B.C. business groups last week unanimously applauded the B.C. government’s decision to build the $8.8 billion Site C hydroelectric dam on the Peace River.

The massive public works project will create thousands of jobs over an eight-year period and provide a century of clean, comparatively cheap power – something industries like mining, pulp mills and aluminum smelters need in large quantities.

But can it be built without sapping the independent power sector in B.C. or inflating the cost of new mines, pipelines and liquefied natural gas plants in the face of the ongoing skilled labour crunch facing the province?

The B.C. government, BC Hydro and business organizations believe it can, although at least one oil and gas analyst with Deloitte warns a labour crunch could lead to the kind of inflation that has driven up the cost of liquefied natural gas projects in Australia.

Despite concerns over Site C’s new price tag, the B.C. government said BC Hydro will start building the new dam next summer. But it’s going to cost a lot more than when it was first proposed.

In 2007, BC Hydro estimated Site C’s cost at $6.6 billion. In 2010, it was revised to $8 billion. More recently, the budget was bumped up to $8.8 billion.

A sizable chunk of that comes from a new $440 million project reserve fund that the government hopes BC Hydro will never have to spend. It also includes an adjustment to account for the cost of moving back from the HST to the PST, and increased costs associated with a four-year delay in starting and completing the project, which added another $435 million.

The government is hoping BC Hydro can bring the dam in at $8.3 billion.

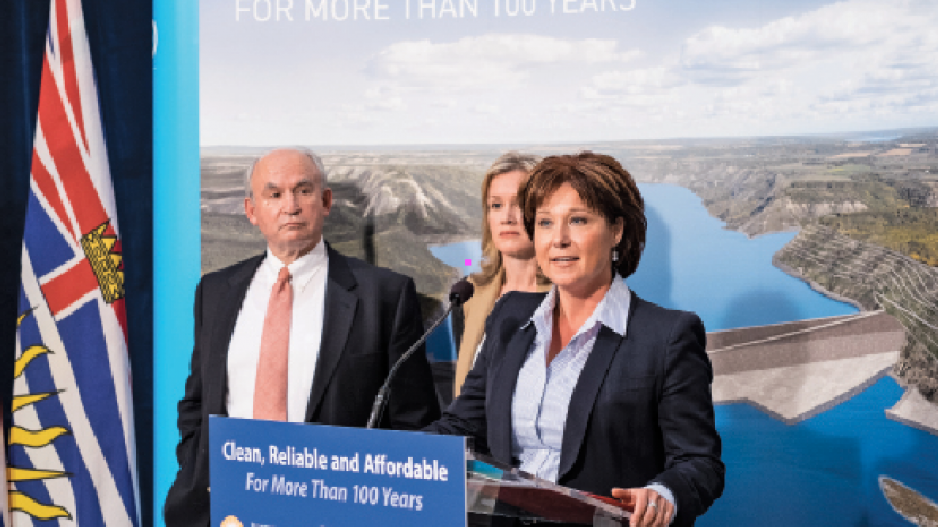

“I know that the folks at BC Hydro are absolutely confident that they’re going to be able to come in under this budget,” Premier Christy Clark said last week.

One of the more puzzling things about Site C’s new numbers is that, while the total budget has gone up by close to $900 million, the per-megawatt-hour costs for ratepayers have come down.

By reducing what government plans to take from BC Hydro in dividends and in water rental charges, the cost to ratepayers has been adjusted down from $83 per MWh to between $64 per MWh and $67 per MWh.

Those prices make Site C look a lot more attractive than other renewable energy sources, like wind farms and run-of-river, which BC Hydro estimated to be in the $110-per-MWh to $130-per-MWh range.

David Austin, a lawyer specializing in energy, wonders how the government and BC Hydro can justify having signed an agreement to provide Shell’s LNG Canada project in Kitimat with electricity at the previous price of $83 per MWh.

“If I were an LNG developer, I’d be asking why I am paying $83 a megawatt instead of today’s Site C price of $67,” he said.

Despite Site C’s higher price tag, B.C. business organizations including the BC Chamber of Commerce, Business Council of BC (BCBC) and Association for Mineral Exploration BC, applauded the decision to build the new dam.

As they point out, the relatively cheap, clean power from B.C.’s existing hydroelectric dams has helped make industries in B.C. – from pulp mills and mines to aluminum smelters – competitive.

David Craig, executive director for Commercial Energy Consumers Association of BC, said his members also generally support Site C, though he questions BC Hydro’s ability to bring the project in on budget, even with the additional reserves.

“The experience that I have, having reviewed all the dam projects that Hydro has ever built, they don’t come in under budget,” he said.

The one business sector that is disappointed with the Site C decision is independent power producers (IPPs). Clean Energy BC and the Canadian Geothermal Energy Association had argued that B.C.’s future energy needs could be met with wind, run-of-river and geothermal power.

Clark said Site C and independent power are not mutually exclusive. She said 25% of B.C.’s power now comes from IPPs and that Site C will meet only 22% of the anticipated demand for additional power over the years, which means there are still opportunities for the clean energy sector.

Though disappointed with the decision, Paul Kariya, executive director for Clean Energy BC, agreed there will still be opportunities in B.C. for IPPs.

“I can’t foresee an option that does not include an opportunity for the clean energy sector going forward,” he said.

Providing a handful of legal challenges don’t hold it up, construction on the dam will start next summer, with a completion date of 2024. The project will employ 10,000 workers, averaging 800 per year over an eight-year period, peaking at 1,700 over a two-year period.

But should new LNG plants and associated pipeline projects proceed at the same time, it could strain Canada’s skilled labour pool.

According to a 2013 Grant Thornton employment impact study, if five LNG projects were to go ahead in B.C., it would create 39,400 full-time equivalent jobs annually over a nine-year construction period.

Geoff Hill, a partner and oil and gas leader for Deloitte, said Western Canada already has high labour costs and that multiple large projects being built at the same time in B.C. can’t help but put further strains on the skilled labour pool.

He added that skilled labour to fill engineering, project management and trades jobs is especially in short supply.

“Canada needs to continue to increase our training and development of our youth, as well as solve some of the immigration challenges that we might have as a country to get those skills.”

Susan Yurkovich, BC Hydro’s lead executive on Site C, said a dam is “really a large earth-moving operation” similar to an open-pit mine.

She said a downturn in mining may free up some workers. BC Hydro has also invested $1 million in skills and trades training at Northern Lights College.

BCBC CEO Greg D’Avignon agrees labour could be a challenge but points out that new major projects will start as others, like the Rio Tinto Alcan smelter expansion, are winding down, and that a slowdown in the Alberta oilfields may free up workers, many of whom are British Columbians who might welcome the chance to come home to B.C.

He added the B.C. government and BC Hydro have done a good job of providing skills and trades training and thinking about the timing and co-ordination of major projects.

Even so, B.C. is going to need foreign workers, he said, not only on the construction projects themselves but also in areas like food services in work camps, and that means the federal government is going to need to revisit the restrictions it has placed on the Temporary Foreign Worker Program.

“The federal government is going to have to review the unintended consequences of the temporary worker model,” he said. “The labour base in the north is just not big enough.