B.C. retail sales surged in August to regain momentum lost in July. Dollar-volume sales jumped 1.4% from July to reach a seasonally adjusted $5.97 billion, outpacing modest national growth of 0.5% over the same period.

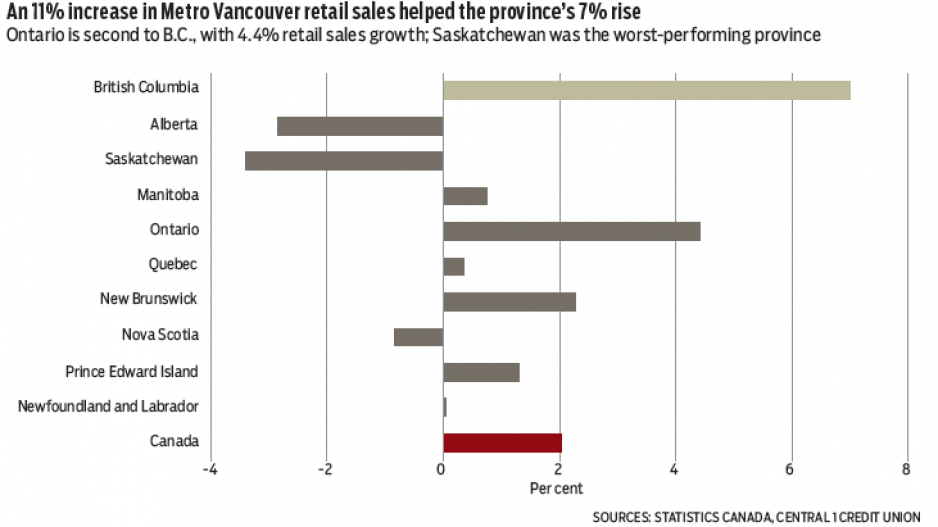

August’s gain adds to the broad up cycle in retail spending observed since early 2014, which has been supported by improved consumer demand, low interest rates, robust housing market conditions and rising tourist activity. Through eight months, B.C. retail sales growth tops the country at 7%, with an 11% increase in Metro Vancouver leading the way. Ontario is a distant second with 4.4% growth. On the other side of the spectrum, year-to-date sales in Alberta and Saskatchewan are down roughly 3% as the energy-sector slowdown echoes through their economies. National retail spending is up a mild 2%.

Among store segments, B.C. gains are being led by a 9.5% increase in the motor vehicle and parts sector driven by new car sales.

Housing-related sectors are also climbing, with sales at building materials/gardening product stores up 25% and furniture and furnishings stores up 16%. Food and beverage retail sales climbed a moderate 7.4% but were a key contributor to growth given their 25% share of overall retail spending.

A 10.5% drop in gasoline sales has tempered the gain but reflects lower prices and is positive for consumers as gas savings can be reallocated to other spending.

Dollar-volume growth in some sectors may reflect higher prices as businesses pass on the effects of the depreciated Canadian currency, which has a more significant effect on clothing, electronics and fresh produce. However, on the whole, retail inflation is well contained. Average national retail price levels are essentially unchanged from a year ago and consumer price inflation in B.C. remains low, suggesting most of the retail spending growth observed reflects higher real sales for businesses.

Full-year retail spending growth in B.C. is forecast to reach 5% this year and hold steady at 5.5% in 2016.

Consumer price index inflation in B.C. increased in September for the fourth time in five months to 1.3% (year-over-year), up slightly from the 1.2% reading in August. This contrasts with decelerated year-over-year national growth, which fell from 1.3% to 1%.

Inflationary pressure in B.C. continues to be dampened by low energy prices. Consumers are benefiting from low gasoline prices, which decelerated in September, with the price at the pump down 15% from a year ago, while natural gas prices fell 18%. Shelter costs eased 0.4% on lower homeowner replacement costs.

As noted earlier, these consumer “gains” are being offset by a sharp increase in food prices (4.5%). •

Bryan Yu is senior economist at Central 1 Credit Union.