It was in the fall last year that Bruno and Peter Wall received an offer too good to refuse.

The prominent Vancouver property developers behind Wall Financial Corp. had spent $16.8 million to buy two aging Nelson Street walk-up apartment blocks on adjacent lots in 2013. They had big plans for the downtown site: a glittering 60-storey residential skyscraper, taking advantage of the location within the city’s West End Community Plan, where a building could rise 168 metres tall under new zoning. The project was dubbed “Nelson on the Park,” and the Walls turned to favourite designer Chris Doray to come up with what they hoped would be a new Vancouver landmark.

But now a consortium of investors was proposing something even more remarkable. They would pay the Walls $60 million for the site alone, which BC Assessment had just valued at $15.6 million. The huge profit was impossible to resist, and the sale was completed in late January.

Doray, a 25-year veteran of the Vancouver development scene whose design has now been shelved, said he was “astonished” by the transaction, which he said set a new benchmark for commercial real estate in the city.

The scale of the purchase, orchestrated by Sun Commercial Real Estate (Suncom) – a firm that specializes in pooling wealthy investors from Vancouver’s Chinese immigrant community – was exceptional enough.

1059 Nelson Street in downtown Vancouver, where property developers Bruno and Peter Wall had once hoped to build a 60-storey skyscraper | Photo: Ian Young

But a South China Morning Post investigation now reveals the strange and frantic backdrop to the transaction – including a two-hour stampede by Suncom’s investors, desperate for a slice of the deal. It is a transaction that also sheds light on the rush of Chinese money fuelling Vancouver’s soaring real estate market.

The now-shelved design for ‘Nelson on the Park’ | Graphic: Chris Doray Studio

The Post interviewed key players and pored over land titles, company directorship and address changes, and English and Chinese social media postings, to understand a transaction that looked, from the outside, incomprehensible – and potentially disastrous.

But Suncom, whose activities are being reviewed by the BC Securities Commission (BCSC), knew exactly what it was doing.

Because on February 29, one month after taking ownership of the Nelson Street site, the Suncom consortium flipped it, corporate records show.

The price was $68 million. And the Post met the new buyer, a rich Chinese immigrant named Gao Shan, last month.

The blocks of apartments at 1059 and 1075 Nelson Street could not be more nondescript.

Julia Lau (centre) with performers at a Suncom party last July 19 | Photo: Facebook

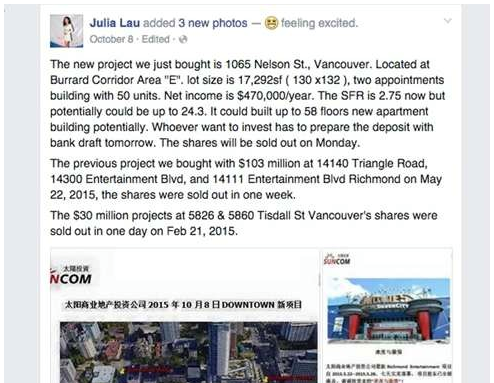

But as she considered the apartments last October 8, Suncom’s self-professed vice-president, Julia Lau Chi Yuen, told her Facebook friends she was feeling excited.

Once among the most successful realtors in Vancouver, the Hong Kong immigrant had been prohibited from practising the previous January, after voluntarily surrendering her licence ahead of a disciplinary hearing by the Real Estate Council of British Columbia.

Nine months later, she was busy rounding up investors for 1075 and 1059 Nelson Street, the site still owned by the Walls, which Suncom was promoting as “1065 Nelson St.”.

Lau was a good fit with Suncom, having fostered close connections with the city’s rich Chinese immigrant buyers; in a 2013 interview, she told the Post they made up 80% of her customers and later boasted on her website of selling more than $560 million worth of homes from 2009 to 2014.

In a Facebook post, Lau claimed “we just bought” 1065 Nelson Street. Suncom was offering $60 million worth of “shares” in the property that were poised to go on sale the next week – and they would go fast.

“Whoever want [sic] to invest has to prepare the deposit with bank draft tomorrow. The shares will be sold out on Monday,” she predicted.

“The shares will be sold out on Monday”. An October 8, 2015, Facebook posting by Suncom’s self-professed vice president Julia Lau | Photo: Facebook

It was no idle brag.

