British Columbian construction companies will be able to bid on a ferry terminal replacement project in Prince Rupert.

But local metal fabricators are out of luck.

That’s because the terminal, located on Crown land at the Port of Prince Rupert, is leased by the State of Alaska. Under Buy America regulations, all of the iron and steel for the project must be supplied by American companies.

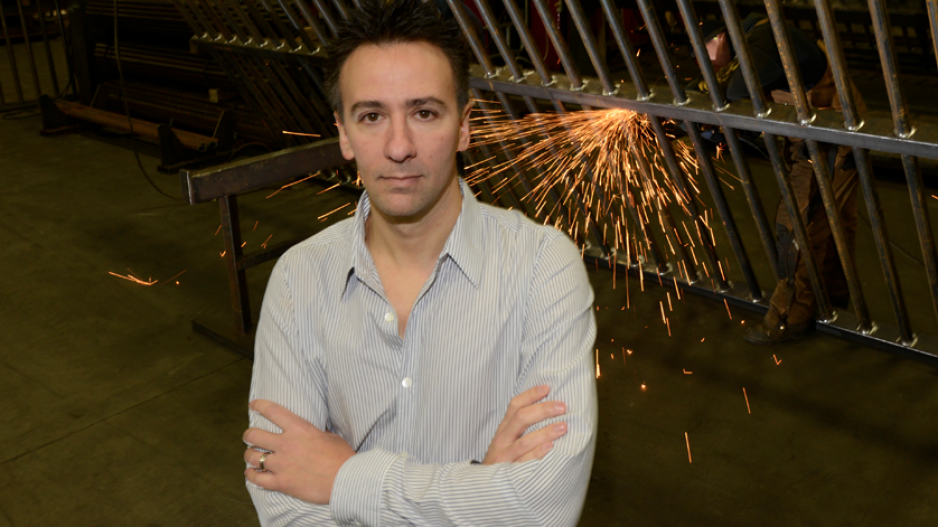

Ari Burstein, the owner and president of Marcon Metalfab in Delta, B.C., said that over the past decade, his company has lost the business it used to have with American companies like Scougal Rubber. Marcon makes many of the smaller steel products that would be used in the Prince Rupert ferry terminal project, Burstein said.

“If you get the ore from the U.S., it’s processed in the U.S., but it comes to Canada for cutting, it’s considered Canadian,” said Marcus Ewert-Johns, vice-president of Canadian Manufacturers and Exporters B.C.

“So as soon as a Canadian hand … touches it in Canada, it’s no longer considered U.S. steel.”

Canada’s Minister of International Trade, Ed Fast, released a statement November 25, saying his ministry is aware of the restrictions on the ferry terminal project and that the federal government is “exploring all options to address the situation.”

Nathan Cullen, the NDP MP whose riding includes Prince Rupert, said the government’s leadership on the file has been weak.

Canada is a signatory to a World Trade Organization agreement that should give Canadian goods and services equal access to infrastructure projects that are funded by the American government.

But according to Foreign Affairs and International Trade Canada, under the North American Free Trade Agreement (NAFTA), the United States requires that “Canadian goods and suppliers be exempt from these requirements if procurement is being done directly by a … federal department or agency and if the value of procurement exceeds NAFTA thresholds (currently US$25,000 for goods, US$79,507 for general services and US$10,335,931 for construction services).”

“The government has been reluctant [to challenge Buy America through NAFTA] —they claim to not want to start a trade war,” Cullen said. “But in a small way, there seems to be a trade war upon us.”

Consequences can be serious for governments who break the rules: this summer, a small town in Colorado learned it could lose federal funding for a bridge that had already been built after it was discovered that some of the steel had been milled in Ontario.

Burstein is now considering acquiring an American company in order to be able to access both American and Canadian business. It’s a route already taken by ADF Group (TSX:DRX), a Quebec company that opened a fabrication plant in Montana in 2012 in order to be able to supply U.S. infrastructure projects.

Canadian contractors will be able to bid to construct the Prince Rupert terminal, confirmed Jeremy Woodrow, a communications officer with Alaska’s Department of Transportation and Public Facilities.

It’s possible that the Buy America provisions could make the project more expensive than if Canadian steel was used, Woodrow said, but the department has priced the project based on U.S.-supplied steel.