B.C.’s tech sector is no doubt punching above its weight when it comes to the amount of venture capital it’s attracting, according to Valerie Mann.

“What still is a little bit starving is the very early stage (series A funding),” the chairwoman of Lawson Lundell LLP’s technology group told Business in Vancouver.

Mann will be among those attending the Canadian Venture Capital and Private Equity Association (CVCA) conference in Vancouver May 19-21, where experts are examining the health of private capital in Canada.

Keynote speakers include Hootsuite founder Ryan Holmes, BMO chief economist Douglas Porter and TPG investment firm CEO Jim Coulter. It’s the first time the conference has been held in Vancouver since 2011.

“It’s certainly a great place to be to meet a lot of the players in the industry,” Mann said.

“The venture capital industry, particularly in the west or in Vancouver…it’s critical to the growth and the advancement of the technology industry.”

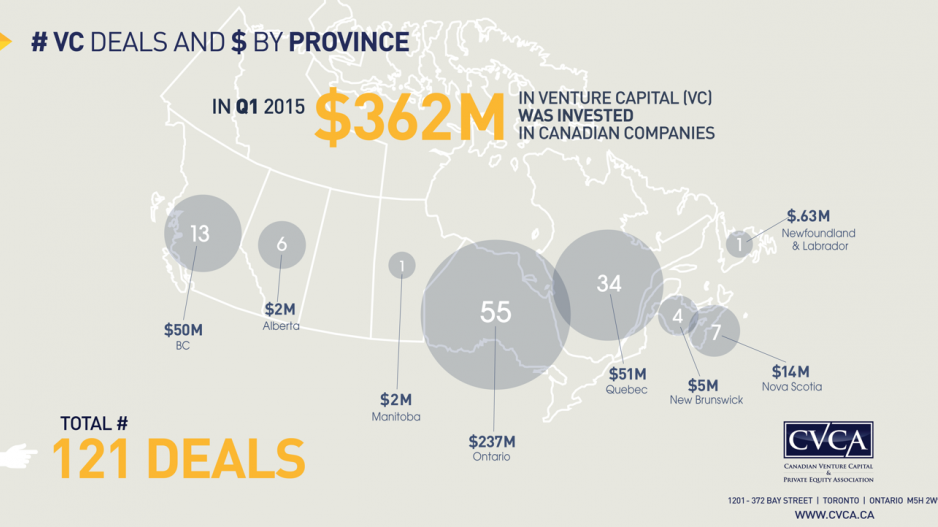

According to the CVCA, B.C. attracted $50 million in venture capital during the first quarter of 2015.

That’s nearly the same amount as Quebec's $51 million despite B.C. having half the population as La belle province.

But Ontario still dwarfed the other provinces, pulling in $237 million during the first quarter.

Mann said “heavweights” like Hootsuite, BuildDirect and D-Wave have helped push B.C. toward becoming a top performer in Canada when it comes to private investments.

But early stage companies are facing a “tough market” and are often dependent on angel investors and smaller local venture capital firms based in the city, she added.

“It (the tech sector) is growing but it needs capital,” Mann said.

“The venture capital industry, the whole need for capital, is really important to keep the technology industry going. We’ve got all the other ingredients that should make the technology industry (robust).”