Housing bubbles have been a leading indicator in 11 of the 14 economic recessions since 1929, but, based on a formula presented by a Nobel laureate and economist, British Columbia appears bubble resistant.

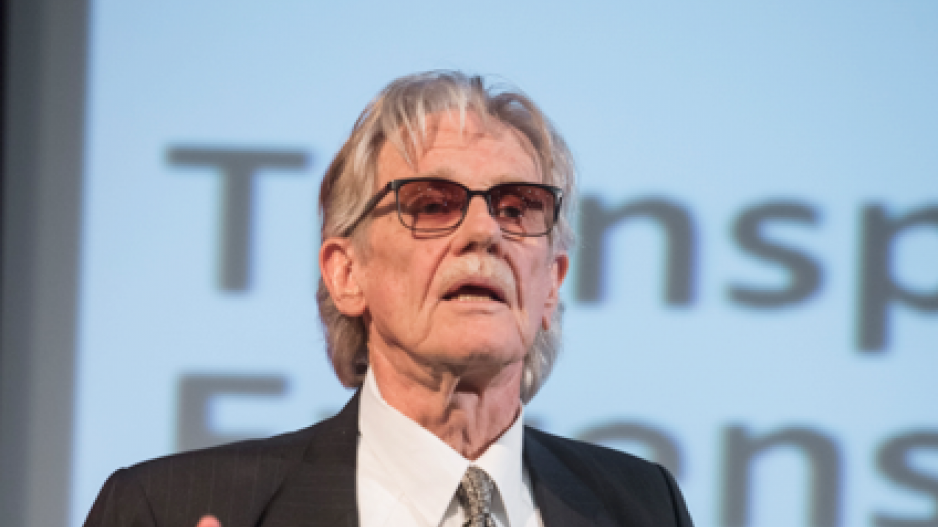

Vernon Smith, awarded the Nobel Prize for Economics in 2002 for his work in empirical economic analysis, is a professor at Chapman University in California and president and chair in finance at the International Foundations of Research in Experimental Economics. He spoke to a packed crowd Nov. 14 in Vancouver in an event presented by Simon Fraser University and the Bank of Montreal.

Smith, 87, who recalls his family’s farm being foreclosed in 1934, said a downturn in the housing market was precursor to the Great Depression, the 2006 “great recession” and virtually every other recession in-between.

The key indicator, Smith said, is housing starts. Homebuilders, he said, are much more aware and reactive to changes in the market than typical homeowners or buyers.

Early in 2006, starts of U.S. housing suddenly began falling from record highs while all other economic indicators were still increasing, Smith noted. A year later, home construction had virtually stopped, U.S. home equity had shed $500 billion in value and the world was in the grip of the worst economic crisis in 100 years.

However, in a follow-up interview with BIV, Smith noted, “all housing markets are regional.” Housing sales and prices in Purdue, Alaska and North Dakota, for example, continued strong right through the 2006-2010 downturn, he said, because of strong job generation and high in-migration.

Using Smith’s formula for housing bubble-burst scenarios, B.C. and Vancouver do not appear threatened, despite record-high prices in the latter. B.C. housing starts this year are up 3.1% from 2013 and forecast to rise a further 1.4% in 2015, according to Canada Mortgage and Housing Corp. In Vancouver, housing starts are up 5% from a year ago and are projected to dip slightly next year, but increase about 3% into 2016.

As well, B.C. unemployment rate remains low, the province is attracting about 39,000 immigrants annually and, for first time in four years, is seeing a net increase in interprovincial migration.

Smith cautioned that a huge inflow of mortgage credit started the last housing bubble and he sees parallels today in low-cost mortgage money. The award-winning economist concedes experts were “blindsided” by the last recession and don’t know when the next one will appear.

“Prediction is impossible,” Smith said.