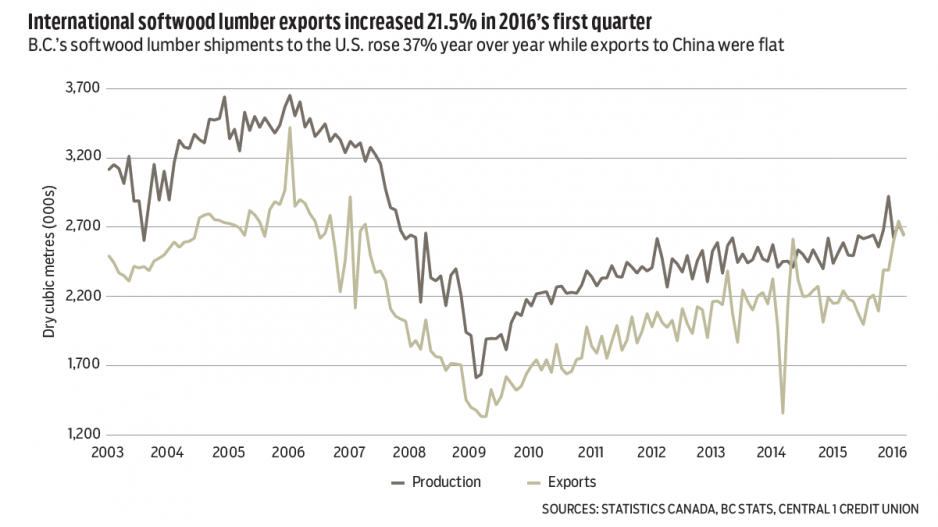

Early-year data points to a promising year for B.C.’s forestry sector. Total softwood lumber production reached a seasonally adjusted 2.65 million dry cubic metres. While down from February, production climbed 2.2% year over year, pushing year-to-date growth to 5.9%. This was the highest first-quarter production since 2007.

Production growth reflects increased international exports, which rose 21.5% from a year ago in the first quarter, with lower dollar-volume growth of 14.6% due to lower average prices. The gap between exports and production growth could reflect sales of existing inventories. Shipments to the U.S. jumped 37% while those to China remained largely the same and exports to Japan contracted.

The expiration of the pre-existing softwood lumber agreement has likely buoyed short-term exports to the U.S. Expiration triggered a one-year grace period for negotiation, which essentially provides free trade access to the U.S. market until mid-October and has shielded Canadian lumber from low benchmark prices and export taxes.

Already sky-high housing prices in the Lower Mainland vaulted to a whole other level in May as a critical lack of inventory and high demand drove further appreciation. The benchmark Multiple Listing Service price for the combined Metro Vancouver and Abbotsford-Mission area jumped 4.8% from April to a seasonally adjusted $778,209. Over the past year, the benchmark price has climbed 30%, driven by a 37% gain in detached housing and slightly more than 20% among other housing types.

Home sales fell sharply from April by 6% to a seasonally adjusted 6,260 units, but year-over-year gains remained close to 25% and the year-to-date increase was 35%. Lower sales likely reflect the pricing out of the market of more buyers and a severe shortage of inventory and listings, rather than lower demand.

The critical supply-and-demand imbalance will likely continue, driving prices even higher.

Despite mild uplift in recent listings, active listings (inventory) are still in decline. Supply is being constrained by a number of factors, including lack of alternative new housing for detached sellers in the local market, while owners of multi-family units are increasingly priced out of detached housing, constraining their ability to move up the housing ladder. •

Bryan Yu is senior economist at Central 1 Credit Union.