B.C.'s job market stalled for a second straight month in September, pointing to deceleration in economic growth and hiring after a blistering first half of 2016. Employment fell slightly from August, underperforming a national gain of 0.4%, with contraction in Metro Vancouver offset by growth elsewhere in the province. Nonetheless, B.C.’s unemployment rate remained the country’s lowest at 5.7% compared with a national rate of 7%.

Among industries, losses were observed in manufacturing, accommodations and food services and resource extraction. Offsetting gains were in finance/insurance/real estate (3.5%), information/culture/recreation (2%) and other services.

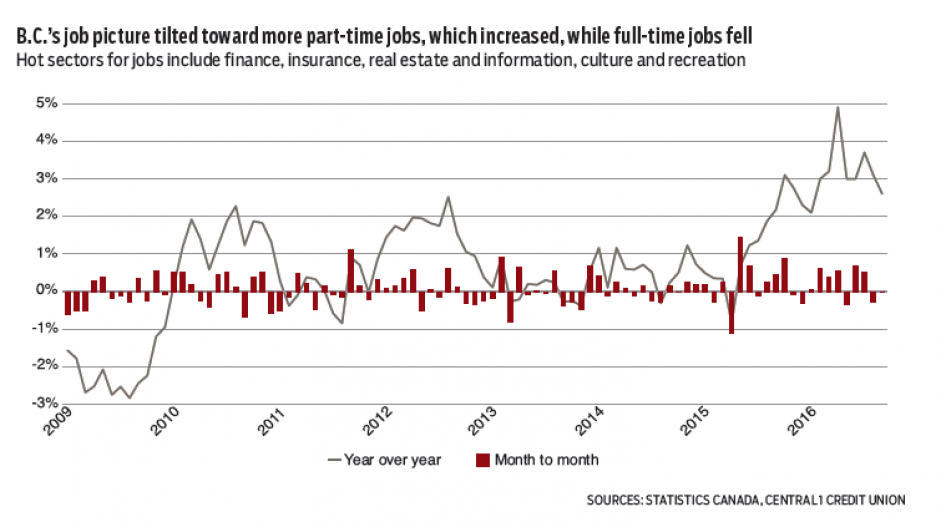

Recent volatility in full-time/part-time counts continued as the number of full-time jobs fell 1% from August, which was largely offset by a 3.7% increase in part-time employment.

Despite trend deceleration, B.C.’s labour market remains strong. Year-over-year employment growth slowed to 2.6% after trending above 3% since March, but remained highest among all provinces. Nationally, growth was 0.8%, with contractions in more than half of the provinces. Annual employment growth is forecast at 3.5% this year in B.C. with an unemployment rate of close to 6%. Gains are concentrated in the robust south coast regions.

The foreign-buyer tax and its effect on confidence further cut home sales in September, while price levels flattened. Multiple Listing Service (MLS) sales in the combined Metro Vancouver and Abbotsford-Mission area declined about 7% from August to 3,800 units and 30% from a year ago.

The benchmark price eased 0.3% from August to $829,400, but stayed flat once seasonal factors were adjusted for, while the average value rebounded after an August drop, reflecting the influence of sales composition effects in recent months.

While rolling over, the benchmark value was still 30% higher than a year ago.

The drag of the foreign-buyer tax will be temporary, but the recent announcement of plans to tighten mortgage insurance criteria means recent sales malaise will deepen into 2017. Higher qualifying rates for government-backed mortgage insurance cuts purchasing power for households and will slow activity at the entry-level and mid-tier market.

Lower Mainland MLS sales are forecast to decline 2% this year, despite being up 12% through the first three quarters, followed by an annual decline of 10% in 2017.

Annual pricing in 2017 will remain close to 2016 levels as prices rise by mid-year. •

Bryan Yu is senior economist at Central 1 Credit Union.