In the summer of 2013, Germany generated negative headlines for being too successful at producing wind and solar power.

For a few hours on June 16, 2013, Germany generated so much electricity through wind and solar that producers had to pay utilities to take surplus electrons, and it was the traditional producers – nuclear and coal-fired power plants – that had to pay.

The event punctuated the criticism that Germany had gotten ahead of itself in its zeal to replace nuclear power with renewables, resulting in an oversupply of costly, unpredictable power.

“That is the clear evidence of the energy storage that is lacking,” said Eric Deschenes, vice-president of energy for Schneider Electric Canada, one of several companies in B.C. developing “the missing link” of renewable energy.

With a B.C. head count of 750, Schneider tops Business in Vancouver’s list of top alternative energy companies.

The problem with wind and solar power is no longer the cost of their technology – both have come down in price dramatically in recent years. The challenge now is storing and balancing all that power, because intermittent energy tends to produce the most power when it is needed least.

Because Germany doesn’t have the ability to store all the wind and solar power it’s suddenly generating, it sometimes has to sell it at a discount or give it away when too much is produced.

That helps explain why the latest technology rush in renewable energy is storage and load-balancing technology. The market for renewable energy storage is staggering.

According to a 2013 Navigant Research report, 1.3 million megawatts of renewable energy is expected to come online around the world over the next 10 years (the equivalent of 1,180 Site C dams), which could create “an unprecedented amount of instability on the grid.”

Navigant estimates the annual revenue for utility-scale batteries needed to address that instability will rise to US$17.8 billion by 2023 from US$221.8 million in 2014.

Like Germany, Japan is rushing to phase out nuclear power with renewables – mainly solar power. According to a Pew Charitable Trusts survey, in 2013, Japan became the fastest-growing clean-energy market in the world, with investments of $28.6 billion, mostly in solar power.

Schneider Electric Canada and Richmond-based Corvus Energy Ltd. both make utility-scale backbone systems for integrating, storing and balancing renewable energy.

In a 2013 demonstration project, Schneider provided a lithium-ion battery system as part of a new micro-grid for the Xeni Gwet’in First Nation in the remote Nemiah Valley in northern B.C. that stores electricity from solar panels.

The system has reduced the community’s consumption of diesel by 25%, according to Natural Resources Canada, one of the project’s funding partners.

Lithium-ion batteries have the advantage of being able to charge and discharge quickly, but they are costly, and in hot environments, like the desert, they require cooling, which requires additional energy.

Redox-flow batteries have the advantage of being able to provide a continuous flow of electricity in extreme climates (either hot or cold), and because they are a closed loop system, the electrolyte used in them can be reused virtually indefinitely. They are also low-maintenance.

One of the new kids on the block in that space is ZincNyx Energy Solutions Inc., a Vancouver startup that is working to commercialize a zinc-based flow battery.

Flow batteries use fuel cells and large containers filled with liquid electrolyte. A number of metals can be used for the electrolyte, including vanadium and iron.

ZincNyx uses zinc oxide in an approach pioneered by Metallic Power, an American company that went bankrupt 10 years ago. The technology was acquired by Teck Resources (TSX:TCK.B), which is also ZincNyx’s principal investor.

Mining companies are interested in energy storage because mines consume a lot of electricity and are often in remote, off-grid regions, which requires either building new transmission lines or burning diesel in generators.

In the ZincNyx system, a regenerator at one end takes the electricity from wind or solar to separate the zinc and oxygen atoms from zinc oxide molecules. The zinc is then stored in a large container filled with liquid and a fuel cell at the other end recombines the zinc and oxygen into zinc oxide. The process produces an electrical charge.

Flow batteries can easily be built to scale.

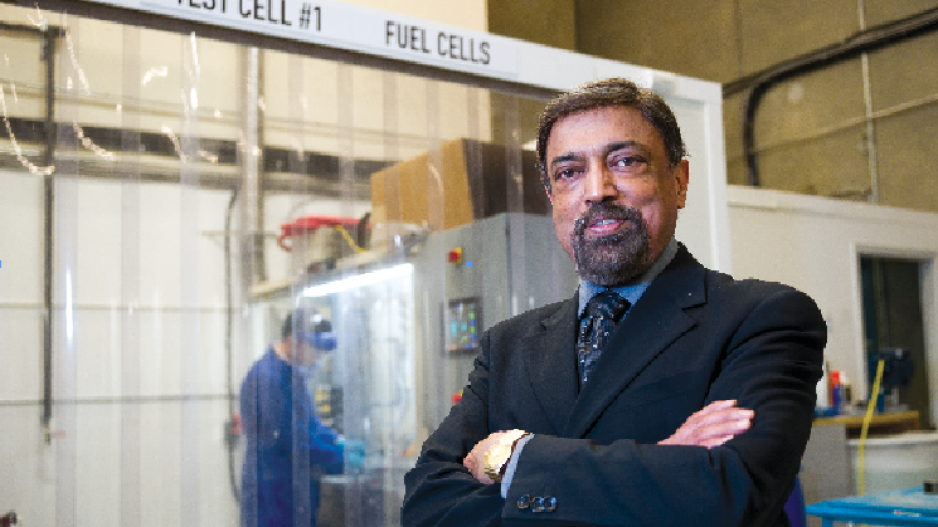

“We can change the size of the tank to give you more energy, and we can change the size of the fuel cell to give you more power,” said ZincNyx CEO Suresh Singh.

“With energy storage you can store it and use it. In a remote community where there’s no grid, you can give them consistent power, and that’s one of the areas that we want to focus on.”

But it’s not just remote off-grid communities or industrial sites that need to solve the storage problem to use renewable energy.

As the German experience demonstrates, once electrical grid systems reach a certain critical mass with intermittent energy, storage is needed to help balance the load. (In the first quarter of 2014, 27% of Germany’s electrical demand was met through wind and solar power.)

As more and more renewable energy is added to grids, Deschenes said storage will become increasingly important simply to level out the peaks and valleys.

“Energy storage is one of the key elements that will help us to reduce the pressure on the grid on many fronts.”