When Industry Minister James Moore accompanied Prime Minister Stephen Harper on an official visit to China this month, it initially appeared the biggest deal struck for the West Coast would be a new market for B.C. cherries.

But Vancouver’s tech sector soon emerged as the biggest winner – at least potentially.

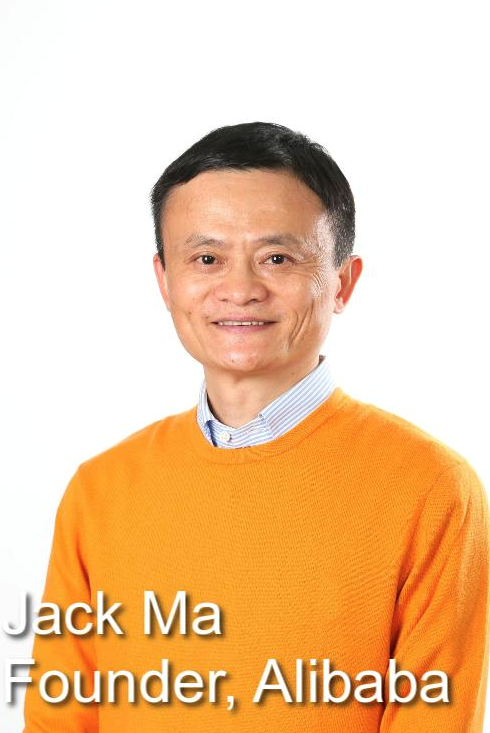

“Had a great meeting with Alibaba.com CEO Jack Ma,” Moore tweeted to followers November 10.

“Alibaba is seriously considering a new campus in Vancouver.”

The Chinese e-commerce giant (NYSE:BABA) was valued at $168 billion following its initial public offering in September, while Alibaba’s prospectus revealed it had US$248 billion in sales last year.

That’s more than the combined total of Amazon’s (Nasdaq: AMZN) US$75 billion and eBay’s (Nasdaq:EBAY) US$16 billion in sales.

Whether Vancouver can support such a colossus in its own backyard is uncertain.

The tech sector employs 84,000 people in B.C., according to a 2012 industry report card from KPMG. But one of the most common concerns in Vancouver’s tech community is that the region is facing a talent crunch, especially in terms of upper-level management.

BC Technology Industry Association CEO Bill Tam said it’s too early to speculate on Alibaba’s impact on the region’s workforce without knowing the scope and size of the Hangzhou-based company’s plans.

“Companies like Amazon have chosen locations here because I think there are already homegrown successes that have kind of built e-commerce solutions,” he said, adding that BuildDirect and Elastic Path are proof Vancouver has the talent to create successful e-commerce companies.

Angel investor Boris Wertz, founder of Version One Ventures, said the arrival of Alibaba could put more pressure on startups in the short term when it comes to hiring talent.

The former chief operating officer of AbeBooks.com, which Amazon acquired in 2008, said the Chinese company’s more competitive salaries and equity offerings could tempt local developers who would otherwise take jobs at startups.

“Long term, I think it’s a good thing because it gives people that want to work in Vancouver ... more options and we’re going to just overall increase the talent pool,” Wertz said. “And people that get trained at Alibaba and Amazon can then switch over to a startup two, three or four years later and have an incredible perspective of a bigger company.”

But one of the reasons he believes the city is so appealing is that there are fewer corporations and startups, compared with San Francisco or Seattle, competing over the city’s solid talent base, which makes Vancouver more cost-effective.

Kirk Kuester, executive managing director of Colliers’ Vancouver brokerage operations, said Alibaba would be well advised to examine Seattle-based Amazon to see how it set up facilities across North America.

While office space catering to the tech industry is in good supply in the city’s downtown core, he said Alibaba would likely have to build its own distribution centre, as such facilities are very specialized. There’s simply nothing in the Lower Mainland that is ready to lease or buy.

Amazon opened its first B.C.-based fulfilment centre in Delta in the fall of 2012. Its position in the centre of the Lower Mainland allowed the company to begin offering same-day delivery last month.

Tam added that Alibaba’s potential interest in Vancouver is also likely related to the city’s development talent as well as its diverse population that shares close ties to Asia.

“When it comes to not just hiring individuals, but also having the sort of inherent cultural knowledge of what’s required to kind of build markets across the ocean, I think Vancouver stands well ahead of other centres in North America,” he said.