The Nelson Street sale was not the biggest that Suncom had promoted, but with its prominent downtown location and massive price-to-valuation markup, the transaction represented a culmination of efforts.

On February 21 last year, Suncom had pitched $30 million worth of shares in two lots at Tisdall Street on Vancouver’s west side that had a BC Assessment valuation of only $11.7 million. Investors snapped up the shares in one day, Lau said on Facebook.

Land titles show 5826 and 5860 Tisdall Street are now owned by a holding company (“5826&5860 Tisdall Holding Ltd”) whose directors are Suncom president Davidson Guo and Denise Dan Wei She.

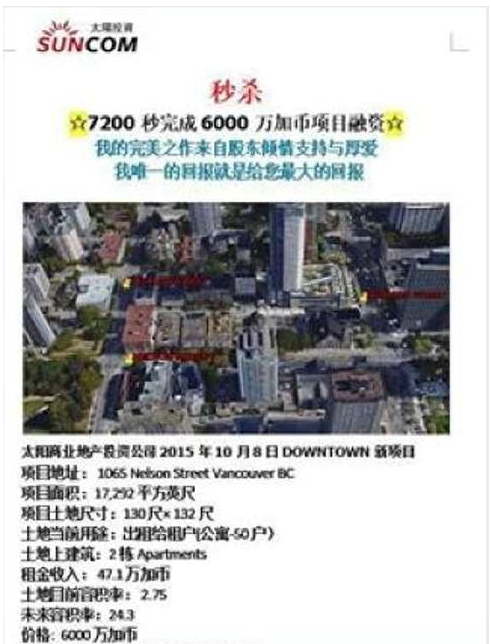

A Chinese language flyer posted online by Julia Lau declares that shares in 1065 Nelson Street sold out in just “7,200 seconds” | Photo: Facebook

Then, on May 22, Suncom put the site of Richmond’s Silver City entertainment complex up for grabs, with $103 million worth of shares selling out in one week.

Guo and She are also the directors of the company (“14111 Entertainment Blvd Investments Ltd”) that now owns that sprawling 10-hectare site.

Meanwhile, capital outflows from China were reaching a fever pitch, as companies and individuals scrambled to send money overseas last year in record volumes ahead of a feared yuan devaluation. The Canadian dollar was also plummeting, making Canadian property relatively more affordable to yuan earners, and average detached-house prices in Metro Vancouver soared more than 40% last year, hitting an average of $1.8 million.

Peer-reviewed research had previously indicated how Vancouver’s property market had decoupled from the local economy and was instead being steered by recent immigrants’ foreign earnings and wealth. The vast majority of those rich immigrants have been Chinese.

And so, against this heady backdrop, on the morning of October 12, Suncom threw open the gates for the Nelson Street sale.

The result was nothing short of a frenzy.

“The 60 million dollars project at 1065 Nelson St Vancouver’s shares sold out in two hours! Thank you very much for the supporting from all my clients!” Lau announced on Facebook on October 14.

A Chinese-language flyer on Suncom letterhead she posted at the same time trumpeted the sale as her “perfect success.”

“Sale of $60 million property project completed in 7,200 seconds,” it said. “My perfect success – thanks to the strong support and love of shareholders. My only return – the maximum returns I can bring to you.”

The Post has no evidence that Lau received remuneration for providing real estate services while unlicensed, as prohibited under the Real Estate Services Act; her Facebook posting from October 14 suggests that she claims not to have been paid. Nor does the Post suggest that Lau was selling shares in real property at the Nelson Street site, as opposed to shares in a company that owned the site.

Neither Lau nor her lawyer, Joe Carangi, responded to Post questions about her role in the Nelson Street sale and her other activities on behalf of Suncom.

“I’m so proud to call myself the vice president!” Julia Lau at a Suncom party in photos she posted online last September. The firm has since claimed she was never an employee or officer of the firm | Photo: Facebook

Fundraising tactics used in deals involving Suncom have previously drawn the attention of the BCSC, which in January announced it was reviewing the firm’s activities, partly in response to a Post article about whether the firm was involved in crowdfunding.

In B.C., crowdfunding – the mass online recruitment of investors – is limited to $250,000 per project and a maximum of two projects per year. Individual investors are limited to $1,500 per project. The BCSC told the Post this month that the review of Suncom was ongoing.

In a statement issued on March 12 via lawyer James Carpick, the company said that “as far as Suncom knows, Ms. Lau was never involved in ‘crowdfunding.’”

