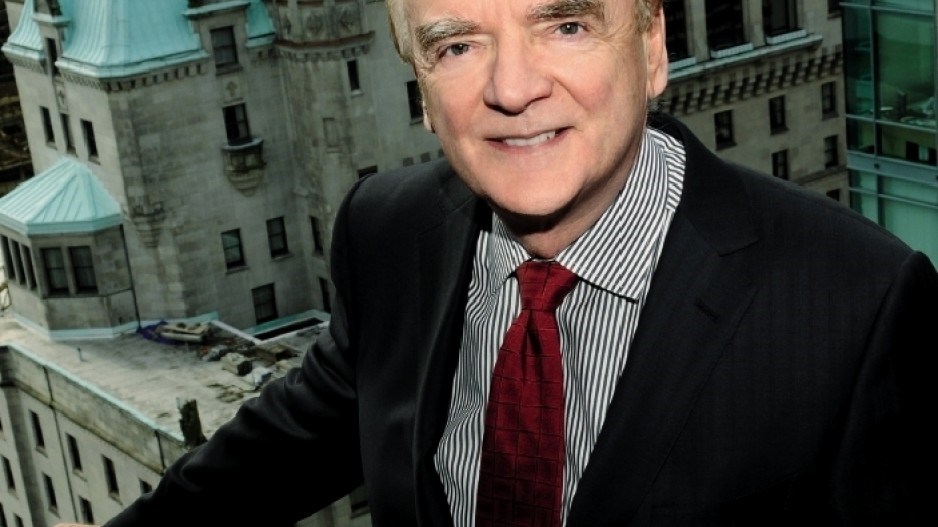

Brian Edgar has a picture on his wall that reads, “never give up.”

It’s a mantra the 62-year-old lawyer has used to quietly, and very methodically, rise to the upper echelons of Vancouver’s notoriously cutthroat mining cluster.

He’s an active board member on six public companies, chairman of one, a close friend to mining magnate Lukas Lundin and has had the same corner office on the 22nd floor of a West Georgia office tower for more than 20 years.

It has one of the best views in the city, but this stalwart, no-nonsense executive will tell you it was better before Cathedral Place tower was built in 1991.

To say Edgar is steeped in the culture of downtown Vancouver’s tightly knit business community would be an understatement.

He’s practised law, advised famous resource tycoons (including the late Adolf Lundin, Lukas’ father) and built and sold more than a few resource companies during his 30-plus years in the business.

But not every venture has been a success, Edgar concedes.

“One of the problems with being the principal of these companies is you basically go down with the ship,” he said, recalling a past project. “I knew we were going to go down, you could see the writing on the wall, but you can’t sell [your shares]. You just take the bullet.”

Why can’t you sell the shares and take a profit?

“Because it’s not right,” he said. “When you’re a director of a company you need to stay with the ship.”

That attitude has netted Edgar more than a few successes, and a sterling relationship with those that cut deals with him.

“It was actually refreshing to deal with him because he was so direct,” said John Festival, president and CEO of BlackPearl Resources (TSX:PXX), a Calgary oil player that counts Edgar among its board members.

Three years ago, Edgar was part of the team that gave BlackPearl a much-needed facelift. “[He] knew exactly what he wanted to see and what he thought would be successful,” said Festival.

A deal was done when the company’s shares were valued at less than a dollar.

Today, BlackPearl, in no small part thanks to its management team, has a share value in excess of $4 and a market capitalization of $1.2 billion.

“He’s ruthless as a director, as he should be because he needs to act on behalf of the shareholders,” Festival said of Edgar.

“It’s a huge responsibility, and he takes it very seriously.”

Edgar’s matter-of-fact business style isn’t a characteristic that came with age.

When he was 27, and had been practising law for less than two years, he marched into his managing partner William Rand’s office and cut a deal after he learned that another partner was about to jump ship.

“I was a kid really,” Edgar recalled, “and said, ‘Bill, one of two things is happening with me: I’m going to go join another firm or I’m going to start a new firm with you.’”

In 1977, Rand & Edgar was formed, and the two men practised corporate and securities law in Vancouver for 16 years.

Before he met his wife, Edgar worked seven days a week building the firm’s reputation and helping Howe Street’s plethora of junior resource companies assemble deals.

Those were the days of the infamous Vancouver Stock Exchange, known for pump-and-dump schemes and unscrupulous promoters.

“Every month something blew up in those days, and often it was not a surprise to me because everybody in the street knew that so-and-so was a criminal and finally somebody arrested him or some big investigation was launched,” said Edgar.

“So there’s the jungle telegraph out there, and when you’re in the business you know who the guys are who you don’t want to be in business with, and we didn’t let them in the office.”

In 1992, after 16 years of practising law, Edgar walked back into Rand’s office.

“I said, ‘Look, that’s enough of this legal business. I think we can do much better for ourselves,’” he said. “And he said, ‘Let’s go for a walk.’”

Rand Edgar Investment Corp. was established shortly thereafter to provide early-stage venture capital to resource companies.

Within two years, three companies Edgar started had a combined market cap of $500 million.

But they weren’t all good times.

Rand Edgar waded through the resource crash in the late 1990s that followed the collapse of Bre-X.

But, in 2003, he helped put a deal together to buy Burnaby vitamin company SISU.

That company was sold for US$5.7 million and assumption of debt in 2005 to the largest supplement manufacturer in the U.S.: NBTY (NYSE:NTY).

After that, Edgar got back into the resource game full time.

He was a director of Vancouver’s Red Back Mining when it was sold to Kinross Gold (TSX:K) in 2010 for US$7.1 billion.

Since then, Edgar has kept himself busy transforming Silver Bull Resources (TSX:SVB) into a silver-zinc explorer that investors pay attention to.

It hasn’t been easy.

Since Edgar got involved, the company has changed all of its senior personnel, methodologies for collecting data and even health and safety regulations.

“It would take a very long time to tell you in detail everything that needed to be fixed,” he said. “The list of things that didn’t need to be fixed would be shorter.”

Today, however, the company is sitting on a global resource of 84 million ounces of silver in the Mexican desert, a large zinc resource and $4.2 million in cash as of last fall.

There’s no way to tell just how successful this latest resource company will be, but Edgar is definitely keen about the possibilities.

“I think it’s undervalued. We have got a lot of silver in the ground.”

The real question is: what does it take to build a successful exploration company in a town that’s home to hundreds?

“I’ve seen lots of companies over the years with inexperienced management that end up [going] broke,” said Edgar.

“Experienced management that understands how to manage risk is incredibly important, and Lady Luck is a nice thing to have.” •