Pension funds and well-heeled private investors are coming back into the B.C. retirement housing sector as vacancy rates fall to single-digits for the first time in years.

The fresh emphasis, however, is on high-end, high-density residences aimed squarely at affluent retirees in the Lower Mainland.

Developers learned valuable lessons during the 2000s building boom that left a glut of senior housing projects in smaller B.C. centres, according to Michael Baragon, one of the few B.C. brokers specializing in retirement residences.

“We were selling them for 50 cents on the dollar,” said Baragon, a partner with Carewest Properties Ltd., of Vancouver.

An example is the 91-unit Cactus Ridge Retirement Residences in Osoyoos, which opened in 2011 but managed to rent only one-fifth of its suites at an average of $1,899 per month. Listed at $14 million in May of 2012 by Cushman & Wakefield, Cactus Ridge was recently sold by Carewest for $6 million.

Baragon said many of the older projects are being taken up, with some renovated for other uses. But rental demand appears to be heating up in a province where 17% of the population is age 65 or older.

Last year, Canada Mortgage and Housing Corp.’s annual Seniors Housing Report found that vacancies in retirement homes are down even as average rents increased. Province-wide, the vacancy rate for retirement homes was 9.1%, down from 10.9% a year earlier, though the average rent had increased to $2,686, up from $2,811 in 2014. In Metro Vancouver, average rents reached $4,187 per month last year.

The new wave of developers is clearly concentrating on luxury-level retirement homes where rents can easily surpass $5,000 per month.

Last month, BayBridge Seniors Housing Inc., a wholly owned subsidiary of the Ontario Teachers’ Pension Plan, closed its $578 million purchase of Vancouver-based Amica Mature Lifestyles Inc. Amica had owned 25 properties, including high-end retirement residences in Vancouver.

Meanwhile Element Lifestyle Retirement Inc. is launching two high-end projects. This includes the $90 million Opal in Vancouver’s Cambie Village neighbourhood. Opal will include 55 rental apartments and 45 luxury condominiums, including a 2,400-square-foot penthouse, expected to list at more than $2 million.

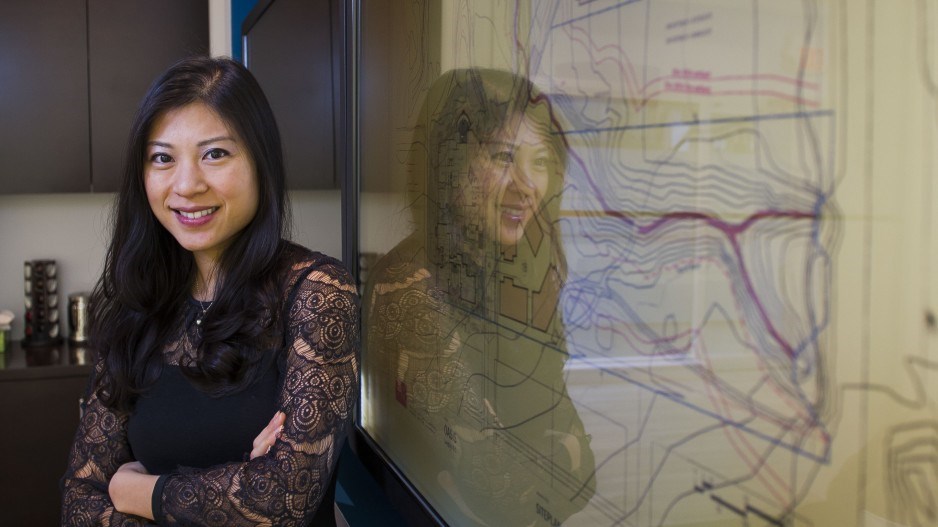

But Candy Ho, director and vice-president of Element said the future of retirement residences could be in projects such as Element’s proposed Oasis development, which has won an international design award.

Now in the planning and zoning stage, the $200-300 million Oasis, set on 17 acres next to the Langley Events Centre, is a new concept in retirement homes, Ho said, because it aims to become an “intergenerational community.”

“A core concept is for seniors to receive appropriate hospitality and professional support and care services, while related adults, children and grandchildren live in walking proximity within the same community,” Ho said. The project concept includes a green space with a creek, community gardens, other outdoor and indoor recreational and social amenities and a European-style retail village, she said, that would include a major grocery store.

The vision calls for seniors to live in one section of Oasis, while families would purchase condominiums and townhouses in two separate residential towers. Both seniors and their children or grandchildren could access the Oasis amenities, Ho explained.