But the firm distanced itself from Lau, saying that she was never formally employed by Suncom, but was “allowed to use the title ‘vice-president’ for a few months in the summer of 2015.”

“Suncom terminated her use of that title, although she may have placed ads that used it that could not be recalled instantly, and she may have used it for a longer time than she was permitted to do, but, if that happened, this was not something within Suncom’s control or done with its approval,” the statement said.

Suncom refused to discuss the identity of its investors, and whether they qualified for exemptions from prospectus issuance, normally required in the case of securities sales.

As for Suncom’s plans for the site, the firm revealed that it had “no ongoing involvement” in the property.

The site had already been resold – and with speed that suggested negotiations were underway even before the purchase from the Walls had closed at the end of January.

Keeping up with the changing ownership of the Nelson Street site has been no simple matter.

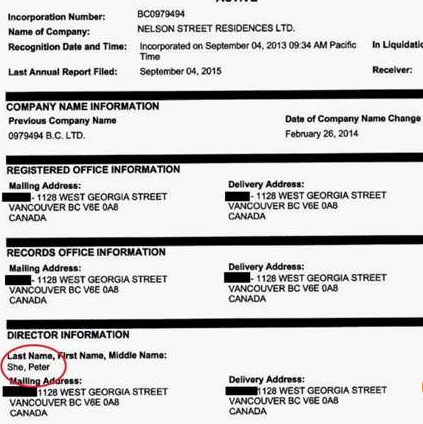

The changes do not show up in land titles for the two lots, because they remain to this day in the hands of Nelson Street Residences Ltd., a firm set up by the Walls in 2013 that was added to the titles in March 2014.

Instead, it is ownership of Nelson Street Residences that has changed hands, thereby avoiding property transfer taxes of $1.78 million for Suncom’s consortium. The share-transfer tactic is common among commercial real estate deals and perfectly lawful.

These transfers are depicted in directorship and mailing address changes for the company, which switched on January 30 from Wall Financial Corp.’s office to a multimillion-dollar penthouse in the downtown Shangri-La Estates.

The new director was named as “Peter She”; Suncom refused to discuss his connection, if any, to the firm, and Peter She did not respond to Post questions delivered via a registered letter that was accepted at his address.

A corporate search for Nelson Street Residences, conducted on February 10, 2016, lists Peter She as the new director, with the mailing address switching to a penthouse in the Shangri-La Estates on West Georgia St. | Photo: BC Registry Services

However, realtor David Taylor, the Colliers International vice-president who acted as a consultant to the Walls on the sale, confirmed that they had sold the Nelson Street site to Suncom’s consortium for $60 million.

Joanne Liu, Wall Financial vice-president, said she was prohibited from discussing the sale by a confidentiality clause, although she confirmed that Peter She did not represent the Walls.

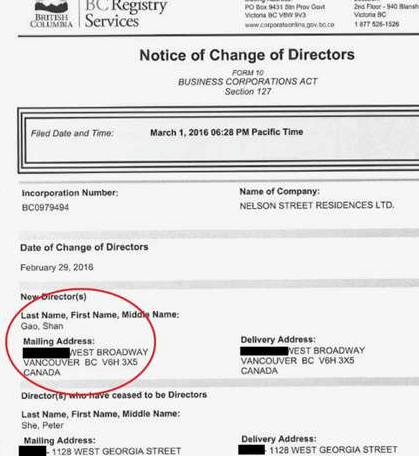

In any case, Peter She did not last long in his position at Nelson Street Residences, because on February 29, directorship again changed, to a man named Gao Shan, whose address was listed as an accountancy office on West Broadway.

By keeping his name off the land titles, Gao legally avoided paying more than $2 million in property transfer taxes.

Another corporate search, conducted on March 24, shows that on February 29, 2016, Peter She was replaced by Gao Shan as the sole director of Nelson Street Residences, with its address moving from She’s downtown penthouse to an accountancy office on West Broadway | Photo: BC Registry Services

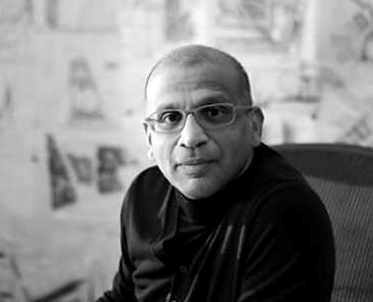

Doray, who designed Vancouver’s Wall Centre and was again commissioned by Bruno and Peter Wall for the ill-starred Nelson on the Park project, has watched the site change hands with a mounting sense of disbelief.

