This week, we take time to delve into B.C.’s forestry sector, which has recently shown signs of slowing after growing at a solid pace in recent years.

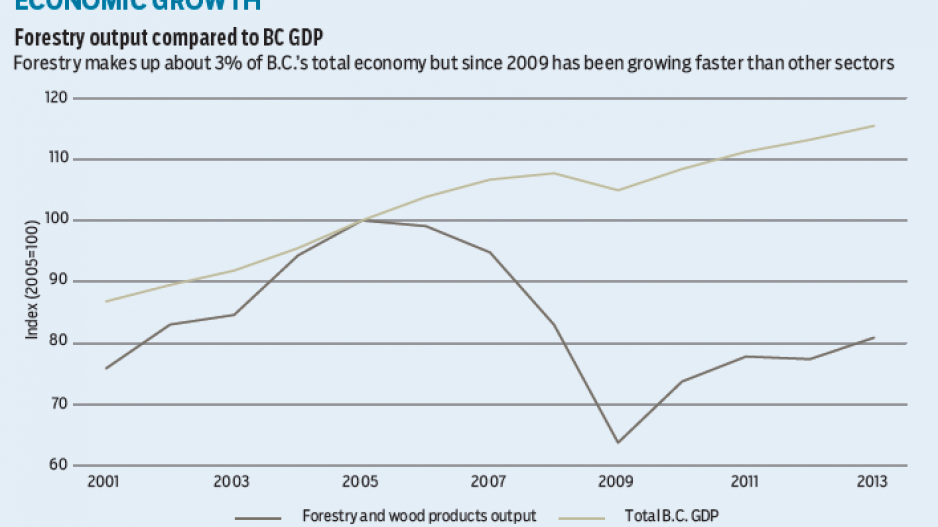

B.C.’s forestry sector has been a growth sector for the economy in recent years as strengthening housing demand from the U.S., a solid Canadian market and rotation of exports towards China lifted overall activity. Since output bottomed in 2009, growth in direct forestry and related manufactured goods averaged about 6% per year through 2013, compared to 2.4% for the economy as a whole. While the sector has yet to fully patch the divot generated by the U.S. housing bust and Great Recession from 2006 to 2009 – and most likely will not, since those levels were associated with the U.S. housing bubble – the forestry sector has generally outpaced growth in the broader economy.

The contribution to provincial GDP growth has been marginal given that the sector makes up about 3% of the total economy, but the recovery has been a welcome development for forestry-reliant communities in B.C. Although demand remains below mid-decade peaks and the sector is under pressure from the long-term impacts of the mountain pine beetle (MPB) infestation, the demand cycle and significant price uplift have led to increased timber harvests, reinvestments in local mills and higher lumber production. Monthly volatility aside, lumber prices have trended near pre-recession highs at about US$380 per 1,000 board feet, with mild gains in pulp and paper. For local economies, this improvement has provided the ingredients for local income growth and demand.

Demand-side improvements lifted B.C.’s annual timber harvest to about 71 million dry cubic metres in 2013 to reach nearly 90% of the peak level observed during the mid-2000s. However, regional differences have persisted. Relative to the peak harvesting period in 2005, coastal and southern Interior harvests were about 5% to 10% of peak, while the northern Interior struggled with 75%. These differences reflected end-use demand as post-earthquake Japanese reconstruction efforts and log exports to China were more oriented towards coastal supply. Meanwhile, a rebound in northern B.C. was impeded by the severity of the U.S. housing recession, capacity constraints from mill closures earlier in the decade, and supply issues from the MPB epidemic. The MPB was less severe in southern B.C. markets.

Lumber production growth has lagged behind overall timber harvest growth. Production has climbed 30% from 2009 cycle lows but reached only 75% of peak in 2013. A rotation in lumber exports to China has been key to positive momentum alongside the gradual recovery in the U.S. housing market, but a stronger uplift from the latter is required for production to improve to respectable levels. In contrast, raw log exports have climbed to a record high as manufacturer demand from China stoked exports.

Momentum has subsided this year and forestry will not be a significant growth contributor in 2014. The U.S. housing market recovery stalled over the past year following a sharp rise in mortgage rates south of the border. Housing starts, which are still below household formation, held range-bound and will likely be up a disappointing 9% from 2013. Early-year consensus estimates had forecast a 20% increase. Meanwhile, slowing growth trends in China and the end of Japanese reconstruction projects have also limited growth in B.C.’s forestry sector.

Although product prices remain elevated and have provided a lift in dollar terms, particularly with a favourable exchange rate, most metrics have underperformed. Through July and August, timber harvests were about 7% lower, while lumber exports and production were at best flat. Meanwhile, log exports were down about 5%. Growth has been stronger in pulp and paper manufacturing but is relative to a low base. By our estimates, growth in forestry-related output will be about 2.5% this year, down from near 5% in 2013.

Going forward, Central 1 remains confident that forestry will outperform provincial growth in both 2015 and 2016, with growth exceeding 4%. We expect U.S. housing starts to climb 20% in 2015 as the economy and incomes improve and pent-up demand is unleashed into the market. Meanwhile, lumber exports to China will continue to climb despite some deceleration in the economy owing to a larger economic base. However, the share of lumber exports will shrink as U.S. demand recovers. By the end of the decade, forestry-sector growth will fall to about 2% as the housing cycle eases and supply-side impacts of the mountain pine beetle constrain harvest and production levels in the province. •

Bryan Yu is an economist at Central 1 Credit Union.