Unlike in Alberta, where falling oil prices is unequivocally bad news, in B.C., $70-per-barrel oil is more of a good news-bad news story, economists say.

What is more important for B.C., with its aspiration of developing a liquefied natural gas industry, is natural gas prices – and those have also been inching down where it counts most, in Asia.

There are pros and cons to low oil prices. The average consumer benefits from lower gas prices, and exporters also benefit, because the Canadian dollar moves with oil prices, and a low Canadian dollar is good for exporters – but not so good for anyone buying U.S. goods.

Governments are among the biggest losers, since they see royalties and taxes drop. Overall, the negative economic impact of cheap oil on the Canadian economy will depend on how far oil prices fall and how long they stay low.

“If we see prices back into $80 within three months or so, the impact will be quite minimal,” said Helmut Pastrick, chief economist for Central 1 Credit Union. “But if we assume that $70 will prevail for several more months, the impact does become more substantial.”

It is telling that when Alberta’s new Premier Jim Prentice was in Vancouver speaking to the Vancouver Board of Trade on December 1, oil prices barely got a mention. Prentice is more concerned about pipelines not getting built than current oil prices.

For B.C., the main concern about falling oil prices is what it might mean for LNG projects. If oil prices continue to drop and stay low, it could have a two-fold impact on LNG projects.

“When it comes to LNG, some of the large companies are integrated and they have oil operations as well as gas as well as LNG hopes, and to the extent that we’re seeing the drop in oil prices affect their revenue, that could mean that they have less capital available for investment to LNG,” Pastrick said.

Unlike oil, which is globally priced, natural gas is regionally priced, which explains the huge spread between North American and Asian gas prices.

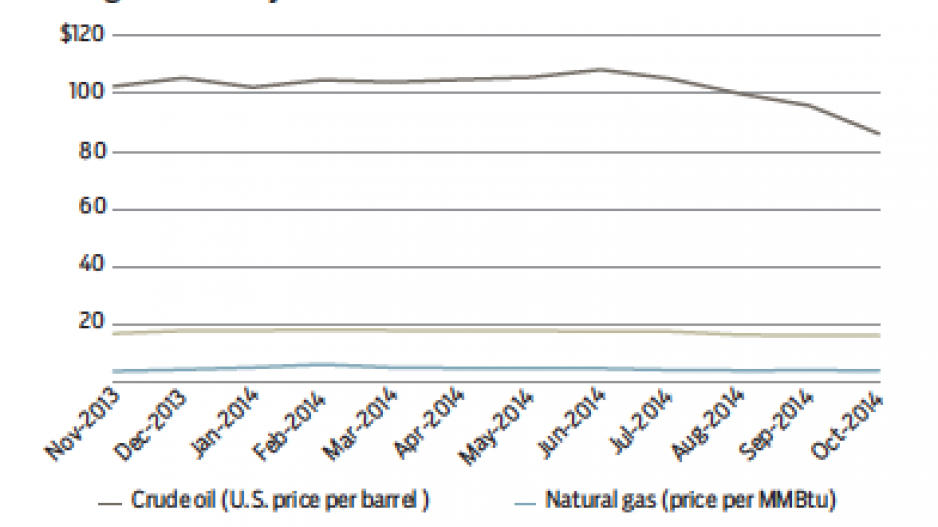

The problem is that, in Asia, long-term LNG contracts are indexed to oil. In 2012, Asian LNG prices were in the $18 MMBtu (million British thermal units) range, and are now down to about US$16 MMBtu. B.C. producers would need prices of about $14 MMBtu to be profitable, according to one analyst. Sustained low oil prices could push Asian LNG prices down even further.

“As time goes by, it’s more and more likely that the pressure will increase downwards,” said Brad Hayes, president of the petroleum consulting firm Petral Robertson Consulting Ltd.

“I think it just makes their economics more challenging, and if they’re really reliant on a delivered price in Asia and there’s downward pressure there, there’s the projections for lower revenues here.”

But for those who fear a sustained slide in oil prices, energy economist Mark Jaccard pointed out that markets always correct an imbalance, and said energy companies don’t look at current prices.

“They do it based on a 20-year projection at least, especially these huge capital investments,” he said. “So the discussion should not be about today’s price. It should be about projected prices.” •

With files from Jen St. Denis