His innovative design for the site, nicknamed the “pixelated tower,” was shortlisted at the 2015 World Architecture Festival in Singapore. It features a lattice-like facade that seems to dissolve into the sky.

But Doray now considers the plans shelved. “[They] weren’t so much interested in the project, but more in the land, as an investment,” Doray said of the consortium that bought the site off the Walls.

The widespread industry rumour – since confirmed by the Post – that the site had already been flipped seemed to validate Doray’s suspicions that the previous sale was a purely “speculative purchase.”

“I cannot believe that people will pay that kind of money for a plot of land”. Chris Doray, designer of the shelved “Nelson on the Park” skyscraper | Photo: Chris Doray Studio

Doray said Wall Financial had attempted to persuade its buyers to press on with the skyscraper project, which he said had been “quite well received by the city” last summer.

“It was there, pretty much ready to go, but they were not interested. They just sold it to another party,” he said.

Doray added that in a quarter century of involvement in Vancouver’s real estate scene he had seen nothing like the transactions linked to the Nelson Street lot.

“I cannot believe that people will pay that kind of money for a plot of land. The whole industry is astonished.”

The now-shelved design for ‘Nelson on the Park’, and its “pixelated” roof | Graphic: Chris Doray Studio

In a strange twist, the new buyer of the site, Gao Shan, shares his name with a well-known Chinese embezzler who lived as a fugitive in Vancouver before surrendering in 2012 to authorities in the mainland, where he is less than two years into a 15-year jail term.

A third Gao Shan, meanwhile, is listed by Interpol as a fraud suspect and international fugitive.

And so the Post requested to meet the director of Nelson Street Residences, to confirm that he was not acting on behalf of either of his dubious namesakes by using their identity documents. An April 4 meeting took place at the office of Gao’s accountant, Jonathan Wong.

Gao, tanned and dressed casually in a long-sleeved polo shirt, bore no resemblance to either of his namesakes, who are aged 50 and 52; he appeared younger than both.

“[There are] many people named Gao Shan,” he joked in English, glancing at the Interpol notice.

Wong handed over his client’s B.C. driver’s licence as identification, but the date of birth had been covered with an opaque piece of tape, which the Post asked to be removed.

Wong was reluctant, citing concerns about identity theft, but Gao waved away his worries and the tape was briefly peeled off to show a 1971 birthdate matching neither that of the convicted embezzler nor the fugitive fraud suspect.

The Post makes no suggestion of any wrongdoing by Gao or Wong, nor does it suggest any connection between the Nelson Street Residences director and either of the two men who share his name.

Wong was keen for the meeting to end, but the Post asked Gao for an on-the-record interview. The accountant demurred, but Gao gave a grin.

“One question only,” Gao said, holding up a finger.

Why would Gao pay $68 million for the Nelson Street properties, when this was so far in excess of the valuation? After a brief discussion in Putonghua, Wong answered on Gao’s behalf, without disputing the sum.

“It is an investment that Mr. Gao sees will give him a good return, and that’s why he made the purchase. I hate to give such a general answer but that’s how business decisions are made. If it’s not going to make money, he’s not going to invest,” Wong said.

The Post managed one follow-up question, asking Gao if he intended to develop the site.

“Yes, this is a development site, it’s for development,” said Wong, after a nod from Gao.

Wong also allowed that his client be described as a property developer.

In a subsequent email, Wong said: “Historical price and government assessment values were irrelevant in setting the purchase price of the two properties. Only the projected net profit was relevant.”

He added that “you may be amazed” by checking the potential development returns on the site.

Designer Doray, who understands the potential of the site as well as anyone, isn’t so sure.

“If the developer pays $60 million for the piece of land, can you imagine what any condos on it would sell for, if they finally finish this project?” Doray asked, laughing. “It will be untouchable – well, for the local market. It could only be an elite group of people at this price.”•

Ian Young writes the Hongcouver blog, which is devoted to the hybrid culture of its namesake cities: Hong Kong and Vancouver. This instalment originally appeared in the South China Morning Post (www.scmp.com).

Check out BIV’s podcast for the week of April 25, 2016: