ExxonMobil Canada Ltd. and Imperial Oil Resources Ltd. have initiated an environmental review process for a $15 billion to $25 billion liquefied natural gas plant in Prince Rupert through the filing of a project description.

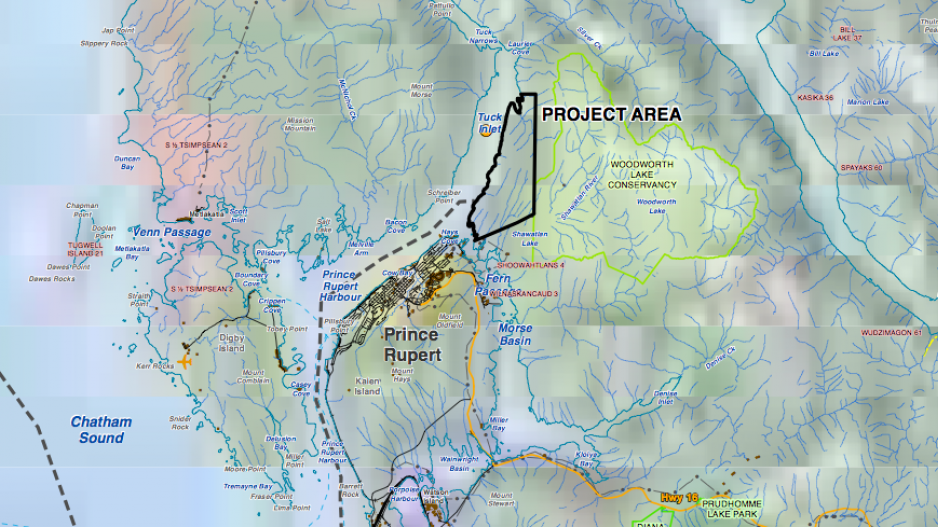

The WCC LNG Project in Tuck Inlet is still in early innings, compared with some other large projects proposed by other energy giants such as Petronas, Shell and Chevron.

Imperial Oil, a subsidiary of Exxon Mobil, has not yet identified a third party pipeline supplier, for example. Nor has it decided yet whether it would build a land-based plant, or multiple barge-mounted floating liquefaction plants.

“We’re in a relatively early stage of the project definition,” said Imperial Oil spokesperson Pius Rolheiser.

In scale, it would be roughly on par with some of the other large LNG proposals. The two-train facility would produce 15 million metric tonnes of LNG per year, which would require roughly 330 to 430 LNG carriers per year to ship the gas to Asia.

Imperial Oil and Exxon Mobil have considerable natural gas holdings in Northeastern B.C. in the Montney, Horne River and Duvernay shale formations, although they are still largely undeveloped.

“We continue to be one of the largest acreage holders in the Horne River Basin, as well as the Montney and Duvernay,” Rolheiser said.

There are fears that depressed oil prices could threaten LNG projects in B.C., especially ones that are further along.

The Petronas Pacific NorthWest LNG plant – which would also be built in Prince Rupert – is considered a front-runner in the race to develop and LNG industry in B.C., but concerns about cost controls at a time when oil revenues have dropped sharply has led Petronas to delay making a final investment decision, according to some analysts.

Assuming the WCC LNG Project makes it through the regulatory process without any major delays, the earliest the company would make an investment decision would be around 2018.

“The earliest that construction would begin – assuming regulatory approval and a decision to construct – would be sometime after 2018,” Rolheiser said. “And the earliest that operations could begin would be 2023, 2024-range.”

While falling oil revenue may pose challenges for projects that are closer to a final investment decision, companies like Exxon Mobil and Imperial Oil appear to be banking on a recovery.

And as Imperial Oil points out, the global demand for LNG, particularly in Asia, is by no means expected to abate.

In its project description, it cites figures from the International Energy Agency that shows that global demand for LNG doubled between 2000 and 2010, and is expected to grow another 50% by 2020.

“Our long-term growth strategy is focused on cost advantage, long-term assets,” Rolheiser said.

“Our plans are not significantly affected by near-term crude price fluctuations. We base our strategic decisions on a very, very long-range view.”

With a market cap of close to US$400 billion, Exxon Mobil is the world’s second largest publicly traded company.