Chevron (NYSE:CVX) has announced it would decrease spending this year on Kitimat LNG, a proposed LNG export facility in Northern B.C.

In a conference call January 30, Chevron CEO John Watson said the energy titan would be slashing worldwide LNG spending to $8 billion this year, down from $10 billion in 2014.

“I think people are pretty cautious right now in the LNG market,” said Watson in the conference call.

Kitimat LNG, a partnership with Australia’s Woodside Petroleum, is one of the projects that will see a delay as a result.

Woodside purchased Apache’s 50 per cent share late last year for $2.7 billion.

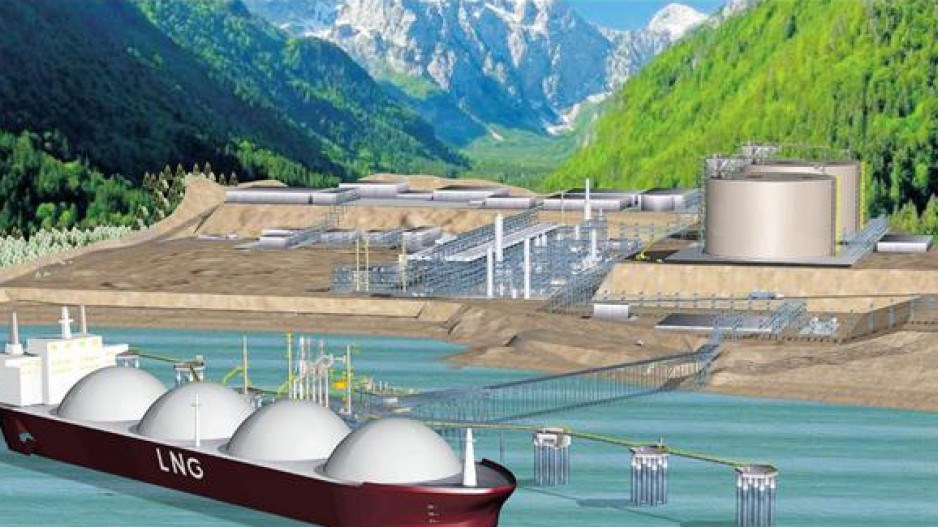

The facility is currently in the Front End Engineering and Design (FEED) phase and is the most mature of B.C.’s 18 proposed projects, said British Columbia-based LNG consultant Zoher Meratla. “On the engineering side,

development and everything, the Kitimat LNG project was and is probably the most advanced project in terms of getting close to moving into the next phase: implementation,” he said. “It was the frontrunner.”

Merlata is the principle of CDS Research Ltd., a consultancy firm, did the pre-FEED and oversaw the first FEED of the project.

Watson said that they are looking for “good contracts to underpin new developments” such as Kitimat, and while they’ll continue working towards First Nations agreements and permitting for the facility, they’re pacing spending on the project.

No final investment decision will be made this year.

As to which proponent might be the first to pull the trigger on a final investment decision, Merlata said that it was anyone’s guess.

“It is, at the moment, a complicated equation,” he said. “In the medium term definitely Canada is in a very good position, certainly the west cost, to export LNG. We have a lot of gas and a lot of investment has already been made.”

Malaysian energy company Petronas was expected to make a decision on their $11 billion facility on Lelu Island before 2015, but that decision was delayed. Similarly, BG Group announced in October of last year that work towards their $16 billion project on Ridley Island was going to slow down.

As to whether or not the cooling oil market is liquidating B.C.’s LNG prospects, Merlata said it was difficult to tell.

“I honestly don’t think anybody knows what makes somebody go or not go at this stage. We’re hoping there will be some action. Obviously government is closer to the ground to be able to get a better feel, but for people outside, we have no idea what the drop in oil prices will have on the economics of exporting LNG from B.C."