Is the next Shopify (TSX:SH; NYSE:SHOP) sitting on the West Coast?

The same week in which the Ottawa startup blew past analyst expectations last month and raised $131 million in its initial public offering, Vancouver-based financial tech company Mogo filed a prospectus that paves the way for it to go public as early as this month.

Meanwhile, Vancouver tech darlings Vision Critical and Hootsuite both appear poised for an initial public offering within the next year or two.

All three have the potential to raise hundreds of millions with their IPOs, but deciding just when that happens could be more art than science.

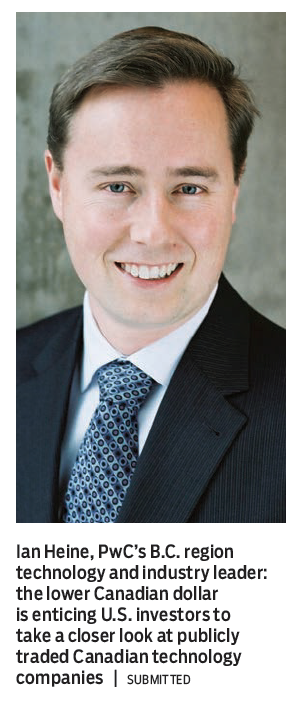

“It’s part of not only being the right type of company in the right space, but also the right time for the market,” said Ian Heine, head of PwC’s technology and industry practice in B.C.

“That’s, I think, a bit of a guessing game.”

But any company that’s just beginning to contemplate going public likely won’t be ready to hit the stock exchange until 2016 due to the lengthy process involved, he added.

Newly listed tech firms are being greeted in a much different manner than just five years ago when the sector was mostly going neglected amid sky-high commodity prices, BMO technology analyst Thanos Moschopoulos said.

“It takes several years for tech companies to mature,” Moschopoulos told BIV. “We’re now seeing the vintage of companies that had kind of started developing their business plans and getting underway post the tech bust.”

Vancouver-based tech firms that have moved beyond the startup phase – Sierra Wireless (TSX:SW), Absolute Software (TSX:ABT) and Avigilon (TSX:AVO) among them – have also cemented the region’s reputation as a legit tech hub that investors south of the border are taking notice of, he said.

Adding to that is the lower value of the Canadian dollar compared with a year ago.

“When the dollar drops a bit, Canadian companies become very attractive, especially when they have a disruptive technology that’s earning U.S. dollars or dollars abroad and it’s paying Canadian costs,” Heine said.

It is providing some welcome relief to a sector that frequently laments the difficulty of raising capital in Vancouver compared with cities like San Francisco or Seattle.

“Lately we’ve seen what I call a renewed interest of companies from Canada to come to the U.S. markets on a cross-listing basis or also just listing here because of the liquidity we have here,” Alex Ibrahim, the New York Stock Exchange’s (NYSE)head of Canadian listings, told BIV in late May.

He said the NYSE has become “the destination” for tech companies over the past four years, which has drawn attention from Canadian companies looking to raise capital from an IPO.

Some are listed only on the NYSE, while others, like Shopify, are cross-listed.

“That’s why you’ll be hearing more and more companies in Canada pursue capital-raising activity either in the local market or in conjunction with the U.S., and I think Shopify’s transaction [in May] solidifies that we are ready,” Ibrahim said.

“The markets are waiting for technology companies from Canada, and the investors are looking to diversify their portfolio and have the opportunity to tap into this [Canadian group] of companies.”