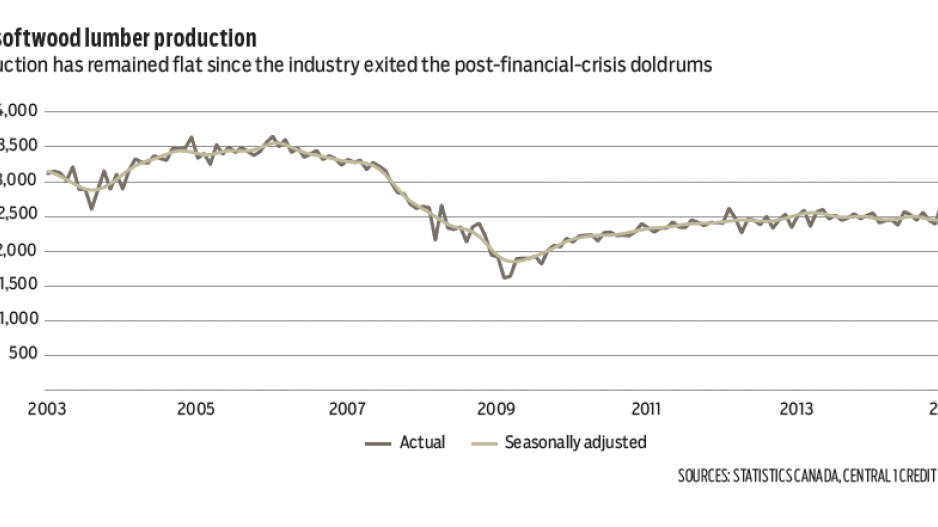

This is not the forestry recovery that was hoped for. B.C.’s lumber production has long been considered a sector that would contribute positively and significantly to provincial economic growth in the post-recession period with U.S. economic growth and increased home building the key triggers for higher lumber export demand.

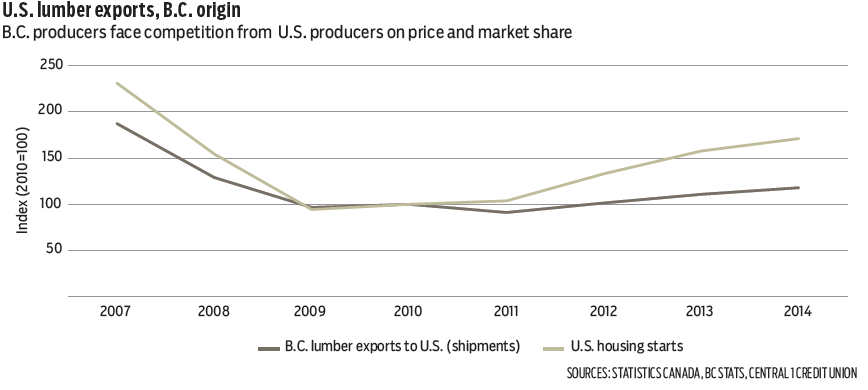

Despite U.S. housing starts rebounding to more than one million units in 2014 from about 609,000 in 2011, and grinding out year-to-date growth of 6% this year, B.C. lumber production remains in a disappointing holding pattern.

Monthly production is trundling along at a pace that is not all that different from the average level observed since 2012. In April, monthly softwood lumber production was up 1.7% from a year ago to 2.67 million dry cubic metres, pushing year-to-date production growth to a lacklustre 1.5%.

Part of this year’s production growth reflects increased capacity due to the restart of rebuilt mills in Prince George and Burns Lake. This aligns with dollar-volume manufacturing growth of sawmill and wood preservation products of 3.7% over the same period with the differential owing in part to mild price growth over the period.

Lumber shipment gains have lagged behind growth in broader wood-product manufacturing activity of about 8% year-to-date, which includes products like veneer, plywood, engineered wood and pellets.

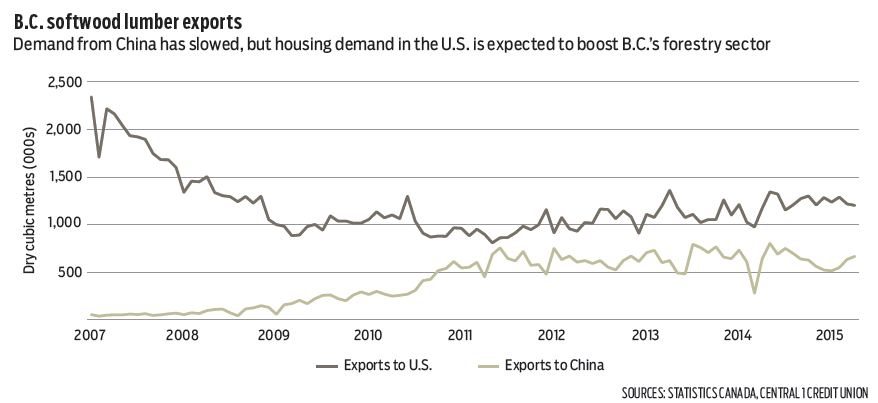

While a seemingly contradictory (and rosier) picture emerges with the growth in year-to-date physical exports of softwood lumber to international markets of 13% through April, the outsized gain reflects base-year effects.

Exports were curtailed sharply in early 2014 during the Metro Vancouver port strike. Similar to production, the underlying month-to-month export trend has generally held range-bound, despite the strong year-over-year gain.

Export demand from China, which has surged sixfold since the recession and provided a needed cushion following the U.S. housing bust, has softened.

Slowing economic growth in China, a weaker housing market, and elevated global supply and lower prices for logs and lumber have conspired against growth in B.C. exports.

Domestically, Canadian housing starts are also showing little momentum, which is unlikely to change given the current soft patch in the economy.

The frustratingly slow rebound in lumber activity is a mild downside risk for our provincial growth outlook, but we see some abatement of current headwinds for the sector.

Rising U.S. housing starts are anticipated to lift B.C. exports even if market share remains a challenge. Current consensus has U.S. starts rising about 7% this year and 14% next year.

Meanwhile, loosening of restrictive housing policies in China and recent cuts to benchmark interest rates should support the housing market.

Forestry is forecast to be a shallow growth driver for B.C. over the next few years. Growth will, however, be temporary given undeniable supply constraints in B.C. that will limit growth near the end of the decade.

The mountain pine beetle infestation has permanently lowered timber supply in the province, which will constrain the availability of fibre for B.C. mills – setting the stage for further mill and timber rights consolidation.

Additionally, the expiration of the existing 2006 Canada-U.S. Softwood Lumber Agreement in October is sure to add further instability to the sector as political rhetoric ramps up to move to a new agreement. •

Bryan Yu is an economist at Central 1 Credit Union.