When it comes to early-stage venture-capital investment, 2012 was a bad year for the clean-tech sector. According to the Cleantech Group, early-stage VC investment in clean tech was down 30%.

A notable exception was water treatment technology companies, which enjoyed a 34% increase in venture-capital investment, driven in part by an urgent need by the mining, oil-and-gas and chemical sectors – all of them heavy users of water – to find cost-effective ways to clean up the water pollution they create.

Over the next five years it's estimated that $120 billion will be spent globally on industrial water-treatment technology, according to Global Water Intelligence.

Vancouver's Axine Water Technologies is among the few Canadian clean-tech companies to attract venture-capital investment recently – about $2 million through Chrysalix Energy Venture Capital and the Business Development Bank of Canada (BDC).

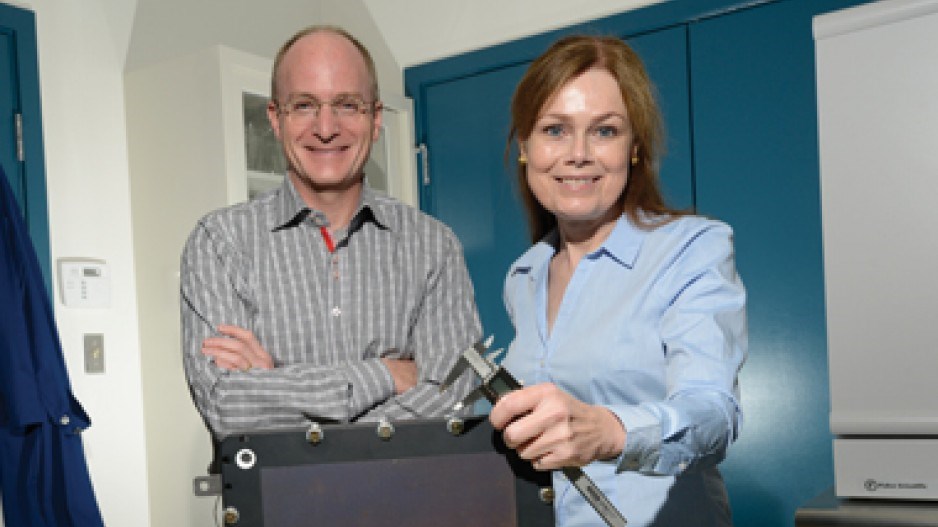

Founded by former Ballard Power Systems (TSX:BLD) scientist Colleen Legzdins and Jonathan Rhone, former CEO for Nexterra Systems Corp., Axine has developed a simple electrolytic process that promises to break bottlenecks in traditional biological treatment processes and lower costs.

"Electro-chemical treatment has been out there for a while, but Axine has figured out a way to do it a lot cheaper," said David Kujawski, vice-president of operations for Refinery Water Engineering & Associates Inc. (RWE), a Texas-based engineering firm that specializes in water processing and reclamation for the oil-and-gas sector.

"From what we've seen so far, it looks really promising to solve some very painful issues that exist with refineries today, especially in the United States."

The oil-and-gas industry is said to process more water than it does oil. In the steam-assisted gravity drainage (SAGD) process used in the oilsands, the water becomes so heavily contaminated with organic compounds that about 10% of it can never be cleaned up.

Axine uses electrolytic cells to create free radicals that react with organic compounds, breaking them down into water, nitrogen, carbon dioxide and a high-quality stream of hydrogen.

It requires far less electricity than other electrochemical processes, requires no chemicals, produces no sludge and can be used in a wide range of industrial effluent treatment, including oil-and-gas extraction, oil refining, pulp and paper-making and chemical, petrochemical and pharmaceutical industries.

"We've benchmarked our technology in terms of costs for a fairly wide variety of applications," Rhone said. "It typically benchmarks at between three and 10 times lower cost than incumbent technologies. So it's highly disruptive in the market."

Primary treatment typically uses biological processes, in which bacteria break down some of the toxic compounds – a process that takes time and produces sludge as a byproduct.

The Axine process doesn't necessarily eliminate the need for biological treatment, but it can speed the process up – and lower costs – when used as a pre-treatment.

"Water treatment in oil and gas and mining – it's an entirely new game," said Ben Sparrow, CEO of Saltworks Technologies, the Vancouver company that developed technology that removes salts from industrial effluent, including oil and gas wastewater. •

BDC to invest $100 million in Canadian clean tech

There is good news on the horizon for Canada's venture-capital starved-clean-tech sector.

BDC Venture Capital recently announced $100 million in new venture-capital funding for early stage companies in the clean-energy and clean-tech sectors under its Energy Clean Tech Fund.

It builds on an earlier investment of $50 million under its ECT portfolio.

"We're hoping to invest in between 12 and 15 new companies over the next three to four years," said Tony Van Bommel, senior manager for the BDC Energy Clean Tech Fund.

BDC Energy has been a lead investor in 60% of the deals done.

"We almost always participate with other venture capitals, mainly in the private sector," Van Bommel said.

There are already 11 companies in BDC's ECT portfolio – seven of them from B.C., two from Ontario and two from Quebec. Most of the companies in the portfolio will be eligible for additional rounds of investment.

BDC typically invests between $2.5 million and $10 million in each company, in a series of investments, depending on milestones being reached. Series A investments typically range from $500,000 to $5 million.

The BDC is looking for early-stage investments, not large-scale projects.

"What we're not looking for is heavily capital-intensive opportunities, like building biorefineries or green chemical facilities or independent power-producer projects like wind farms or solar farms," Van Bommel said.

"Many of [those] projects require $100 million or more just to get off the ground. Our whole fund is $100 million."

Technologies that might qualify for investment are in areas like electronics, novel materials or information and communication technologies that apply to energy, clean-tech and industrial applications.

B.C. companies funded through BDC Venture Capital's ECT fund include Axine Water Technologies, General Fusion, Cooledge Lighting, D-Wave Systems Inc., Nexterra Systems Corp., Teradici Corp. and Switch Materials.