For a company that has invested hundreds of millions of dollars in Canadian pulp mills to become the second-largest pulp and paper producer in Canada, Paper Excellence (PE) doesn’t talk about itself much.

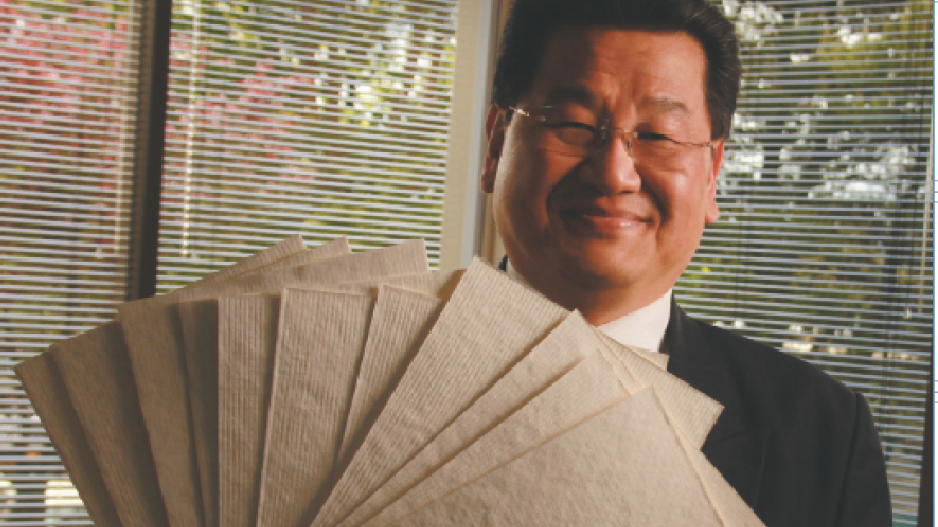

The company’s owner, 35-year-old Jackson Widjaja, who lives in Vancouver, doesn’t give interviews, and up until May 1, the company’s deputy CEO, Pedro Chang, had not spoken publicly about the company’s investments in B.C. and the rest of Canada.

May 1 happened to be the day that its fourth B.C. acquisition – the Tembec Inc. (TSX:TMB) pulp mill in Chetwynd – went back into production for the first time since it was idled in September 2012.

Chang said the company is in Canada for the long haul.

“Many pulp manufacturers look at the pulp industry [to be in] sunset,” Chang said. “Paper Excellence, our vision is different. We look at it as sunrise. We will be here for a century – as far as Asia continues emerging.”

While other forestry companies have shut down mills in Canada in recent years, Paper Excellence has been on a buying spree.

Of the 10 mills it owns worldwide – including three in Europe – seven are in Canada, four of them in B.C.: Howe Sound Pulp and Paper, Skookumchuck, Mackenzie and Chetwynd.

PE invested $115 million modernizing the Howe Sound mill alone and $50 million upgrading the Chetwynd mill, which now employs 136 people. In total, PE’s four B.C. mills directly employ 1,230 people.

Paper Excellence’s first acquisition in Canada was a pulp mill in Meadow Lake, Saskatchewan, in 2007. The company’s reputation preceded it.

In July 2011, Greenpeace issued what sounded like a red alert: Asia Pulp and Paper (APP) had come to Canada with “aggressive” expansion plans. The Indonesian pulp and paper giant – the largest in the world – was then a pariah among environmentalists for clear cutting rain forest in Sumatra. Greenpeace characterized Paper Excellence as an APP “shell” company.

APP has since adopted a zero-deforestation policy in which it vowed to use only plantation trees. In response, Greenpeace suspended its campaign against the company and issued a report card that found the company’s zero-deforestation pledge encouraging.

While there is a family connection between PE and APP (Jackson Widjaja is the son of Teguh Widjaja, chairman of Sinar Mas Group, which owns APP), Chang stressed that PE is not a subsidiary of either company.

It is 100% owned by Jackson Widjaja, and the company is headquartered in Richmond. About 100 people work out of the Richmond headquarters. It employs more than 2,000 people directly across Canada, with mills in B.C., Saskatchewan and Nova Scotia.

The company’s Mackenzie mill has a joint venture agreement with the McLeod Lake Indian Band to supply 800,000 cubic metres of sawlogs and 200,000 cubic metres of pulp logs annually.

But otherwise, PE has no major timber supply of its own, so it sources its fibre from other Canadian forestry companies.

The cost of building and operating a pulp mill is multitudes higher in Canada than in places like Indonesia or China. Asked why the company is so bullish on the Canadian pulp mill sector, Chang said it’s partly a capital cost issue.

A modern pulp mill can cost $2 billion to build, Chang said, whereas Canada has an inventory of idled or underused pulp and paper mills.

“The capital cost is much cheaper with old mills, massive with the new ones,” said Peter Woodbridge, president of Woodbridge Associates, PE’s forestry consulting firm.

“They can get these assets dirt cheap, and it really spreads out their supply chain,” added Kevin Bromley, PwC’s Canadian leader for forestry, paper and packaging.

Whereas mills in Asia and Brazil produce pulp made from fast-growing hardwoods, Canadian northern bleached softwood kraft (NBSK) pulp is made from softwoods, which take a generation to grow.

Despite the long growing timelines, softwoods are valuable because they provide long fibre pulp that strengthens paper products and is often blended with short-fibre hardwood pulp.

Woodbridge said that, despite his youth, Widjaja has a deep knowledge of the pulp and paper business and believes there is a long-term demand for NBSK for blending, not to mention a growing market for paper products in Asia, especially China.

“His vision is, ‘I’m going to be the best in long-fibre pulp making,’” Woodbridge said. “These guys know the paper-making business very well. Jackson Widjaja was trained with Sinar Mas.”

One major difference between PE and other companies in Canada is that it doesn’t rely on selling pulp to various customers around the world. It uses the pulp it makes internally and sells to APP mills, so it is not as vulnerable to pulp price fluctuations.

For that reason, the company can operate its mills round the clock, 365 days per year, with no shutdowns, except for maintenance.

“All mills in the Paper Excellence system operate at total capacity all of the time,” Woodbridge said.

“They don’t have quarterly earning statements that the owner has to say ‘Oh, the shareholders are going to lose money – we’ll shut down.’

“The traditional model in North America and Europe has been, in really bad times, when low pulp prices, everyone shuts down. They don’t do that. The unions love these guys because the jobs are consistent.”

While “love” may be a strong word, Scott Doherty, assistant to the president of Unifor, which represents PE mill employees in B.C., agreed that workers like the idea of not facing layoffs every time pulp prices take a dive.

“For sure it’s very refreshing to not have to take market curtailments,” he said.