by growth in residential building intentions, up 17.6 per cent month to month (m/m). Despite the decline, permits remained well above the pre-pandemic trend.

Growth in residential building permits reflected gains in the multi-family segment (up 23.2 per cent m/m) and a fourth consecutive monthly gain for single-detached homes (up 4.1 per cent). Strong in-flows of new residents into British Columbia during the pandemic, coupled with a tight rental market and a hot ownership market, continue to support new residential investments.

Quarterly, total building permit volumes remained 36.8 per cent higher than in the same period last year. Residential and non-residential building permit volumes were up 2.4 per cent and 144.4 per cent, respectively.

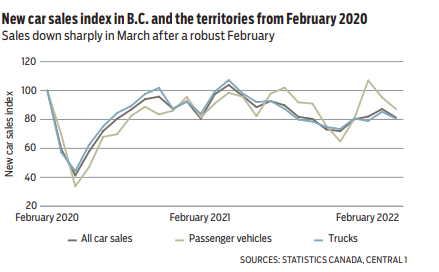

In 2022’s first quarter, total building intentions in all metro areas remained 33.7 per cent up from last year’s pace despite the dip in activity in March. Statistics Canada released new car sales numbers last week for B.C. and the territories and overall sales fell sharply moving down 6.7 per cent m/m after a strong February in which sales moved up 6.4 per cent. While passenger vehicle sales continued to slip (down 8.5 per cent m/m), truck sales also fell in March by 5.4 per cent m/m.

High inflation, including gasoline, greater options to work remotely and supply chain issues keeping the supply of new cars below pre-pandemic levels are all factors contributing to fewer new car sales.

The average price of a new car inched up 0.6 per cent in March to $51,910 as the fall in the average price of a passenger vehicle (down 0.3 per cent) was offset by slightly higher prices for trucks (up 0.7 per cent).

Sales of new cars remain 11.1 per cent behind last year’s pace while the average price of a new car remained 7.6 per cent higher than last year’s pace.

New car sales will likely continue to stall based on supply chain shortages and higher cost of living and borrowing costs for those willing to finance a new car purchase. • Bryan Yu is chief economist at Central 1 Credit Union.