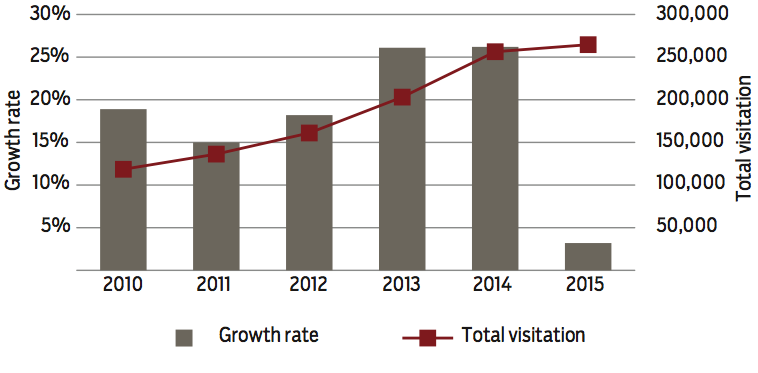

Although a record 264,582 visitors from mainland China visited B.C. in 2015, the annual growth rate plunged last year to a mere 3.2% compared with double digits in each of the previous five years, according to Destination British Columbia.

The question now becomes whether the lure of new high-end retailers locating in downtown Vancouver and airlines offering new direct flights to Chinese cities will be sufficient to return to that heady annual growth – more than 26% in 2013 and 2014.

Or whether Tourism Vancouver’s lobbying efforts to have Chinese organizations host conventions in Vancouver will be successful in luring back visitors from B.C.’s largest overseas market.

“Vancouver is already attractive in terms of being a well--established market for servicing Chinese customers in terms of language, cultural and family ties, food and events,” said Tourism Vancouver CEO Ty Speer.

“We have a range of things that a lot of cities simply don’t have.”

(Chart: The growth rate for mainland Chinese visitors to B.C. plummeted by 23 percentage points to 3.2% in 2015 | Destination British Columbia)

Wealthy Chinese visitors are renowned for shopping sprees in high-end stores. While Vancouver does not rival New York or other fashion capitals, high-end international retailers Brunello Cucinelli and Versace recently opened on the southwest corner of Thurlow and Alberni streets. Prada plans to join them on the luxury strip by opening a 7,700-square-foot store on March 11 at the intersection’s southeast corner.

The most likely explanation for soaring growth in the number of tourists from mainland China between 2010 and 2014 is that China granted Canada approved-destination status in 2010.

That status ended restrictions that forbade many potential Chinese visitors from visiting Canada. It also unleashed a flurry of direct flights by Chinese airlines, which then incrementally raised the frequency of those flights to keep up with demand.

For example, China Southern Airlines launched thrice-weekly flights in 2011, went to five times per week in 2012 and then made its flights daily in 2013.

Sichuan Airlines launched flights in 2012, and longtime carriers Air China and China Eastern Airlines increased flight frequency in 2013.

It has been a while since a Chinese carrier launched new Vancouver flights, but XiamenAir plans to begin new direct flights between Xiamen and Vancouver, three times per week, starting in July.

WestJet has been rumoured to be considering direct flights between Canada and Asia but its spokesman Robert Parker was noncommittal.

“We have never said where we plan to fly next or even where we are considering flying next for competitive reasons,” he said.

(Image: Tourism Vancouver CEO Ty Speer is focusing more on trying to get visitors from mainland China | Chung Chow)

Speer expects that the tourism growth rate will return to at least the high single digits in 2016, in part because of new XiamenAir flights.

“We’re putting an extra emphasis on the meetings and conventions market coming out of Asia but specifically coming out of China,” he said.

Historically, Tourism Vancouver’s travel-trade team, which lobbies for conventions, meetings and events, has included one person focused on Asia.

Speer said he recently added one person to the seven-member team so that two people can focus on China.

One thing those representatives have done is visit Xiamen in advance of the new flights to help acquaint travel agents and travel planners in that city with what Vancouver offers.

Speer views China as a battleground for market share, as B.C. competes with other destinations for the hundreds of millions of Chinese who travel each year, particularly since Chinese airlines have been launching new direct flights to places in New Zealand and the United Arab Emirates.

“It’s not about whether Chinese people will travel or not but, rather, where they will go,” he said.

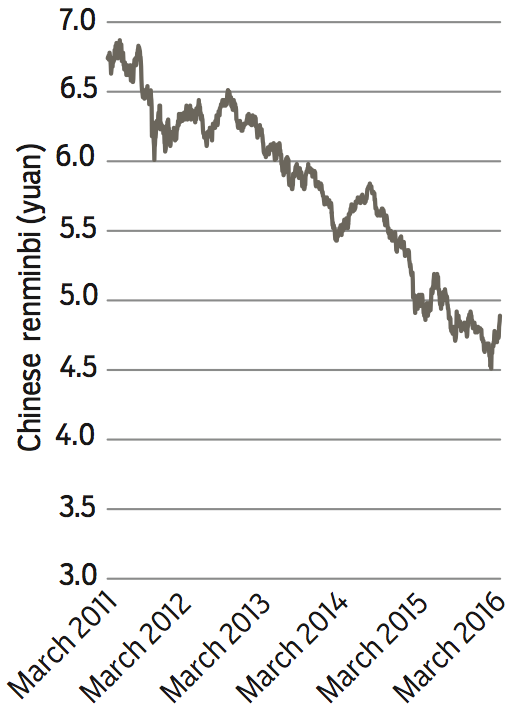

Another advantage for Canada, he said, is that the Chinese currency has been steadily appreciating against the Canadian dollar since 2011 and, in January, hit a decade high.

(Chart: The Canadian dollar has been able to buy decreasing number of Chinese yuan since 2011)

While all this sounds promising, Chinese tourism also depends on a strong Chinese economy.

Official economic growth rates in China have fallen from about 10% annually to about 6%, said Central 1 Credit Union chief economist Helmut Pastrick.

“The gyrations in the stock market in the past 18 months have been considerable,” Pastrick said. “Whether that causes hesitation in people coming here from China? It’s possible.”•