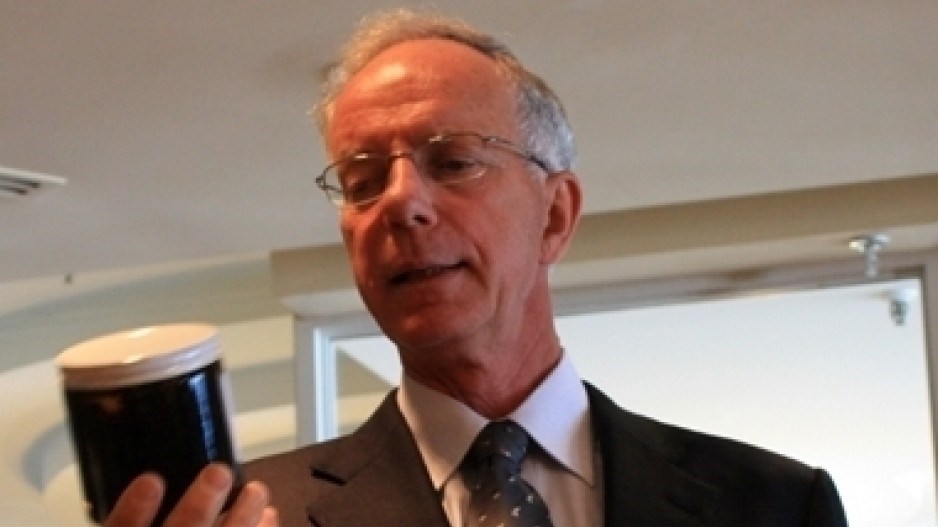

While he expects Chinese investors to cover the majority of costs for the proposed construction of a multibillion-dollar heavy-oil refinery to be located 25 kilometres north of Kitimat, B.C., media mogul David Black says he will nonetheless be seeking a loan guarantee from Ottawa on a portion of the project.

"We will ask the federal government to guarantee one-third of the total $26 billion, or about $8 billion. This guarantee that we are asking for has completely aligned with all the precedents," Black said during the 2013 Calgary Energy Roundtable Conference on Wednesday.

"That's what the federal government did for Muskrat Falls [hydroelectric project] for about $8 billion."

Earlier this year, the president of privately-held Kitimat Clean Ltd. signed a memorandum of understanding with the Industrial and Commercial Bank of China that would see the bank act as both financial advisor to the project and provide financing for the refinery, pipelines and other elements of the project. Black said previously that he expects to have all funding under contract by early 2014.

The Black Press Ltd. owner told this week's conference that adding value to Alberta bitumen through a large coastal refinery in B.C. is perhaps the only way residents of Canada's most westward province would support moving oilsands assets through their jurisdiction.

"The polls in B.C. show, and have shown continuously for some time now, the only way a pipeline across B.C. would be accepted is if there is a refinery," he said. "People don't want just dilbit to be shipped."

According to Black, the 550,000 bbl-per-day refinery project would cost a total of approximately $26 billion, comprised of $18 billion for the refinery itself, a $6-billion diluted bitumen pipeline from Edmonton to Kitimat, as well as part of the cost for a natural-gas pipeline for $1 billion and a tanker fleet at about $1 billion.

"The feasibility study will be commissioned before we proceed, of course. The study is expected to cost about $125-to-150 million, and I believe I have the money in place for that," he said, adding the refinery would be the largest on the west coast of North America, and it would garner annual revenue of about $24 billion through an anticipated consumer base in Asia.

Because the coastal location of the refinery means it would be able to use large modular components from Asia in its construction, Black said building the refinery near Kitimat would be considerably less expensive than if it were to be built in Alberta. He added the refinery would use Calgary-based Expander Energy's Fischer Tropsch technology that would cut carbon dioxide emissions by half compared to a traditional refinery.

"There's a huge political gain in cutting CO2 in B.C. and right across Canada. Cutting [emissions] in half is enormous for us, and it would be a world first. Hopefully once we showcase it, the technology would be used in refineries across the world hereafter."

Black said the benefit to B.C. and Canada in the form of more jobs from a refinery adding value to Alberta oilsands products on the West Coast would also be tremendous.

"The refinery will create 6,000 construction jobs for five years, and for the pipelines 1,000 more. The refinery will result in more permanent jobs than any project ever created in the province. It would create at least 3,000 well-paid permanent jobs that should last 50 to 100 years.

"In addition to that, the petrochemical business usually adds about one job for every job in the refinery. We expect a lot of factories to pop up around the refinery and there is a lot of room for it there. We could easily end up with another 3,000 direct petrochemical jobs in the valley, and it would create thousands of indirect jobs in the area."

The case for producing polypropylene and other domestic value adding initiatives

Cracking propane into propylene before export is a value-adding activity Williams Energy Canada president David Chapell says would offer three to four times the value to those hydrocarbons, resulting in more taxes and revenue for Alberta and an opportunity for more jobs domestically.

"We could take the propane here and, instead of exporting it, take that whole 'value add' and export the polypropylene," he told Wednesday's conference. "Doesn't that make more sense?"

According to Chapell, if factories are set up to make polypropylene in Alberta, then it would probably make economic sense for a propylene derivative plant in the province as well.

"I expect that some people will actually start using that plastic here in Alberta, manufacturing yogurt containers here rather than shipping them in."

Williams Energy currently processes valuable offgas from coker plants in Fort McMurray. From that business, Chapell said, the company has moved into propane dehydrogenation with plans to spend $900 million to build Alberta's first facility to produce polymer-grade propylene.

The company previously announced the facility near its Edmonton-area Redwater fractionation plant will go into service by the second quarter of 2016.

Northeast of Fort Saskatchewan, Sasol Limited has proposed building a multibillion-dollar gas-to-liquids (GTL) facility, which will take the company's Alberta natural gas assets and create a practical, value-added product -- diesel fuel.

"We're basically a diesel-generating machine, and that's what this is all about," said Sasol Canada president Martin Waterhouse.

According to Waterhouse, the development timeframe and spending profile for creating GTL is similar to that of liquefied natural gas (LNG). However, while it is a capital-intensive technology, he said there is a supportive environment in Alberta for adding value to hydrocarbon assets.

"We had a very good reception, and we feel very comfortable in the two years that we have been here that this is going to work."

Earlier this year, Sasol purchased about 526 hectors land for its proposed GTL facility.

Meanwhile, in a joint-venture area within a 300-kilometre radius of Grande Prairie, Ferus Natural Gas Fuels Inc. president Sean Lalani said the intent is to build the first commercial-scale LNG merchant plant in Canada, to be in service within the first quarter of 2014.

"This facility is about 30,000 diesel-gallon equivalent," he said, adding creating LNG in Alberta is already taking place and it can be done safely and economically, and this form of value adding to natural gas makes a lot of sense domestically.

"In 2012, we consumed 6.6 billion diesel litres in this province. If we just throw out a hypothetical example and say 50 per cent [of gas production] could be converted to LNG, and I think that is an achievable target, what we would see is 120 bcf of local gas being consumed every year and we'd see $1 billion in cost savings -- disposable income that would go in the hands of companies and people to be spent throughout the economy."

From dailybulletin.com