In a record-setting year for Canadian electricity exports, British Columbia bolted to first place in 2015, according to new data from the National Energy Board.

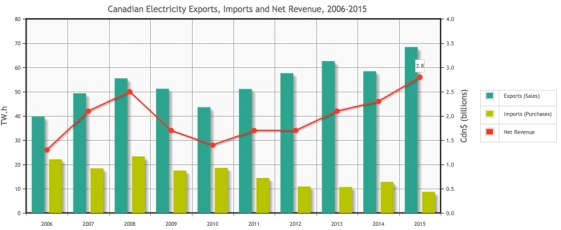

Canada’s net electricity exports increased by more than 14 terawatt hours (TWH) in 2015, leading to an overall 30% increase over the year before.

That surpasses records set in 2013, when export volumes hit 62 TWH. Net revenues reached $2.8 billion, a 20% jump over the previous year.

More than half of the overall 2015 increase in net exports can be attributed to a 7.4 TWH increase in net exports from B.C.

The data was released in an NEB report March 17.

Imports from the U.S. fell below 9 TWH in 2015, the lowest amount in almost twenty years.

The NEB says several factors have contributed to the increase in Canadian exports overall, including droughts in the U.S. Northwest and California that reduced hydro generation in those areas, and colder than normal temperatures in the U.S. Northeast which increased demand.

Relatively high U.S. prices compared to Canadian prices also supported increased exports, the NEB said.

In all, Quebec, Ontario, Manitoba and British Columbia account for more than 95% of Canadian electricity export volumes.

B.C. has long been a strategic buyer and seller of electricity, the NEB noted in a December report highlighting how the province uses its hydro system to maximize gains from electricity trade.

The province was a net importer of electricity for seven out of the past 11 years, the report said.

“However, B.C. has had a positive trade revenue balance since 2011 due to its additions of generation over the last few years and its ability to buy electricity when prices are lower (during the night or during spring) and sell when prices are higher (during peak hours).”

The province’s ability to “buy low and sell high” is based on several factors, the NEB says, including “sizeable amounts” of added wind power generation capacity south of the border, making prices in the United States Pacific Northwest low—especially during spring and early summer, when there is abundant hydro generation from rain and melting snow.

“At such times, B.C. may choose to import electricity from the (U.S.) and keep B.C. water stored behind dams—releasing it later to generate and sell hydro power during higher priced periods.”

In order for this strategy to pay out, the B.C. export price needs to be at least $10 per megawatt hour higher than the import price, the NEB says, primarily to cover transmission costs.

(A chart showing annual Canadian electricity exports, imports and net revenue from 2006 to 2015. Two sets of columns show export sales volumes and import purchase volumes and a horizontal line depicts net revenues in Canadian dollars. Exports and net revenues generally follow the same trend of rising from 2006-2008, declining from 2008-2010 and then increasing to record highs in 2015)

NEB historical data shows that average B.C. electricity export prices over the past 10 years were consistently higher than average import prices.

“Despite this consistent price differential, B.C.’s net revenue has not always been positive because the differential earned on exports was sometimes not large enough to offset the costs of net imports needed to meet domestic demand,” the report reads.

BC Hydro aims be energy self-sufficient by the end of this year, meaning B.C.’s trade balance and revenues are both expected to continue their upward trend.

In the meantime, imports have remained stable, mostly from the U.S. Northwest where B.C. sources over 98% of its imports.

B.C. bucked this import trend between 2011 and 2014, when the province doubled power exports to California (22.2 TWH) over the Northwest U.S.

The NEB notes this is because B.C.’s hydroelectric power qualifies as “low-emission” under the rules of California’s carbon market, making it more attractive than other options.

In addition, the NEB notes that some B.C. wind farms have been certified to sell both energy and renewable energy credits that California utilities can use to meet obligations under the state’s renewable energy standards.

The report comes at a time when debate continues over markets for power from Site C, the $8.8 billion dam under construction on the Peace River.

The B.C. government says Site C will be needed to meet domestic demand. However, current power projections show demand being flat, driven in part by declines in industrial activity in resource sectors.

Power exports to California and Alberta have been floated as a potential outlets for Site C electricity—ideas that have met with opposition from critics who say the dam is not needed.