It’s a good thing for CEOs that their pay isn’t necessarily tied to profits or share prices. If they were, the CEO of Teck Resources Ltd. (TSX:TCK.B) might have had to take a pay cut last year.

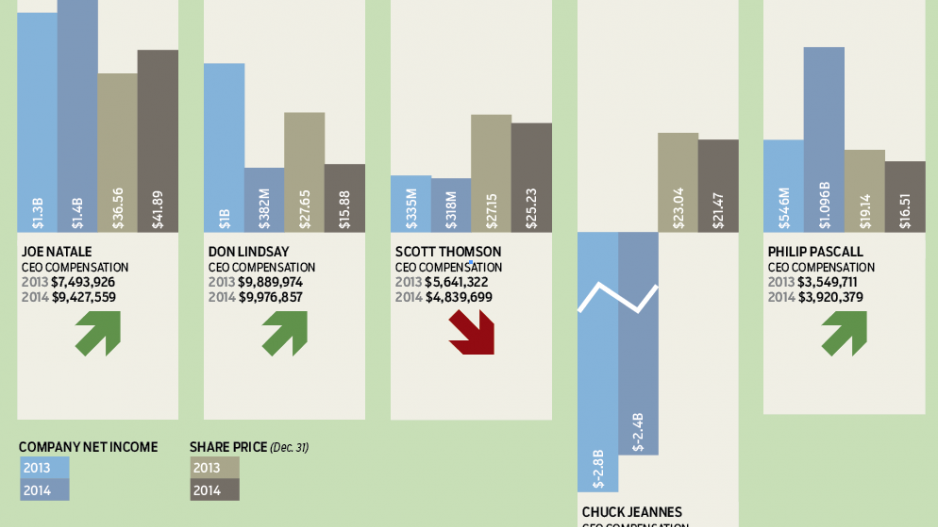

But Don Lindsay received a modest bump in his total compensation for 2014, according to the company’s recent financials.

That’s despite Teck’s 2014 profits being down by more than half and its share prices falling by about 35% during the year.

On the other hand, Teck’s management undertook some tough cost-cutting measures last year, including implementing a 5% workforce reduction and putting its planned restart of the Quintette mine near Tumbler Ridge on hold.

The question of executive remuneration boiled over recently for Barrick Gold Corp. (TSX:ABX), which has come under fire over the chairman’s compensation package.

The British Columbia Investment Management Corp. (BCIMC) was one of three pension funds that put Barrick on notice that they planned to vote against re-electing Barrick’s board of directors. In April, 75% of shareholders voted against Barrick’s executive compensation package.

The issue was a significant pay hike for Barrick’s chairman, John Thornton. In 2014, his total compensation was $12,913,547 – up from $9,458,495 in 2013.

This is despite Barrick’s share value dropping 44% over the course of a year, from $35.08 at the start of 2013 to $19.54 at the start of 2014. The company has also resorted to cutbacks to make up for a net loss of $3 billion in 2014.

Arden Dalik, managing partner for Global Governance Advisors, an executive compensation and governance firm, said there are good reasons why mining executives are so handsomely rewarded, compared with most other sectors.

It can take a decade or more to bring a new mine into operation, so continuity of top executive talent is more important than in most other sectors – something that sophisticated shareholders understand.

For them, it would seem penny- wise and pound foolish to lose an experienced CEO who knows how to ride out mining’s cycles over a $1 million or $2 million pay raise.

This might explain why some B.C. mining executives make more than Apple Inc. (Nasdaq:AAPL) CEO Tim Cook, who was paid US$9.2 million in 2014.

“To hold those people through this long investment period is a real challenge, and the market views it that way,” Dalik said. “‘Are we at risk?’ is a question they have to ask of losing that person. They have to weigh that because … these questions are going to come up: ‘How is it going to look to shareholders? Well, it’s going to look worse if we lose them – and he’s a key resource going out the door.’”

If shareholders think mining company CEOs are overpaid, they should take a look at what Hollywood pays the CEOs of film and TV companies. David Zaslav, CEO of Discovery Channel, received US$156 million in 2014. His pay was skewed by a long-term contract signing bonus. He made US$33 million in 2013.

“What we call the talent industry – the athletes and Hollywood – they are unique industries unto themselves, so you really cannot compare them to anyone else,” Dalik said. “It’s just its own market unto itself.”