By Nelson Bennett

Pipedream nightmares

This was not a good week for oil companies, and it was particularly bad for Canadian pipeline companies and Alberta’s oil sector.

On Thursday, it was reported that New York’s attorney general had begun investigating Exxon Mobil over concerns it misled investors about the risk climate change posed to its business, and on Friday, President Barack Obama officially announced he would kill the TransCanada’s Keystone XL pipeline.

The pipeline “would not serve the interests of the United States,” he said. In other words, there’s nothing in it for the U.S. But there’s more to the decision than just whether or not U.S. refineries need more Canadian oil. Climate change was also a factor in the decision.

"If we want to prevent the worst effects of climate change before it's too late, the time to act is now,” Obama tweeted.

TransCanada’s shares were down 6% by midday.

Things aren’t looking all that rosy for Enbridge, either. While it’s not yet official, Canada’s new Liberal government has promised to kill the Northern Gateway pipeline project, as well, and overhaul the regulatory processes that Kinder Morgan is currently going through for its Trans Mountain pipeline expansion.

So, it’s been a pretty bad week all around for Big Oil, and a very bad year. Going forward, it could be a very bad era for both oil and coal, as world leaders – and many businesses, as well – send signals that they are taking the imperative to act on climate change seriously.

When oil prices began dropping in August 2014 below $100 per barrel, eventually falling to below $50 per barrel, some analysts predicted that prices would bounce back within a few months.

They did, in fact, bounce back a bit this summer, but have since dropped back below $50 per barrel.

It’s not the only key commodity that is in the toilet. Others, like metallurgical coal – a key B.C. commodity – are also in a prolonged trough, the result of what has been characterized as the Chinese hog cycle.

According to this explanation, when China was on its double-digit growth trajectory, soaring demand for growth commodities (steel, copper, energy) prompted resource companies to invest in new mines and oil projects, and when China began to cool, producers were stuck with a glut of these commodities.

Demand for key growth related commodities will eventually go back up – it always does. But coal and oil are two commodities that are facing a whole new set of challenges above and beyond simple supply and demand economics.

If you have not felt the climate change zeitgeist in the air, you haven’t been paying attention. At the end of September, for example, China and the U.S. issued a joint statement on climate change in which both countries committed to carbon reduction targets.

Companies like Exxon Mobil are now being accused of deliberately misleading shareholders about the risk that coping with climate change poses to its business. The accusation is that Exxon wasn’t just in denial, but that it was actively engaged in downplaying climate change, and therefore failing in its duty to properly inform its shareholders about the risks climate change and climate action policies pose to its business.

As for Canadian pipeline projects, TransCanada still has the $12 billion Energy East pipeline proposal – a natural gas pipeline that would be converted to move oil from Alberta and Saskatchewan to refineries in Eastern Canada. At least there’s a value proposition there for Eastern Canada, as Canadian refineries would benefit.

But both the Northern Gateway and Keystone XL pipelines suffered from the same social licence questions in B.C. and the U.S., where one of the outstanding questions was: “What’s in it for us?”

And the answer is: some construction jobs and most of the risk. Even Donald Trump, a billionaire businessman and Republican presidential candidate – who has said he would approve the project if elected president – is now saying he would want to see a bigger share of the oil flowing through the pipeline going to U.S. refineries.

The irony here is that, before the shale oil revolution, the U.S. was dependent on oil from places like Saudi Arabia. Canada ended up playing a key role in the U.S. becoming energy self-sufficient. Canada now is the single largest supplier of oil to the U.S. U.S. — supplying more oil than Saudi Arabia, Kuwait and Iraq combined.

But the U.S. doesn’t want any more Canadian oil, which is why oil companies are so desperate to get pipelines built. That is now looking less likely.

So, if you are looking to dump your TransCanada and Enbridge stock and don’t know where to put your money, you might want to consider railway stock.

Ezra Levant versus Alberta Oil Magazine

While we’re on the topic of oil, a strange spectacle unfolded earlier this week when the editor of Alberta Oil magazine got into a tete-a-tete with Ezra Levant, the former Sun News broadcaster and staunch defender of the oil industry.

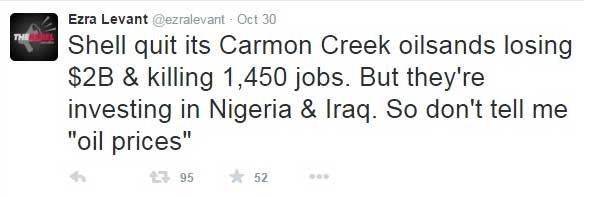

On October 30, he tweeted:

This prompted Max Fawcett, editor for Alberta Oil magazine, to respond in an online piece on Monday, November 2: “Actually, Ezra, that’s exactly what I’m going to tell you.”

He wrote that the break-even point for the Carmon Creek project had been believed to be about $100 per barrel, which meant that the project simply doesn’t make sense when oil is less than half that price right now, regardless of who is in power.

“Neither, for that matter, does the idea that Shell would eat a $2 billion write down on a project with an expected lifespan that’s measured in decades simply to spite a government that might not be around in four years,” he added.

He said it wasn’t fair for Levant to blame new Alberta NDP Premier Rachel Notley for killing the Carmon Creek project.

Levant responded in his own online piece, in which he called Alberta Oil Magazine an “anti-oil propaganda rag”: “She doubled the carbon tax, hiked the corporate tax 20%, raised personal income taxes, launched a new oil royalty tax review and launched a global warming tax review, and says she opposes pipelines — and that’s not a war on the oil patch?

“In three days after the budget, oil companies laid off 5,000 workers. If that’s not a war on oil, what is?”

So here we have a magazine that covers the oil industry (presumably it’s pro-oil) being branded an anti-oil rag. Strange days, indeed.