The Conservative government says a recently introduced collection of tax cuts will put money back into the pockets of hard-working families.

But critics say that one controversial component of the Conservatives’ new family tax cut – income-splitting – is a step back for women in the workforce.

“Income-splitting creates incentives for people to reduce their work hours if not step out of the workforce at all,” said Marina Adshade, an economics professor at the University of British Columbia (UBC) who has studied economics and marriage.

“In Canada, the most productive people are in the workforce,” Adshade said. “Anything that creates incentives for people to leave the workforce just can’t generally be good for Canadians.”

Income-splitting most benefits families when there is a big difference in the amount each spouse earns; the idea is to even out the difference between the higher tax rate a single earner pays on $100,000, for instance, compared with the lower tax rate paid when each spouse makes $50,000.

“When couples choose to have children, you don’t really have a single-income family or a two-income family; you have a family income,” said James Moore, minister of industry and MP for Port Moody-Westwood-Port Coquitlam.

The measure is already in place for seniors’ pension incomes in Canada. The Conservatives pledged to introduce it for families with children in the 2011 election campaign.

That proposal was criticized by many, including Alexandre Laurin of the C.D. Howe Institute, in part because it would have provided a very high benefit – over $6,000 – to high-income, single-earner families, and considerably less or nothing to other types of families.

The new measure caps the benefit at $2,000. That restriction does make the policy “less harmful,” said Laurin, director of research at the think-tank.

“It does not completely eliminate the disincentives to work, but it does mitigate the disincentive,” Laurin said, noting that studies of joint taxation in the United States and France have shown a clear link between income-splitting and non-participation in the workforce.

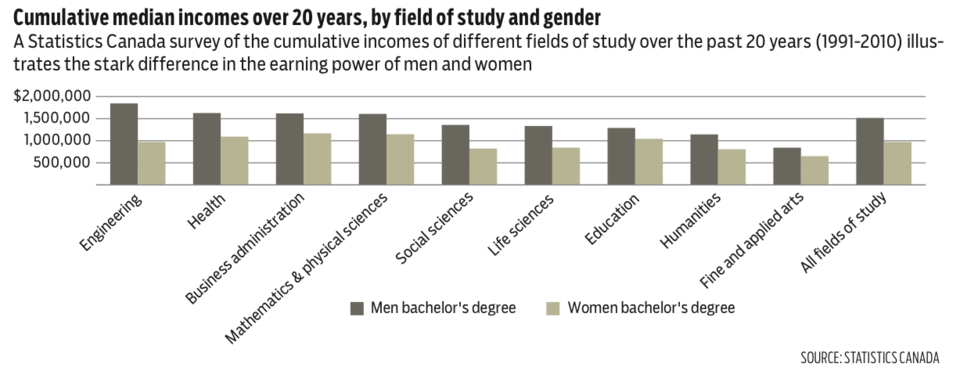

Any kind of disincentive for women to return to work or increase the amount they work could bode ill for Canada’s gender wage gap, said Adshade. That’s because time spent out of the workplace translates into fewer opportunities to gain work experience, take advantage of training and be promoted to higher-earning positions.

“It could legitimately prolong how long we expect to see the gender wage gap in this country,” Adshade said.

The benefit still only applies to a very particular type of family, said Kevin Milligan, also an economics professor at UBC. To take advantage of the benefit, families in which both parents work need to earn incomes that place them in different tax brackets. Since Canada’s tax brackets are fairly wide, that excludes many families.

Moore argued that other tax measures in the package, such as increasing the Universal Child Care Benefit by $60 a month per child, will benefit all families with children. (The package also increases a child-care expense deduction.) But Milligan said the many tax credits now in place for families aren’t that efficient or easy to understand.

The way the government has set up income-splitting is particularly confusing, Laurin said.

“It’s obviously going to add a lot of complexity to the tax system, and I don’t think it’s going to do much in terms of economic efficiency,” he said.

When it comes to a policy that would encourage women to participate in the workforce, all three economists pointed to subsidized child care.

“It’s an expensive policy, but at least it’s a policy that has strong economic impacts,” Laurin said.

Moore said that his government has supported women in the workplace through encouraging more female participation on corporate boards and in the civil service.

@jenstden